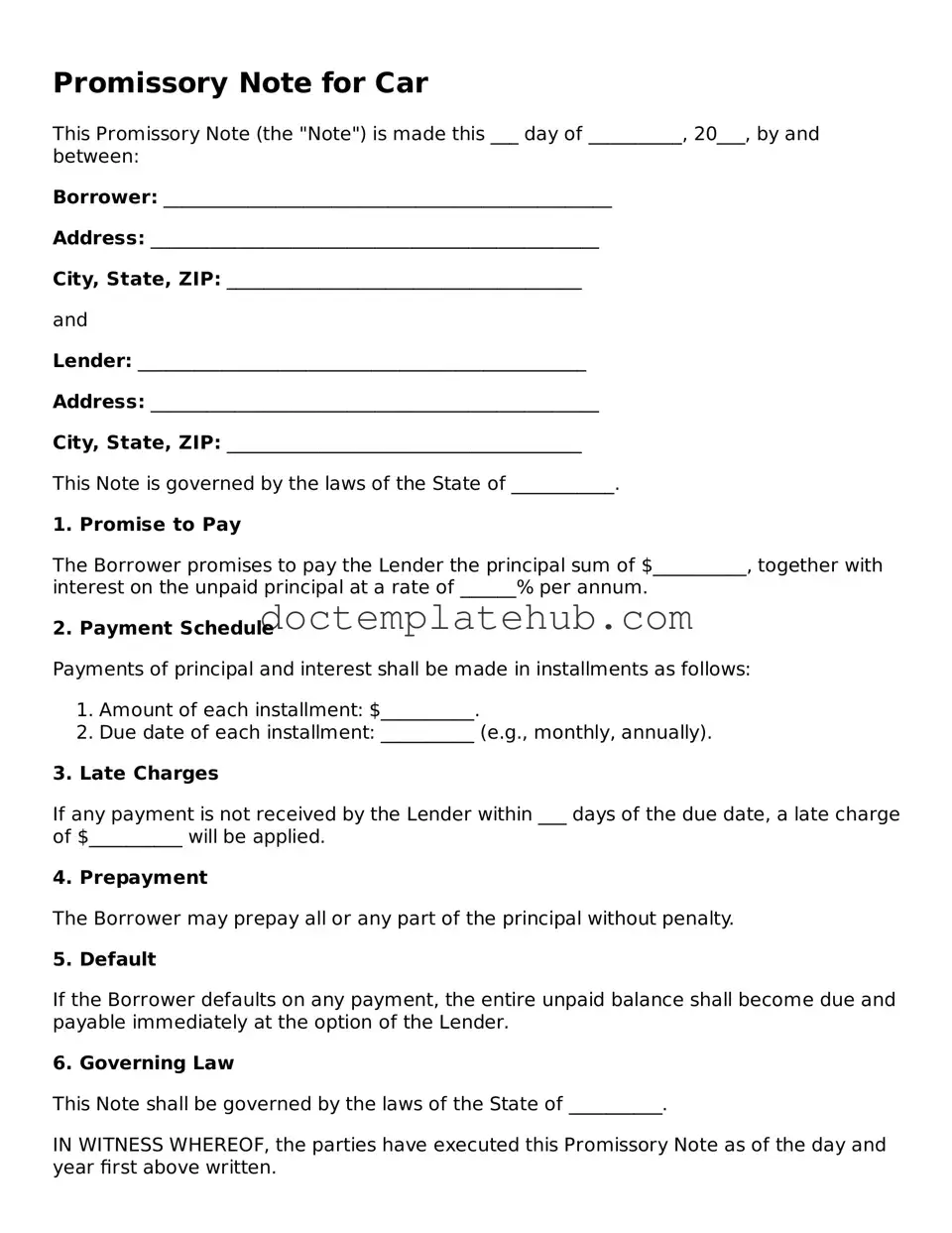

Official Promissory Note for a Car Form

When purchasing a car, whether new or used, a Promissory Note for a Car serves as a crucial document in the financing process. This form outlines the terms of the loan agreement between the buyer and the lender, detailing the amount borrowed, the interest rate, and the repayment schedule. It establishes the buyer's obligation to repay the loan, and it often includes provisions for late payments or default. Additionally, the note may specify collateral, typically the vehicle itself, ensuring that the lender has a claim on the car until the loan is fully paid. Understanding the components of this form is essential for both parties, as it protects the lender's interests while providing the buyer with a clear framework for repayment. By properly completing and signing this document, buyers can secure the necessary funds to drive away in their new vehicle, while lenders can confidently extend credit with an enforceable agreement in place.

