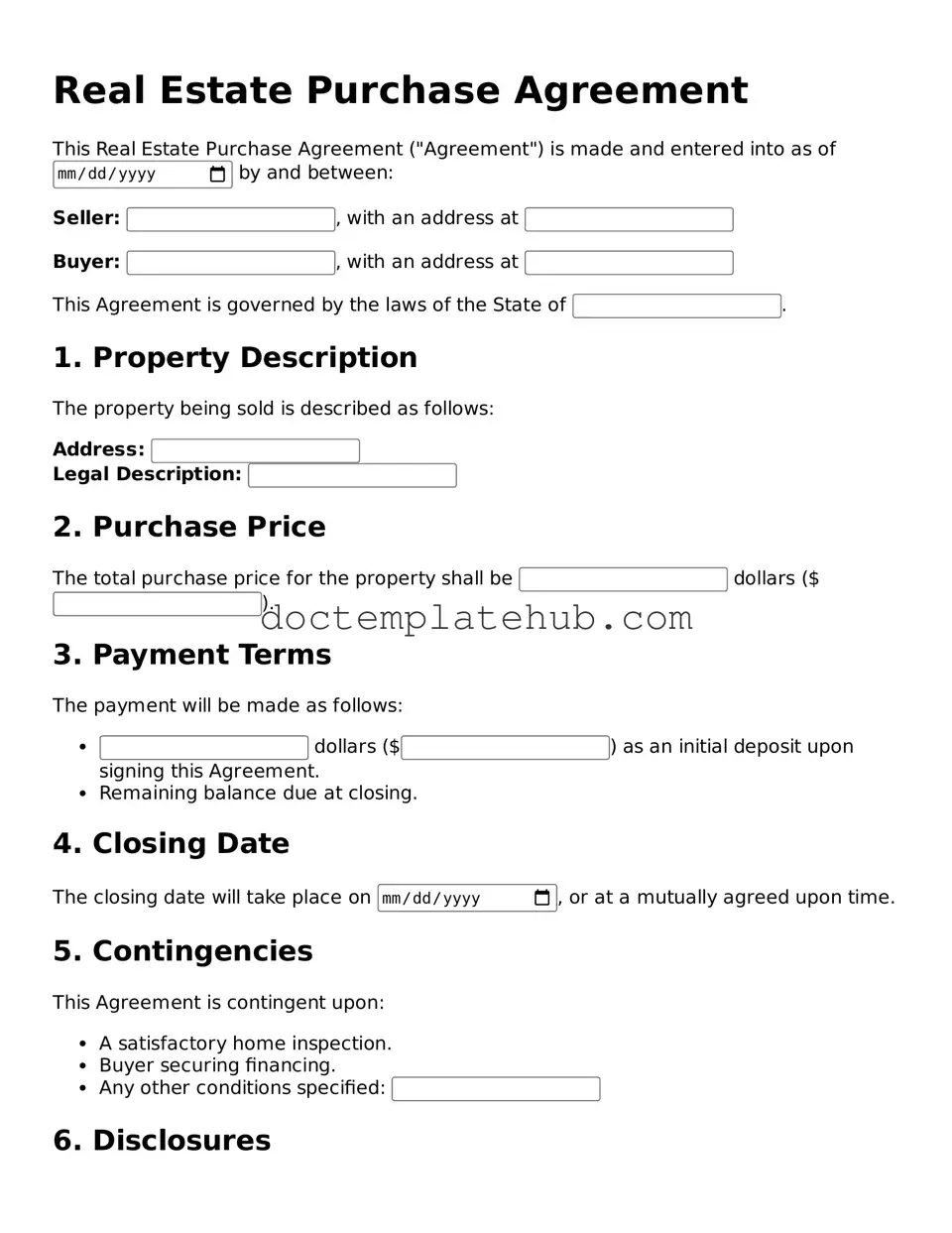

Official Real Estate Purchase Agreement Form

The Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property, outlining the terms and conditions agreed upon by both the buyer and the seller. This form typically includes essential details such as the purchase price, property description, and the closing date, ensuring that both parties have a clear understanding of their obligations. Additionally, it often addresses contingencies, which are conditions that must be met for the sale to proceed, such as financing approval or home inspections. The agreement also specifies the earnest money deposit, a sum paid by the buyer to demonstrate their commitment to the purchase. By including provisions related to disclosures, repairs, and potential disputes, the form aims to protect the interests of both parties and facilitate a smooth transaction. Ultimately, the Real Estate Purchase Agreement serves as a roadmap for the sale, detailing the rights and responsibilities of everyone involved in the real estate transaction.

Similar forms

The Real Estate Purchase Agreement (REPA) is similar to a Lease Agreement. Both documents outline the terms and conditions under which a property is used or occupied. A Lease Agreement typically specifies the duration of the lease, monthly rent, and responsibilities of both the landlord and tenant. In contrast, the REPA focuses on the sale of property, detailing the purchase price, closing date, and contingencies. However, both agreements serve to protect the rights and obligations of the parties involved.

Another document akin to the REPA is the Option to Purchase Agreement. This agreement grants a potential buyer the right to purchase a property within a specified timeframe. Like the REPA, it includes essential details such as the purchase price and terms. The key difference lies in the fact that the Option to Purchase does not require an immediate sale but allows the buyer to secure the property for future purchase, providing flexibility for both parties.

