Fill Your Release Of Lien Texas Form

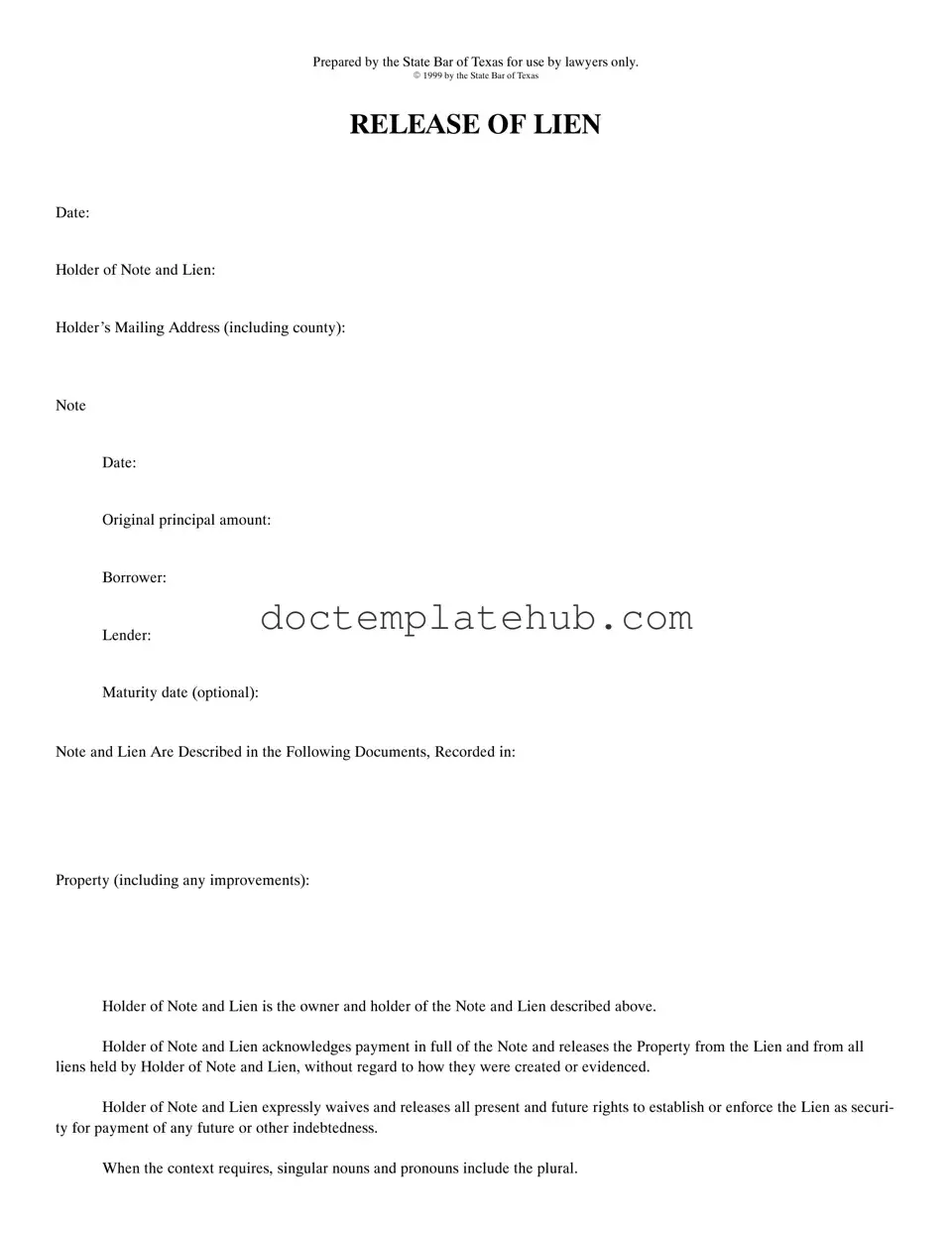

The Release of Lien Texas form serves as a crucial document in the process of clearing a lien from a property, providing a clear path for borrowers to regain full ownership rights. This form is prepared by the State Bar of Texas specifically for use by attorneys, ensuring that the legal nuances are properly addressed. Key elements of the form include details such as the date of the release, the name and address of the lien holder, and the original principal amount of the note. It also identifies the borrower and lender, along with the maturity date, if applicable. The form confirms that the holder of the note and lien acknowledges full payment, thus releasing the property from the lien. This release applies to all liens held by the holder, regardless of how they were created. Importantly, the document includes a waiver of future rights to enforce the lien for any additional debts. The acknowledgment section ensures that the signatures are verified by a notary public, adding a layer of authenticity to the transaction. This process not only protects the interests of the lien holder but also provides peace of mind for the borrower, allowing them to move forward without the burden of encumbrances on their property.

Similar forms

The Satisfaction of Mortgage document serves a similar purpose to the Release of Lien in Texas. When a mortgage is paid off, the lender must formally acknowledge that the borrower has fulfilled their financial obligation. This document is filed with the county to remove the mortgage lien from the property title. Just like the Release of Lien, the Satisfaction of Mortgage indicates that the lender waives any future claims against the property related to that specific debt, ensuring that the borrower can enjoy clear ownership without lingering encumbrances.

The Deed of Trust is another document that relates closely to the Release of Lien. In Texas, a Deed of Trust secures a loan by placing a lien on the property. When the loan is paid off, a Release of Lien is often issued to remove the lien from the property title. The Deed of Trust outlines the terms of the loan and the rights of the lender, while the Release of Lien confirms that the borrower has satisfied their obligation, thus restoring full ownership rights to the property.

