Official Quitclaim Deed Form

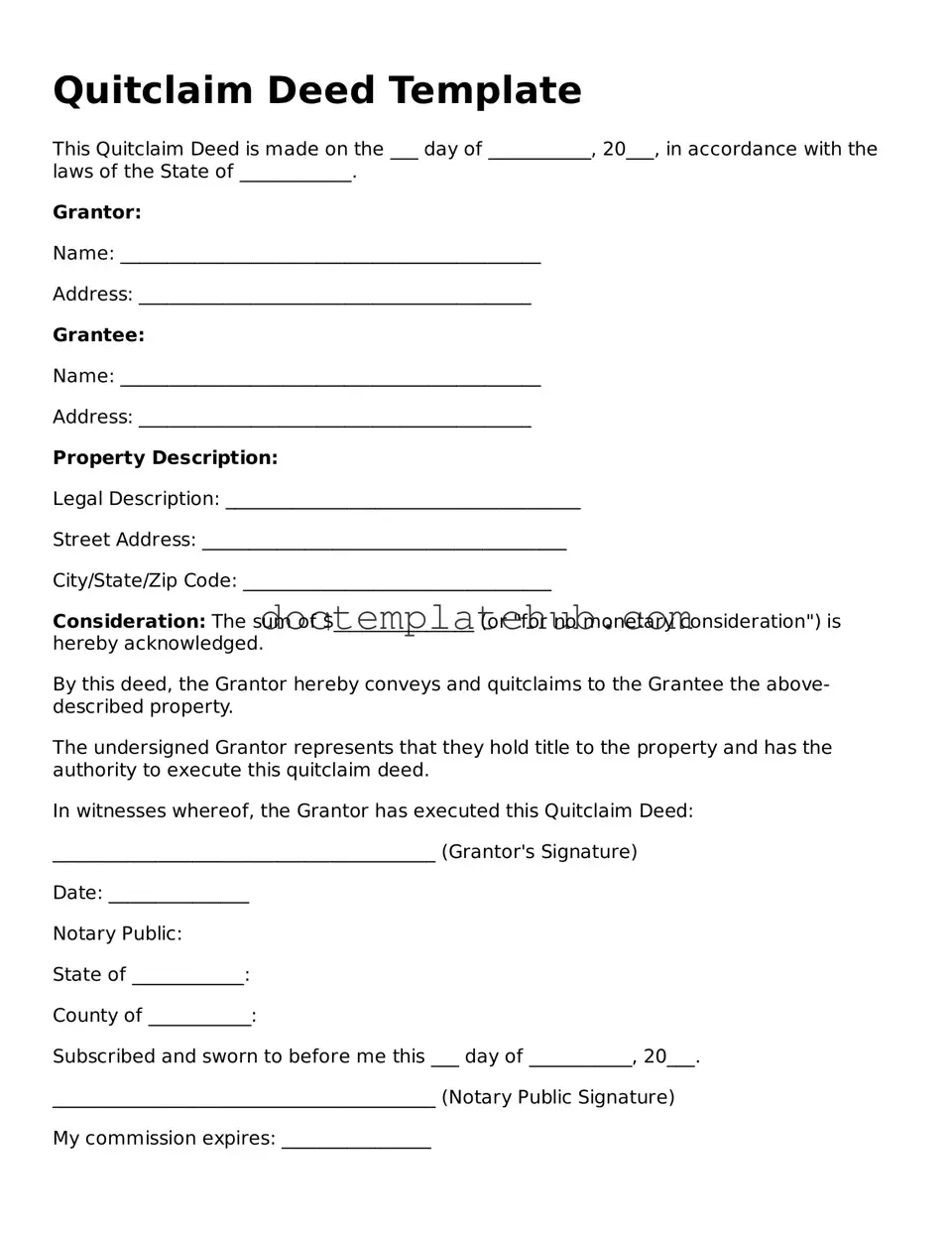

A Quitclaim Deed is a vital legal document used in real estate transactions, particularly when transferring property ownership. This form allows one party, known as the grantor, to transfer any interest they may have in a property to another party, called the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply conveys whatever interest the grantor possesses, if any. This makes it a popular choice in situations such as transferring property between family members, clearing up title issues, or when a property is gifted. The form typically includes essential details such as the names of the parties involved, a legal description of the property, and the date of transfer. Additionally, it often requires the grantor's signature, and in some cases, notarization is necessary to ensure the document's validity. Understanding the Quitclaim Deed is crucial for anyone involved in property transactions, as it outlines the rights being transferred and helps clarify ownership matters.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, the key difference lies in the level of protection offered. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. This means the buyer is protected against any claims or disputes regarding ownership. In contrast, a Quitclaim Deed does not provide such assurances, making it a riskier option for buyers.

For couples preparing to marry, understanding the legal implications of a Prenuptial Agreement is vital. This document can serve as a powerful tool for safeguarding individual assets and clarifying financial expectations. To learn more, explore our guide on the comprehensive Prenuptial Agreement considerations at this link.

