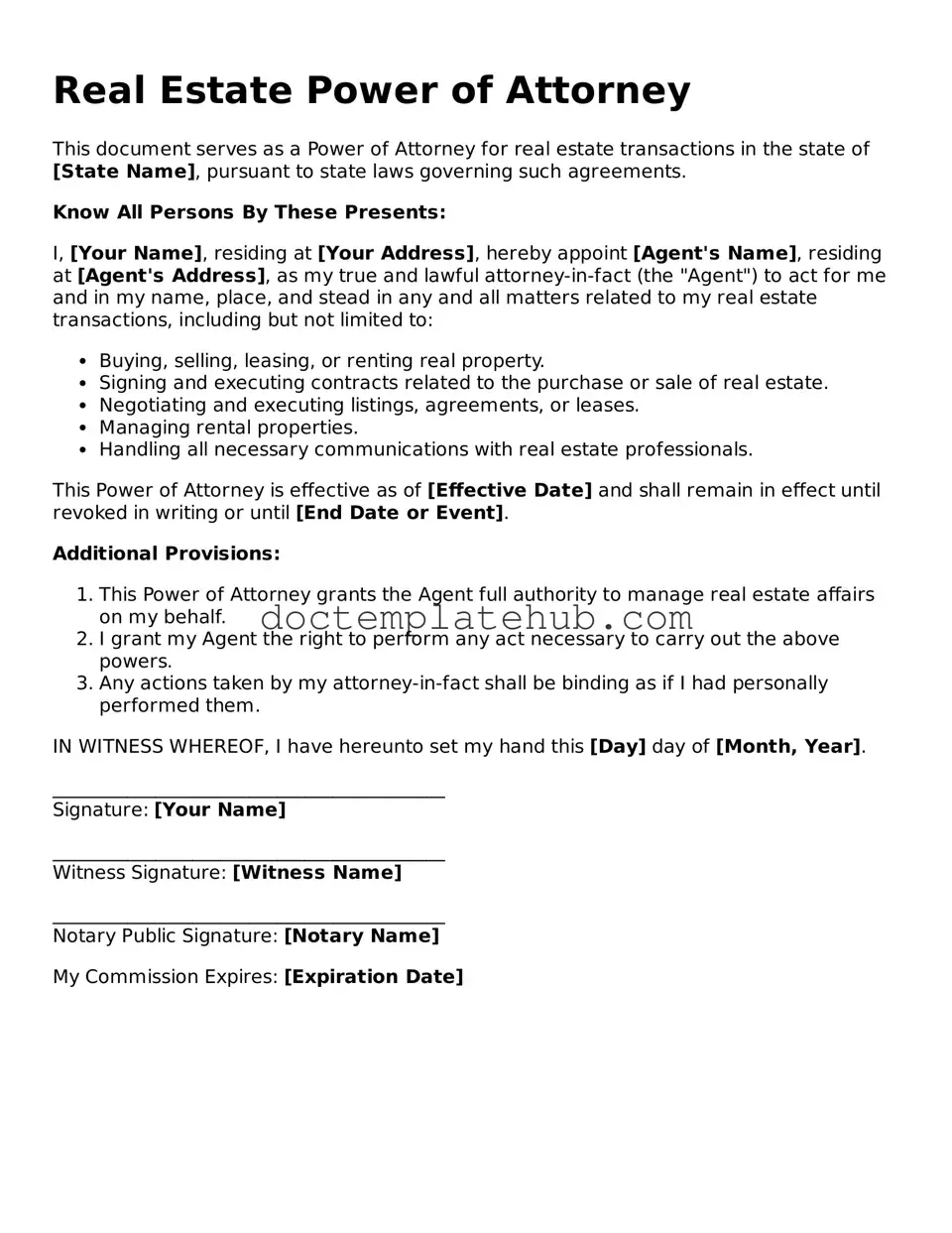

Official Real Estate Power of Attorney Form

When it comes to real estate transactions, having the right tools at your disposal can make all the difference. One crucial tool is the Real Estate Power of Attorney form, which empowers an individual to act on behalf of another in matters related to property. This form is particularly valuable when the property owner is unable to be present for important decisions, whether due to travel, health issues, or other commitments. The form typically outlines the specific powers granted, such as buying, selling, or managing property, and can be tailored to meet the unique needs of the parties involved. It's important to note that this authority can be limited to certain transactions or be more general in nature. Additionally, the form must be signed and notarized to ensure its legality, providing a safeguard for all parties. Understanding the nuances of this form not only helps in facilitating smoother transactions but also protects the interests of everyone involved.

