Official Promissory Note Form

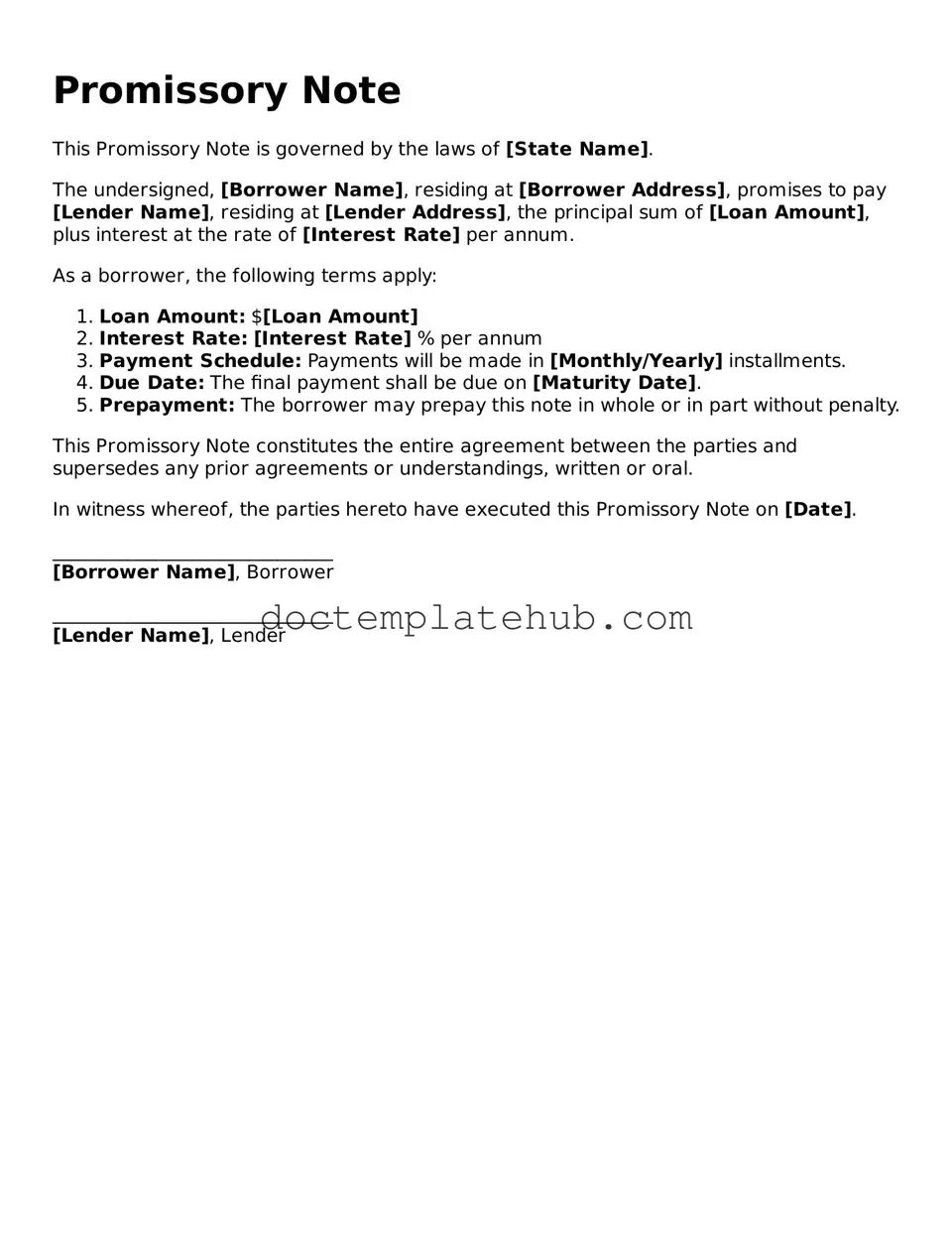

Understanding the Promissory Note form is crucial for anyone involved in lending or borrowing money. This important financial document outlines the borrower's commitment to repay a specified amount of money to the lender under agreed-upon terms. Key elements of the form include the principal amount, interest rate, repayment schedule, and maturity date, all of which provide clarity and structure to the loan agreement. Additionally, the note may specify collateral, which serves as security for the lender in case of default. It is essential for both parties to carefully review the terms outlined in the Promissory Note, as it serves as a legally binding contract. By ensuring that all necessary details are included and clearly articulated, individuals can protect their interests and foster trust in the lending relationship. Understanding these aspects can help prevent misunderstandings and disputes in the future.

Similar forms

A loan agreement is a document that outlines the terms under which one party borrows money from another. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement typically includes more detailed terms and conditions, such as collateral requirements and default consequences, making it more comprehensive than a simple promissory note.

A mortgage agreement is similar to a promissory note in that it involves a loan secured by real property. The borrower promises to repay the loan, and the lender retains a claim on the property until the loan is paid off. While a promissory note is a straightforward promise to pay, a mortgage agreement includes additional terms regarding the property, such as foreclosure rights in case of default.

An IOU, or "I owe you," is an informal document acknowledging a debt. Like a promissory note, it indicates that one party owes money to another. However, an IOU typically lacks the formal structure and detailed repayment terms found in a promissory note. It serves as a simple acknowledgment of debt without the legal enforceability that a promissory note provides.

A credit agreement governs the terms of credit extended by a lender to a borrower. Similar to a promissory note, it outlines the amount of credit, repayment terms, and interest rates. Credit agreements often cover a broader range of conditions, including fees and penalties, making them more complex than a standard promissory note.

A lease agreement is another document that shares similarities with a promissory note. In a lease, one party agrees to pay rent to another for the use of property. Both documents involve a promise to pay and specify payment terms. However, a lease agreement also includes additional provisions regarding the use of the property and responsibilities of both parties.