A Grant Deed also serves the purpose of transferring property ownership, much like a Quitclaim Deed. The primary distinction is that a Grant Deed includes certain warranties. Specifically, it assures that the property has not been sold to anyone else and that it is free from any undisclosed encumbrances. This provides some level of security to the buyer, unlike a Quitclaim Deed, which offers no warranties.

An Affidavit of Title is another document that shares similarities with a Quitclaim Deed. This document is often used in real estate transactions to confirm the seller's ownership of the property and to disclose any potential claims against it. While a Quitclaim Deed transfers ownership without guarantees, an Affidavit of Title provides a sworn statement about the title's status, offering more assurance to the buyer.

A Deed of Trust is related to a Quitclaim Deed in that it involves property, but it serves a different purpose. A Deed of Trust is used to secure a loan with real estate as collateral. While a Quitclaim Deed transfers ownership without conditions, a Deed of Trust establishes a lender's interest in the property until the loan is paid off. This document is crucial in financing transactions.

A Lease Agreement can also be seen as similar to a Quitclaim Deed in that both involve the use of property. However, a Lease Agreement grants temporary possession and use of the property, while a Quitclaim Deed transfers ownership outright. Both documents establish rights and responsibilities, but they do so in different contexts—one for ownership and the other for tenancy.

A Power of Attorney can be compared to a Quitclaim Deed in terms of authority over property transactions. While a Quitclaim Deed transfers ownership from one party to another, a Power of Attorney allows an individual to act on behalf of another in property matters. This document can facilitate the execution of a Quitclaim Deed if the property owner is unable to sign it personally.

Finally, a Real Estate Purchase Agreement is similar to a Quitclaim Deed in that it outlines the terms of a property sale. However, this agreement is a contract that details the conditions of the sale, including price and contingencies, rather than transferring ownership itself. A Quitclaim Deed would typically follow the execution of a Purchase Agreement to finalize the transfer of ownership.

Fill out Common Types of Quitclaim Deed Templates

Deed of Gift Template - The Gift Deed can strengthen relationships by formalizing the act of giving.

Having a well-structured Operating Agreement form is essential for any Texas-based limited liability company (LLC) to prevent misunderstandings among members. This document details the operating procedures, financial decisions, and various roles within the company, acting as a foundational guide that ensures clarity and order in operations. For those looking for templates and resources, smarttemplates.net provides useful tools to help streamline the process.

More About Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title. Instead, it simply conveys whatever interest the grantor has in the property at the time of the transfer.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other well, such as transferring property between family members or divorcing spouses. They can also be useful for clearing up title issues or correcting errors in property records. However, they are not recommended for transactions involving unknown parties or where a title search is necessary.

What are the risks associated with using a Quitclaim Deed?

The primary risk of using a Quitclaim Deed is that it does not provide any warranties or guarantees about the property title. This means that if there are any liens, claims, or other encumbrances on the property, the new owner may inherit those issues. It is essential to understand the implications and conduct due diligence before proceeding with this type of deed.

How do I complete a Quitclaim Deed?

To complete a Quitclaim Deed, you must include specific information such as the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Both parties should sign the document in front of a notary public. Once completed, the Quitclaim Deed should be filed with the appropriate county office to ensure it is officially recorded.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such assurances and simply transfers whatever interest the grantor may have.

Can I revoke a Quitclaim Deed?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally. However, the parties involved can create a new legal document, such as a Revocation of Quitclaim Deed, to formally cancel the transfer. It is advisable to consult with a legal professional to understand the implications and processes involved.

Do I need an attorney to create a Quitclaim Deed?

Dos and Don'ts

When filling out a Quitclaim Deed form, it's essential to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn't do:

- Do include the full names of all parties involved.

- Do provide a complete legal description of the property.

- Do sign the document in the presence of a notary public.

- Do check for any outstanding liens or claims on the property.

- Do keep a copy of the completed deed for your records.

- Don't leave any blank spaces on the form.

- Don't forget to date the document.

- Don't use informal names or nicknames.

- Don't submit the deed without proper notarization.

Quitclaim Deed - Usage Steps

After obtaining the Quitclaim Deed form, it is essential to complete it accurately to ensure the transfer of property rights is legally recognized. Once the form is filled out, it will need to be signed and notarized before being filed with the appropriate local authority.

- Begin by entering the names of the parties involved. The person transferring the property is known as the "Grantor," while the person receiving the property is the "Grantee." Ensure that the names are spelled correctly.

- Provide the current address of the Grantor. This information helps to establish the identity of the individual transferring the property.

- Next, include the address of the Grantee. This should be the location where the Grantee can be reached.

- Identify the property being transferred. This typically includes a legal description of the property, which can often be found on the property deed or tax records. Be as detailed as possible.

- Indicate the date of the transfer. This is the date when the Grantor intends to transfer ownership to the Grantee.

- Have the Grantor sign the form. This signature must be done in the presence of a notary public, who will then also sign and stamp the document to validate it.

- Check for any additional requirements specific to your local jurisdiction. Some areas may require extra information or documentation to accompany the Quitclaim Deed.

- Finally, file the completed Quitclaim Deed with the appropriate local authority, such as the county recorder’s office. There may be a filing fee associated with this process.