Similar forms

The Real Estate Power of Attorney form is similar to the General Power of Attorney. Both documents allow an individual to designate another person to act on their behalf. The General Power of Attorney covers a wide range of financial and legal matters, while the Real Estate Power of Attorney is specifically tailored for real estate transactions. This specificity makes the Real Estate Power of Attorney a more focused tool for property-related decisions.

Another similar document is the Durable Power of Attorney. This form remains effective even if the person who created it becomes incapacitated. Like the Real Estate Power of Attorney, it allows the appointed agent to make decisions on behalf of the principal. However, the Durable Power of Attorney can encompass a broader range of decisions beyond just real estate, providing a safety net for various financial matters.

The Limited Power of Attorney is also akin to the Real Estate Power of Attorney. This document grants the agent authority to perform specific tasks or make certain decisions on behalf of the principal. In the case of real estate, it may limit the agent's powers to a single transaction or type of property, allowing for precise control over the actions taken by the agent.

The Real Estate Power of Attorney is a vital document, but several other forms share similar functions or purposes. A Durable Power of Attorney also empowers an individual to make decisions on behalf of another person, but with a crucial difference: it remains in effect even if the principal becomes incapacitated. This feature makes it particularly important for managing financial and legal matters during difficult times. For further details on Durable Power of Attorney forms, you can visit smarttemplates.net.

The Healthcare Power of Attorney bears similarity as well, although it pertains to medical decisions rather than real estate. This document allows an individual to appoint someone to make healthcare choices if they are unable to do so. Both forms empower a designated agent to act in the best interest of the principal, but they apply to different aspects of life.

The Financial Power of Attorney is another comparable document. It allows an individual to designate someone to manage their financial affairs, including banking, investments, and property management. While the Real Estate Power of Attorney is specifically for property transactions, the Financial Power of Attorney can cover a broader range of financial responsibilities, including real estate matters.

The Living Trust is similar in that it allows for the management and distribution of an individual's assets, including real estate. A Living Trust can help avoid probate, and it designates a trustee to handle the assets according to the trust's terms. While the Real Estate Power of Attorney allows for immediate decision-making regarding property, a Living Trust often provides for long-term management and distribution of assets.

The Quitclaim Deed is another document related to real estate transactions. It allows an individual to transfer their interest in a property to another party without making any guarantees about the title. While the Real Estate Power of Attorney authorizes someone to act on behalf of the principal in property matters, a Quitclaim Deed is a method of transferring ownership directly.

The Warranty Deed is similar in that it involves the transfer of real estate. This document guarantees that the seller holds clear title to the property and has the right to sell it. While the Real Estate Power of Attorney empowers an agent to act on behalf of the principal, a Warranty Deed serves as a formal legal instrument that ensures protection for the buyer in a property transaction.

The Affidavit of Heirship is relevant in situations involving the transfer of property after someone's death. This document helps establish the heirs of a deceased individual and their rights to the property. Similar to the Real Estate Power of Attorney, it deals with property ownership but does so in the context of inheritance rather than active management or sale.

Lastly, the Lease Agreement is comparable in that it involves real estate but focuses on the rental of property rather than ownership transfer. This document outlines the terms under which a tenant can occupy a property. While the Real Estate Power of Attorney allows someone to make decisions about buying or selling property, a Lease Agreement governs the relationship between a landlord and tenant.

Fill out Common Types of Real Estate Power of Attorney Templates

How to Write a Notarized Letter for a Vehicle - Allows someone to represent the owner in vehicle-related negotiations.

When considering the essential aspects of a Power of Attorney, it's important to explore resources that can provide further insights, such as the one available at documentonline.org/blank-power-of-attorney/, which offers comprehensive information on the topic. This legal document enables one person to authorize another to manage financial or legal matters, particularly useful for those who may be incapacitated or otherwise unable to handle their affairs.