The Quitclaim Deed can also be compared to the Release of Lien. While a Quitclaim Deed transfers ownership interest in a property without guaranteeing that the title is clear, it can be used to remove a party's interest in a property. When a lien is released, it acts similarly by clearing the property of any claims the lien holder had. Both documents facilitate the transfer or release of interest in property, allowing for a smoother transition in ownership and helping to clarify property rights.

The Certificate of Title is another document that shares similarities with the Release of Lien. This certificate provides proof of a property’s ownership and any liens or encumbrances against it. When a lien is released, the Certificate of Title is updated to reflect that change, ensuring that potential buyers or lenders can see that the property is free from that specific lien. This process helps maintain transparency in property transactions, akin to the function of the Release of Lien.

The Chick-fil-A job application form is an essential document for those looking to become part of the esteemed fast-food chain, gathering vital details about applicants, such as their employment history and available hours. Completing this form accurately is integral to joining a reputable team focused on delivering top-notch customer service and community engagement. For further information, you can access the application form here: https://documentonline.org/blank-chick-fil-a-job-application/.

Finally, the Affidavit of Heirship can be likened to the Release of Lien in terms of clarifying ownership. This document is often used to establish the rightful heirs to a property when the owner passes away without a will. While it does not directly release a lien, it can help clear up any disputes regarding property ownership, similar to how a Release of Lien clarifies the status of liens on a property. Both documents aim to ensure that ownership is clear and unencumbered, facilitating smoother property transactions.

Other PDF Templates

U.S. Corporation Income Tax Return - Corporate deductions, including business expenses, are detailed on the 1120.

How to Fill Out I864 - The form is a commitment that reflects support and responsibility.

To further clarify the importance of having a comprehensive understanding of the New York Room Rental Agreement, it is advisable for both landlords and tenants to refer to resources like smarttemplates.net, which provide valuable templates and guidance for creating a well-structured agreement that meets state requirements.

Different Types of Background Checks - Minor traffic violations are not considered when reviewing your application.

More About Release Of Lien Texas

What is a Release of Lien in Texas?

