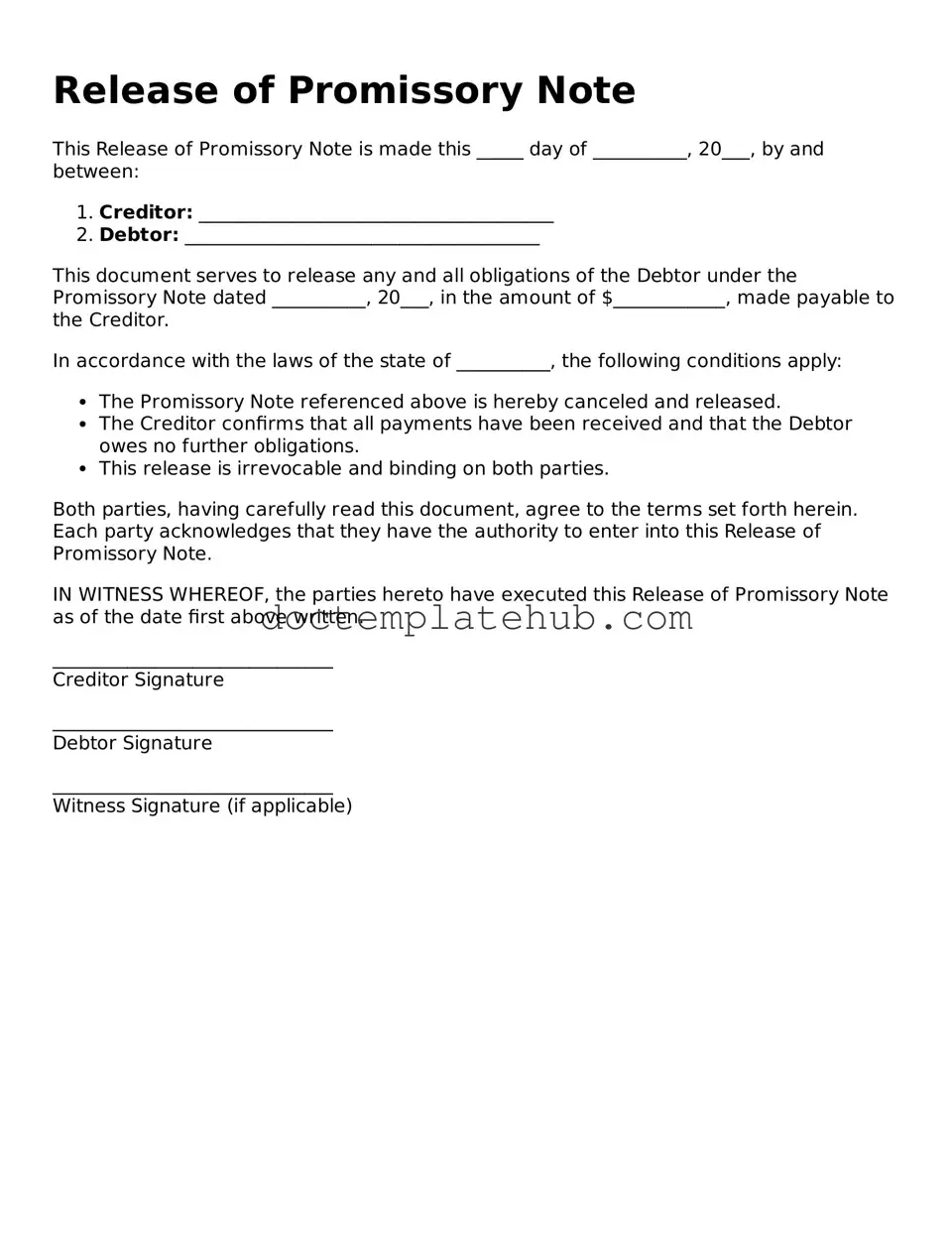

Official Release of Promissory Note Form

The Release of Promissory Note form plays a vital role in the realm of financial transactions and debt management. This document signifies the formal release of a borrower from their obligation to repay a loan, effectively marking the conclusion of a financial agreement. When properly completed, the form provides essential details such as the names of the parties involved, the original loan amount, and the date of repayment. It also serves as a legal acknowledgment that the debt has been satisfied, which can prevent future disputes over the obligation. Understanding the importance of this form is crucial for both lenders and borrowers, as it not only protects the interests of the lender but also provides peace of mind to the borrower. By ensuring that all necessary information is accurately documented, the Release of Promissory Note form helps facilitate a smooth transition and closure in financial dealings.

Similar forms

The Release of Promissory Note form shares similarities with a Loan Satisfaction Letter. Both documents serve to confirm that a borrower has fulfilled their obligations under a loan agreement. When a loan is paid off, the lender issues a Loan Satisfaction Letter to officially acknowledge that the debt has been satisfied. This letter not only provides peace of mind to the borrower but also serves as proof that the lender no longer has any claims against the borrower regarding that specific loan.