Similar forms

A loan agreement is a document that outlines the terms of a loan between a borrower and a lender. Like a promissory note for a car, it specifies the amount borrowed, the interest rate, and the repayment schedule. Both documents serve to protect the lender's interests while clearly communicating the borrower's obligations. However, a loan agreement often includes additional clauses, such as collateral requirements or default conditions, providing a more comprehensive framework for the transaction.

A mortgage note is similar to a promissory note for a car in that it is a written promise to repay borrowed money. This document is specifically used in real estate transactions, detailing the borrower's commitment to repay the loan used to purchase a home. Just like the car promissory note, it outlines the loan amount, interest rate, and payment terms. However, a mortgage note typically involves larger sums and longer repayment periods, as well as the property itself serving as collateral.

As individuals navigate the intricacies of financing options for vehicles, it is crucial to understand the various associated documents, including a California Promissory Note form. This legally binding agreement ensures clarity in the repayment process, providing both the borrower and lender with a clear framework for their financial obligations. For those seeking comprehensive resources on these agreements, All California Forms offer valuable guidance and templates to facilitate these transactions smoothly.

A personal loan agreement is another document that shares similarities with a car promissory note. This agreement details the terms under which one individual lends money to another. Both documents include key details such as the loan amount, repayment schedule, and interest rates. However, personal loans are often unsecured, meaning they do not require collateral, unlike a car loan, which is secured by the vehicle itself.

A student loan agreement functions similarly to a car promissory note by outlining the terms of a loan taken out to pay for educational expenses. This document specifies the amount borrowed, interest rates, and repayment terms. While both types of loans require repayment, student loans often have unique features such as deferment options and income-driven repayment plans, which are less common in car loans.

A business loan agreement is another document that resembles a promissory note for a car. It details the terms under which a financial institution lends money to a business. Both documents outline the loan amount, repayment terms, and interest rates. However, business loans may also include specific conditions related to the use of funds and performance metrics that the borrower must meet, adding complexity to the agreement.

A lease agreement can be compared to a car promissory note in that it outlines the terms under which one party rents property from another. While a promissory note involves borrowing money to purchase an asset, a lease agreement allows for the use of an asset without ownership. Both documents specify payment amounts and schedules, but a lease agreement typically includes terms related to maintenance and the return of the asset at the end of the lease term.

An installment agreement is another document that shares characteristics with a car promissory note. This agreement allows a borrower to repay a debt in smaller, manageable payments over time. Like the car promissory note, it outlines the total amount owed, interest rates, and payment schedules. However, installment agreements may apply to various types of debts, not just those related to vehicle purchases.

A credit card agreement is somewhat similar to a car promissory note in that it outlines the terms of borrowing. It specifies the credit limit, interest rates, and payment terms. While a promissory note for a car involves a specific loan amount for a purchase, a credit card agreement allows for ongoing borrowing up to a limit. Both documents emphasize the importance of timely payments to avoid penalties.

A rental agreement for a vehicle, such as a car rental contract, shares similarities with a promissory note for a car. Both documents establish terms for the use of a vehicle, including payment amounts and duration. However, a rental agreement typically involves temporary use without ownership, while a promissory note signifies a commitment to purchase the vehicle over time.

A title loan agreement is also comparable to a car promissory note, as it involves borrowing money using a vehicle as collateral. This document details the loan amount, interest rates, and repayment terms, similar to a car promissory note. The key difference lies in the nature of the loan; title loans are often short-term and may carry higher interest rates, reflecting the risk associated with the collateral.