A Release of Lien is a legal document that officially removes a lien from a property. In Texas, when a borrower pays off a loan secured by a lien, the lender must acknowledge that the debt has been satisfied. This document serves as proof that the lender relinquishes their claim to the property, allowing the owner to have a clear title.

Who prepares the Release of Lien form?

The Release of Lien form is typically prepared by a lawyer. It's important to ensure that the document is completed correctly to avoid any potential legal issues in the future. While the State Bar of Texas provides a template, it is advisable to seek legal assistance for proper execution and recording.

What information is required to complete the form?

To fill out the Release of Lien form, you will need several key pieces of information. This includes the date of the release, the name and address of the lien holder, details about the note and lien, the original principal amount, the borrower's name, and the property description. Additionally, the form may require acknowledgment by a notary public to verify the identities of the parties involved.

What happens after the Release of Lien is filed?

Once the Release of Lien is completed and signed, it must be filed with the appropriate county clerk's office where the original lien was recorded. After filing, the lien is officially removed from the property records. This step is crucial, as it ensures that future buyers or lenders can see that the property is free from that particular lien.

Can a Release of Lien be contested?

Yes, a Release of Lien can potentially be contested. If there are disputes regarding the payment of the underlying debt or if the lien holder did not have the authority to release the lien, issues may arise. It's essential to keep all documentation related to the payment and release of the lien to address any challenges that may occur.

Is there a fee associated with filing a Release of Lien?

Yes, there is usually a fee for filing a Release of Lien with the county clerk's office. The amount can vary by county, so it's a good idea to check with the local office for the exact fee. Additionally, if you hire a lawyer to assist in preparing and filing the document, there may be legal fees involved as well.

What should I do if I lose my Release of Lien document?

If you lose your Release of Lien document, you can request a copy from the county clerk's office where it was filed. It's important to keep a copy of this document for your records, as it serves as proof that the lien has been released. If necessary, you may also consult a lawyer for further assistance in recovering or re-establishing the release.

Dos and Don'ts

When filling out the Release of Lien form in Texas, it’s essential to approach the task with care. Here are some do's and don’ts to keep in mind:

- Do ensure all fields are completed accurately. Missing information can lead to delays.

- Do double-check the spelling of names and addresses. Accuracy is key to avoid future complications.

- Do include the date of acknowledgment. This is crucial for legal documentation.

- Do provide a clear description of the property involved. Be specific to prevent misunderstandings.

- Don't leave out the notary section. An acknowledgment by a notary public is necessary for the form to be valid.

- Don't use vague terms when describing the lien or the note. Clarity helps in legal contexts.

- Don't forget to keep a copy of the completed form for your records. Documentation is important for future reference.

Release Of Lien Texas - Usage Steps

Once you have gathered the necessary information, it’s time to fill out the Release of Lien form in Texas. This form is important for formally releasing a lien on a property, ensuring that the lienholder acknowledges payment in full. Follow these steps to complete the form accurately.

- Date: Write the date when the form is being filled out.

- Holder of Note and Lien: Enter the name of the individual or entity that holds the note and lien.

- Holder’s Mailing Address: Provide the complete mailing address of the holder, including the county.

- Note Date: Fill in the date when the original note was created.

- Original Principal Amount: Indicate the original amount of the loan or debt secured by the lien.

- Borrower: Enter the name of the borrower who took out the loan.

- Lender: Write the name of the lender who provided the loan.

- Maturity Date (optional): If applicable, include the date when the loan was due to be paid in full.

- Note and Lien Are Described in the Following Documents, Recorded in: Specify the documents that describe the note and lien, along with where they are recorded.

- Property: Describe the property that is subject to the lien, including any improvements made.

- Acknowledgment: Leave space for the notary public to acknowledge the signing of the document.

- Notary Public Information: Include the notary’s name (printed) and the expiration date of their commission.

- Corporate Acknowledgment (if applicable): If the lienholder is a corporation, provide the necessary information for the corporate acknowledgment.

- Return Address: Write the address where the recorded document should be returned after processing.