Fill Your Sample Tax Return Transcript Form

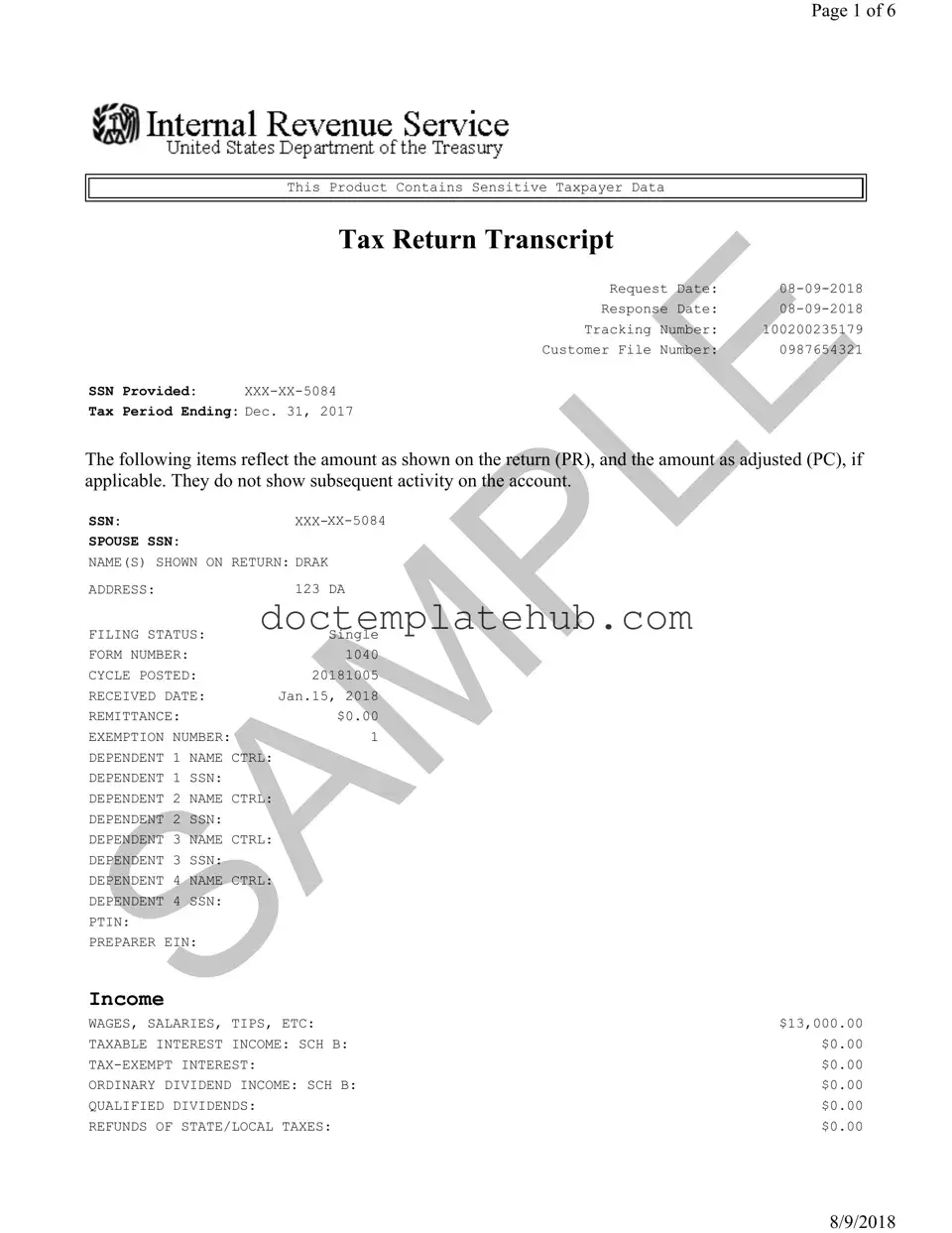

When it comes to understanding your tax situation, the Sample Tax Return Transcript form serves as a crucial document. This form provides a snapshot of your tax return, showcasing key information such as your filing status, income sources, and tax liabilities. For instance, it includes details like wages, salaries, and any business income, allowing you to see a comprehensive view of your financial year. You’ll also find adjustments to income, which can impact your overall tax burden. The form highlights deductions, credits, and payments, making it easier to assess whether you owe money or are due a refund. With a clear breakdown of taxable income and taxes owed, this transcript can be invaluable for various purposes, such as loan applications or verifying income. Understanding how to read and utilize this form can empower you to make informed financial decisions and ensure you stay on top of your tax obligations.

Similar forms

The IRS Form 1040 is the standard individual income tax return form used in the United States. Like the Sample Tax Return Transcript, it provides detailed information about an individual's income, deductions, and tax liability for a given tax year. Both documents are essential for taxpayers to report their financial activities and calculate taxes owed or refunds due. However, while the Form 1040 is the actual return filed by the taxpayer, the Sample Tax Return Transcript serves as a summary of that return, showing key figures without revealing sensitive details.