Fill out Common Types of Promissory Note for a Car Templates

Satisfaction and Release Form - This document is often signed by both parties at the loan's end.

When engaging in any financial transaction, using a Florida Promissory Note form is essential for both parties. This legally binding document clearly outlines the loan amount, interest rate, and repayment schedule, ensuring that both the lender and borrower understand their obligations. For more details and to access the form, you can visit https://floridaforms.net/, which provides the necessary resources to facilitate this important agreement.

More About Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines a borrower's promise to repay a loan used to purchase a vehicle. This note specifies the amount borrowed, the interest rate, the repayment schedule, and any other terms agreed upon by the lender and borrower. It serves as a formal agreement and can be enforced in court if necessary.

Who needs a Promissory Note for a Car?

If you are borrowing money to buy a car, whether from a bank, credit union, or an individual, a Promissory Note is essential. It protects both the lender and the borrower by clearly stating the terms of the loan. Even if the loan is informal, having a written agreement can prevent misunderstandings down the road.

What information should be included in a Promissory Note for a Car?

The note should include the names and addresses of both the borrower and the lender, the loan amount, the interest rate, the repayment schedule, and the due date. Additionally, it should state any collateral involved—usually the car itself—and any penalties for late payments or defaults. Clear terms help avoid disputes later.

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and it must be signed by the borrower. If the borrower fails to repay the loan, the lender can take legal action based on the terms outlined in the note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the new terms. This protects both sides and ensures that everyone is on the same page moving forward.

What happens if the borrower defaults on the loan?

If the borrower defaults—meaning they fail to make the required payments—the lender has the right to take action. This could include repossessing the car or taking legal steps to recover the owed amount. The specific actions depend on the terms laid out in the Promissory Note and local laws.

Do I need a lawyer to create a Promissory Note for a Car?

While it’s not strictly necessary to hire a lawyer, consulting one can be beneficial, especially for larger loans or complicated agreements. A legal professional can ensure that the note is properly drafted and complies with state laws. However, many templates are available online that can help you create a basic Promissory Note without legal assistance.

Dos and Don'ts

When filling out a Promissory Note for a Car, it's essential to ensure accuracy and clarity. Here’s a list of things you should and shouldn't do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate information about the buyer and seller.

- Do: Specify the loan amount clearly.

- Do: Include the interest rate, if applicable.

- Do: State the repayment schedule in clear terms.

- Do: Sign and date the document once completed.

- Do: Keep a copy for your records.

- Don't: Leave any sections blank unless instructed.

- Don't: Use vague language that could lead to confusion.

- Don't: Alter the form without proper authorization.

- Don't: Forget to check for typos or errors.

- Don't: Rely solely on verbal agreements; everything should be in writing.

- Don't: Rush through the process; take your time to ensure accuracy.

- Don't: Ignore state-specific requirements that may apply.

Promissory Note for a Car - Usage Steps

Filling out the Promissory Note for a Car form is a straightforward process. Once completed, this document will outline the terms of your loan agreement, establishing a clear understanding between you and the lender. Follow these steps carefully to ensure all necessary information is accurately recorded.

- Start with the date: Write the date when you are filling out the form at the top of the document.

- Identify the borrower: Enter your full name and address in the designated section.

- Specify the lender: Provide the name and address of the lender or financial institution.

- Detail the loan amount: Clearly state the total amount being borrowed for the car.

- Set the interest rate: Indicate the interest rate applicable to the loan.

- Define the repayment schedule: Specify the frequency of payments (e.g., monthly, bi-weekly) and the due date for each payment.

- Include the loan term: State the total duration of the loan in months or years.

- Describe the collateral: Identify the car being financed, including make, model, year, and Vehicle Identification Number (VIN).

- Sign the document: Both you and the lender should sign and date the form at the bottom.

After completing these steps, review the form for accuracy. Make copies for your records and provide a copy to the lender. This will ensure both parties have a clear understanding of the agreement.