A personal guarantee is a document where an individual agrees to be responsible for a debt or obligation if the primary borrower defaults. Like a promissory note, it involves a commitment to repay. However, a personal guarantee often accompanies other agreements, such as business loans, and serves as additional security for the lender.

Understanding various financial agreements, such as a Personal Loan Agreement or a Mortgage, is crucial for making informed decisions. Moreover, if you're looking for templates to assist with legal documentation, you may find resources at smarttemplates.net particularly helpful.

A bond is a formal contract to repay borrowed money, typically issued by corporations or governments. Similar to a promissory note, a bond includes a promise to pay back the principal amount along with interest. Bonds, however, are often sold to multiple investors and can be traded on secondary markets, which distinguishes them from individual promissory notes.

A trust deed is a document that secures a loan by transferring property rights to a trustee. Like a promissory note, it involves a promise to repay a debt. The key difference is that a trust deed involves real property as collateral, providing the lender with a claim to the property in case of default, whereas a promissory note does not involve such security.

A seller financing agreement is a document where the seller of a property finances the buyer's purchase. It functions similarly to a promissory note, as the buyer agrees to repay the seller over time. However, seller financing agreements often include terms related to the sale of the property and may involve more complex conditions than a standard promissory note.

A debt settlement agreement is a document that outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Similar to a promissory note, it involves a promise to pay. However, a debt settlement agreement typically includes negotiated terms and conditions that differ from the original debt, often reflecting a compromise between the debtor and creditor.

Promissory Note Document Types

Common Forms

Corrective Deed California - A Corrective Deed provides clarity and can save time in property transactions.

The importance of securing an Emotional Support Animal Letter cannot be overstated, as it not only facilitates access to necessary support but also empowers individuals by legally validating their need for an emotional companion. For those looking to obtain this essential document, resources like documentonline.org/blank-emotional-support-animal-letter/ provide valuable guidance through the process, ensuring that individuals can effectively advocate for their needs in various situations such as housing or travel.

Letter of Intent Sample for Business - The document may outline contingencies that could impact the transaction's completion.

More About Promissory Note

What is a Promissory Note?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. It serves as a legal document that outlines the terms of a loan or credit agreement, making it clear to both parties what is expected.

Who uses a Promissory Note?

Individuals, businesses, and financial institutions commonly use promissory notes. They can be used in various situations, such as personal loans between friends or family, business loans, or real estate transactions. Essentially, anyone who lends or borrows money may find a promissory note useful.

What are the key components of a Promissory Note?

A promissory note typically includes the following components: the names of the borrower and lender, the principal amount, the interest rate, the repayment schedule, and any collateral securing the loan. Additionally, it may specify the consequences of default and any applicable fees.

Is a Promissory Note legally binding?

Yes, a promissory note is legally binding as long as it meets certain criteria. It must include the essential elements of a contract, such as mutual consent, consideration, and a lawful purpose. When properly executed, it can be enforced in a court of law.

Do I need a lawyer to create a Promissory Note?

While it is not strictly necessary to hire a lawyer to create a promissory note, it can be beneficial. A lawyer can help ensure that the document is legally sound and tailored to your specific needs. This may prevent future disputes or misunderstandings.

Can a Promissory Note be modified?

Yes, a promissory note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement to maintain clarity and enforceability.

What happens if the borrower defaults on a Promissory Note?

If the borrower defaults, the lender has several options. They may pursue legal action to recover the owed amount, which could include filing a lawsuit. If the note is secured by collateral, the lender may also have the right to seize the collateral to satisfy the debt.

Can a Promissory Note be transferred to another person?

Yes, a promissory note can typically be transferred to another person or entity. This process is known as endorsement. However, the original borrower should be aware of the transfer, as it may affect the terms of repayment or the relationship with the new lender.

What is the difference between a Promissory Note and a Loan Agreement?

A promissory note is a simpler document that focuses primarily on the promise to repay the loan, while a loan agreement is more detailed. A loan agreement usually includes terms and conditions, covenants, and additional provisions regarding the loan. In essence, a promissory note is often part of a loan agreement.

Are there any tax implications related to a Promissory Note?

Yes, there can be tax implications associated with promissory notes. For instance, interest income received by the lender may be subject to taxation. Borrowers should also be aware of potential deductions related to interest payments. Consulting a tax professional is advisable to understand the specific tax consequences.

Dos and Don'ts

When filling out a Promissory Note form, it's essential to follow specific guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do: Read the entire form carefully before starting.

- Do: Provide clear and accurate information about the borrower and lender.

- Do: Specify the loan amount and interest rate clearly.

- Do: Include repayment terms, such as the due date and payment schedule.

- Don't: Leave any sections blank; fill out every required field.

- Don't: Use vague language; be specific about the terms.

- Don't: Forget to sign and date the document.

- Don't: Ignore state laws that may affect the note.

Promissory Note - Usage Steps

After obtaining the Promissory Note form, it is essential to fill it out accurately to ensure that all necessary information is provided. This document will require specific details about the parties involved, the loan amount, and the terms of repayment. Once completed, the form should be signed by both parties to formalize the agreement.

- Begin by entering the date at the top of the form.

- Identify the lender by writing their full name and address in the designated section.

- Next, provide the borrower's full name and address in the appropriate area.

- Clearly state the loan amount in both numerical and written form.

- Specify the interest rate applicable to the loan, if any.

- Outline the repayment schedule, including the frequency of payments (e.g., monthly, quarterly) and the total number of payments.

- Include any late fees or penalties for missed payments, if applicable.

- Indicate the due date for the final payment.

- Both the lender and borrower should sign and date the document at the bottom.

- Make copies of the completed form for both parties' records.