Another document akin to the Release of Promissory Note is the Mortgage Satisfaction Document. This document is used when a mortgage has been fully paid off. Similar to the release of a promissory note, the Mortgage Satisfaction Document indicates that the borrower has completed all payments and that the lender relinquishes any claim to the property. It is crucial for homeowners to obtain this document, as it clears the title and allows for the unhindered sale or transfer of the property in the future.

In addition to the aforementioned documents, one vital form to consider is the Florida Promissory Note, which serves as a legal document outlining the terms of a loan and repayment schedule. To gain further insights and to access the form itself, you can visit https://floridaforms.net/blank-promissory-note-form, which is instrumental for borrowers in ensuring that all legal aspects of their loan agreements are accurately addressed.

The Quitclaim Deed is also comparable to the Release of Promissory Note. While it primarily deals with property rights, its purpose is to transfer ownership without any guarantees. In the context of a promissory note, if a borrower has paid off their debt, a Quitclaim Deed might be used to transfer any remaining interest the lender has in the property back to the borrower. This ensures that the borrower holds clear title to the property, free from any claims by the lender.

A Settlement Agreement is another document that bears resemblance to the Release of Promissory Note. This agreement outlines the terms under which a dispute is resolved, often involving the payment of a debt. Once the terms are met, the lender may provide a Release of Promissory Note, effectively stating that the borrower has satisfied their obligations. This agreement can help both parties avoid further legal action and provides clarity on the resolution of the debt.

Lastly, the Certificate of Release is similar to the Release of Promissory Note in that it formally acknowledges the conclusion of a financial obligation. This certificate is often used in various financial transactions, including loans and liens. Once the borrower has fulfilled their repayment duties, the lender issues this certificate, confirming that the debt has been settled. It serves as a vital record for the borrower, indicating that they are no longer liable for the debt in question.

Fill out Common Types of Release of Promissory Note Templates

Basic Promissory Note - Provides clarity on interest rates and repayment duration for a car loan.

In addition to understanding the significance of a California Promissory Note form, it is essential to be aware of the various templates available to meet specific needs. For anyone in search of a comprehensive resource, All California Forms offers a range of options that facilitate the drafting of these important financial agreements.

More About Release of Promissory Note

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. When a borrower repays a loan in full, the lender can issue this form to confirm that the debt has been settled and that the borrower is no longer obligated to make any payments. This form serves as proof that the lender has released their claim on the borrower's assets related to the loan.

Why is it important to have a Release of Promissory Note?

Having a Release of Promissory Note is crucial for both parties involved. For the borrower, it provides a clear record that the debt has been paid off, which can be important for credit reporting and future financial transactions. For the lender, it protects against any future claims regarding the loan, ensuring that they cannot be held liable for the debt once it has been satisfied.

How do I obtain a Release of Promissory Note form?

You can typically obtain a Release of Promissory Note form from various sources. Many legal websites offer templates that you can customize to your needs. Additionally, if you have a legal advisor, they can provide you with a tailored form that meets your specific requirements. Ensure that the form complies with your state’s regulations to avoid any issues later on.

What information is required to complete the form?

To complete the Release of Promissory Note form, you will need to include specific information such as the names of the borrower and lender, the date of the original promissory note, the amount of the loan, and the date the loan was paid in full. You may also need to provide details about the method of payment and any relevant loan account numbers. Accurate information helps prevent any misunderstandings or disputes in the future.

Is notarization required for the Release of Promissory Note?

While notarization is not always legally required, it is highly recommended. Having the Release of Promissory Note notarized adds an extra layer of authenticity and can help prevent disputes over the validity of the document. Some lenders may also require notarization as part of their internal policies, so it is wise to check with them before finalizing the document.

What happens if I do not obtain a Release of Promissory Note?

If you do not obtain a Release of Promissory Note after repaying a loan, you may face potential complications. The lender could mistakenly believe that the debt is still outstanding, which could affect your credit score and financial reputation. Additionally, without this document, you might find it challenging to prove that the debt has been settled, leading to potential legal disputes in the future.

Can I use a Release of Promissory Note for any type of loan?

Generally, a Release of Promissory Note can be used for various types of loans, including personal loans, business loans, and mortgages. However, specific requirements may vary depending on the nature of the loan and the lender's policies. It is advisable to consult with a legal professional to ensure that the form is appropriate for your particular situation.

Dos and Don'ts

When filling out the Release of Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information in all required fields.

- Do sign and date the form where indicated.

- Don't leave any fields blank unless specified as optional.

- Don't use correction fluid or tape on the form.

Release of Promissory Note - Usage Steps

After completing the Release of Promissory Note form, it’s important to ensure all information is accurate and clear. This will help facilitate the next steps in the process, which may involve notifying relevant parties or filing the document with a specific authority.

- Begin by writing the date at the top of the form.

- Fill in the name of the borrower in the designated space.

- Enter the name of the lender in the appropriate section.

- Include the amount of the promissory note that is being released.

- Provide a brief description of the terms of the promissory note.

- Sign the form where indicated, ensuring your signature matches the name provided.

- Have the lender sign the form as well, if required.

- Make copies of the completed form for your records.

- Submit the form to the appropriate party or authority as needed.