Power of Attorney for Child Texas - The form can include authority limits to prevent misuse of power.

More About Real Estate Power of Attorney

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, known as the principal, specifically in matters related to real estate transactions. This can include buying, selling, leasing, or managing property. The document grants the agent the authority to make decisions and sign documents regarding the real estate on behalf of the principal.

Why would someone need a Real Estate Power of Attorney?

There are several reasons why someone might need a Real Estate Power of Attorney. For instance, if the principal is unable to be present for a transaction due to health issues, travel, or other commitments, having an agent can ensure that the transaction proceeds smoothly. Additionally, individuals who are aging or have mobility issues may find it beneficial to designate someone they trust to handle their real estate matters.

How does one create a Real Estate Power of Attorney?

Creating a Real Estate Power of Attorney typically involves drafting the document, which must clearly outline the powers granted to the agent. It should include the principal’s name, the agent’s name, and a detailed description of the real estate matters the agent is authorized to handle. Once the document is drafted, the principal must sign it, often in the presence of a notary public, to ensure its legality.

Can a Real Estate Power of Attorney be revoked?

Yes, a Real Estate Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent to do so. To revoke the document, the principal should create a written revocation notice and provide it to the agent and any relevant parties involved in real estate transactions. It is advisable to also notify any institutions or agencies that may have a copy of the original Power of Attorney.

Are there any limitations to the powers granted in a Real Estate Power of Attorney?

Yes, the powers granted in a Real Estate Power of Attorney can be limited based on the principal’s preferences. The principal can specify certain actions that the agent is authorized to take or exclude particular transactions altogether. It’s important for the principal to be clear about their intentions to ensure that the agent acts within the boundaries set by the document.

Is a Real Estate Power of Attorney effective immediately?

A Real Estate Power of Attorney can be effective immediately upon signing, or it can be set to become effective at a later date or upon a specific event, such as the principal becoming incapacitated. This is known as a "springing" power of attorney. The principal should decide what works best for their situation when drafting the document.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and has a valid Real Estate Power of Attorney in place, the agent can step in and manage the real estate affairs as outlined in the document. This can help avoid delays in transactions and ensure that the principal’s wishes are honored. However, if there is no Power of Attorney in place, it may become necessary for family members to seek a court-appointed guardian or conservator to manage the principal’s affairs.

Dos and Don'ts

When filling out a Real Estate Power of Attorney form, it’s essential to approach the task with care. This document grants someone the authority to act on your behalf regarding real estate transactions. Here are four key do's and don'ts to keep in mind:

- Do: Clearly identify the person you are appointing as your agent. Make sure their name and contact information are accurate.

- Do: Specify the powers you are granting. Be explicit about what actions your agent can take on your behalf.

- Don't: Forget to date and sign the document. An unsigned or undated form may lead to complications later.

- Don't: Rush through the process. Take your time to review the form and ensure all information is correct before submission.

By following these guidelines, you can help ensure that your Real Estate Power of Attorney is filled out correctly and serves its intended purpose effectively.

Real Estate Power of Attorney - Usage Steps

Completing the Real Estate Power of Attorney form is a straightforward process that requires careful attention to detail. By following the steps outlined below, you can ensure that the form is filled out correctly, allowing for the effective delegation of real estate decision-making authority.

- Begin by downloading the Real Estate Power of Attorney form from a reliable source.

- Read the instructions provided with the form to understand the requirements.

- In the designated section, enter the full name and address of the person granting the power of attorney (the "Principal").

- Next, fill in the full name and address of the person receiving the authority (the "Agent").

- Clearly specify the powers being granted to the Agent. This may include buying, selling, or managing real estate.

- Indicate the duration of the power of attorney, whether it is effective immediately or for a specific time period.

- Include any additional instructions or limitations regarding the Agent's authority, if necessary.

- Both the Principal and the Agent must sign and date the form in the appropriate sections.

- Have the signatures notarized to ensure the form is legally binding.

- Make copies of the completed form for both the Principal and the Agent for their records.