A Purchase and Sale Agreement (PSA) is also similar to the REPA. Both documents facilitate the transfer of property ownership and outline the terms of the transaction. The PSA is often used interchangeably with the REPA, but it may include additional clauses regarding inspections, financing, and contingencies. Both agreements aim to ensure a smooth transaction and protect the interests of the buyer and seller.

The Listing Agreement shares similarities with the REPA as well. While the REPA is focused on the sale of the property, the Listing Agreement establishes a relationship between the property owner and the real estate agent. It outlines the agent's responsibilities, commission, and duration of the listing. Both documents are essential in the real estate process, ensuring that all parties understand their roles and obligations.

A Joint Venture Agreement can also be compared to the REPA, particularly in real estate investment scenarios. This agreement outlines the partnership between two or more parties to invest in property together. Like the REPA, it details financial contributions, profit-sharing, and responsibilities. Both agreements are crucial for defining the terms of collaboration and protecting the interests of each party involved.

Lastly, a Mortgage Agreement bears some resemblance to the REPA. While the REPA focuses on the sale and purchase of property, the Mortgage Agreement details the terms of financing the purchase. It includes information about the loan amount, interest rate, and repayment schedule. Both documents are integral to the property acquisition process, ensuring that all financial aspects are clearly defined and understood by the parties involved.

Real Estate Purchase Agreement Document Types

Common Forms

Spanish Job Application Form - Clear and truthful responses lead to more effective employment evaluations.

Renewal of Passport - Heads need to occupy 32mm to 36mm of the photo.

Set Up March Madness Bracket - Dive into the statistics and past performances for insights.

More About Real Estate Purchase Agreement

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding contract between a buyer and a seller outlining the terms of a property sale. This document specifies key details such as the purchase price, property description, and closing date. It serves as a roadmap for the transaction, ensuring both parties understand their rights and obligations. By putting everything in writing, it minimizes misunderstandings and protects both the buyer and the seller throughout the process.

What are the essential components of a Real Estate Purchase Agreement?

Several critical components must be included in a Real Estate Purchase Agreement. First, the agreement should clearly identify the buyer and seller, along with their contact information. Next, it must describe the property being sold, including its address and legal description. The purchase price is another vital element, along with any earnest money deposit. Additionally, the agreement should outline contingencies, such as financing or inspections, and specify the closing date. Finally, it should address any inclusions or exclusions, like appliances or fixtures, that come with the sale.

How does a Real Estate Purchase Agreement protect both parties?

This agreement acts as a safeguard for both buyers and sellers. For buyers, it ensures they have a clear understanding of what they are purchasing and provides a framework for recourse if the seller fails to meet their obligations. For sellers, the agreement outlines the terms under which they will sell their property, helping to prevent potential disputes. By clearly defining the expectations and responsibilities of both parties, the agreement helps to create a smoother transaction and reduces the risk of legal issues down the line.

Can a Real Estate Purchase Agreement be modified after it is signed?

Yes, a Real Estate Purchase Agreement can be modified after it has been signed, but both parties must agree to any changes. Modifications can occur for various reasons, such as changes in the closing date or adjustments to the purchase price. It’s essential to document any changes in writing and have both parties sign the modified agreement to ensure that the new terms are enforceable. This practice helps maintain clarity and protects the interests of both the buyer and seller.

What happens if one party breaches the Real Estate Purchase Agreement?

If one party breaches the agreement, the other party has several options. They may choose to pursue legal remedies, which could include seeking damages or specific performance—meaning they can ask the court to enforce the terms of the contract. Alternatively, the non-breaching party may decide to terminate the agreement and seek a refund of any earnest money deposited. The specific actions available depend on the nature of the breach and the terms outlined in the agreement. Therefore, it’s crucial to understand the implications of breaching the contract and to seek legal advice if needed.

Dos and Don'ts

When filling out the Real Estate Purchase Agreement form, it's important to be careful and thorough. Here’s a list of things you should and shouldn't do:

- Do read the entire agreement carefully before signing.

- Do provide accurate information about the property and the parties involved.

- Do consult with a real estate professional if you have questions.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any blank spaces; fill in all required fields.

Following these guidelines will help ensure a smoother transaction and protect your interests.

Real Estate Purchase Agreement - Usage Steps

Once you have the Real Estate Purchase Agreement form in front of you, it’s essential to fill it out accurately to ensure a smooth transaction. This document will guide you through the process of buying or selling property. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Fill in the names and addresses of the buyer and seller.

- Clearly describe the property being sold. Include the address, legal description, and any relevant details.

- Specify the purchase price. Indicate the total amount the buyer agrees to pay for the property.

- Outline the terms of the sale. Include any contingencies, such as financing or inspection requirements.

- Determine the closing date. Specify when the transaction will be finalized and ownership transferred.

- Include any additional terms or conditions that both parties have agreed upon.

- Sign and date the agreement. Both the buyer and seller must provide their signatures.

After completing the form, review it carefully for accuracy. Any errors or omissions could lead to complications later on. Once everything is confirmed, the agreement can be presented for further processing.