The IRS Form 1099 is another important document that is similar to the Sample Tax Return Transcript. This form is used to report various types of income other than wages, salaries, and tips. Just as the transcript summarizes income sources, the 1099 provides a breakdown of income received from different entities, such as freelance work or rental income. Both documents are crucial for accurate tax reporting, ensuring that all income is accounted for when filing taxes.

The W-2 form is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Similar to the Sample Tax Return Transcript, it includes critical income information that is necessary for completing tax returns. Both documents help taxpayers verify their income and ensure that the correct amounts are reported to the IRS, aiding in the overall accuracy of tax filings.

The Schedule C is used by sole proprietors to report income or loss from a business they operated or a profession they practiced. Like the Sample Tax Return Transcript, it details income sources and expenses, which are essential for calculating net profit or loss. Both documents are important for self-employed individuals to report their earnings accurately and determine their tax obligations.

The IRS Form 4868 is an application for an automatic extension of time to file a U.S. individual income tax return. Similar to the Sample Tax Return Transcript, it contains taxpayer identification information and indicates the tax year in question. Both documents are used in the tax filing process, with the Form 4868 allowing taxpayers additional time to file while the transcript summarizes previously filed returns.

The IRS Form 8888 allows taxpayers to request a direct deposit of their tax refund into one or more accounts. This form is related to the Sample Tax Return Transcript in that both deal with the taxpayer's financial information and refunds. While the transcript summarizes the overall tax situation, Form 8888 specifically addresses how the refund will be received, ensuring a smooth process for taxpayers expecting a return.

The IRS Form 941 is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Similar to the Sample Tax Return Transcript, it provides a summary of financial activities over a specific period. Both documents are essential for compliance with tax regulations, ensuring that all withholding and reporting requirements are met by employers.

The IRS Form 990 is an annual reporting return that certain tax-exempt organizations must file with the IRS. It provides a comprehensive overview of the organization's financial activities, similar to the Sample Tax Return Transcript, which summarizes an individual's financial information. Both documents serve to inform the IRS about the financial status of the filer, ensuring transparency and compliance with tax laws.

Other PDF Templates

Da1380 - Compliance with AR 140-185 regulations is essential when filling out the DA 1380.

Boo Application Form - Searching for a partner who believes in maintaining balance in life.

More About Sample Tax Return Transcript

What is a Sample Tax Return Transcript and why might I need one?

A Sample Tax Return Transcript provides a snapshot of your tax return information as filed with the IRS. This document includes key details such as your income, filing status, and deductions. Individuals often need this transcript for various purposes, including applying for loans, verifying income for rental applications, or providing proof of income for government assistance programs. It serves as an official record, summarizing your tax situation without disclosing sensitive information, such as your full Social Security number.

How do I obtain a Sample Tax Return Transcript?

To obtain a Sample Tax Return Transcript, you can request it directly from the IRS. There are several methods to do this: online through the IRS website, by mail using Form 4506-T, or by calling the IRS at their designated number. If you choose to go online, you'll need to create an account or log in to an existing one. This process allows for a quick and efficient retrieval of your transcript. Remember, it’s essential to have your personal information handy, including your Social Security number and the tax year for which you are requesting the transcript.

What information is included in the Sample Tax Return Transcript?

The Sample Tax Return Transcript includes various pieces of information that reflect your tax return, such as your total income, adjusted gross income, and any tax credits or deductions you claimed. It also shows your filing status, exemptions, and any taxes owed or refunds due. However, it does not include detailed line-by-line entries from your original tax return. Instead, it summarizes the critical elements, making it easier for you and others to understand your tax situation at a glance.

Is there a fee associated with requesting a Sample Tax Return Transcript?

No, there is no fee for requesting a Sample Tax Return Transcript from the IRS. The service is provided free of charge, which makes it accessible for anyone who needs to verify their tax information. However, if you choose to use a third-party service to obtain your transcript, those services may charge a fee. It’s advisable to utilize the official IRS channels to avoid any unnecessary costs.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of dos and don'ts.

- Do double-check your Social Security Number (SSN) for accuracy.

- Do ensure that all income sources are reported correctly, including wages and business income.

- Do keep your tax documents organized and easily accessible for reference.

- Do follow the instructions provided with the form carefully.

- Don’t leave any required fields blank; all sections must be completed.

- Don’t submit the form without reviewing it for errors or omissions.

- Don’t forget to sign and date the form before submission.

Sample Tax Return Transcript - Usage Steps

Filling out the Sample Tax Return Transcript form is a straightforward process, but it requires attention to detail. Each section of the form contains important information that needs to be accurately represented. Whether you’re doing this for your records or to provide to a third party, following these steps will help ensure that you complete the form correctly.

- Obtain the Form: Start by downloading or printing the Sample Tax Return Transcript form.

- Fill in Personal Information: Enter your Social Security Number (SSN) and your spouse's SSN if applicable. Also, include your name as it appears on your tax return.

- Provide Your Address: Write down your current mailing address. This should match the address used on your tax return.

- Select Filing Status: Indicate your filing status, such as Single, Married Filing Jointly, etc.

- Enter Tax Period: Specify the tax period you are requesting the transcript for, such as the year ended December 31, 2017.

- Report Income Details: Fill in your income details, including wages, salaries, and any other relevant income as shown on your tax return.

- Adjustments to Income: If applicable, report any adjustments to your income, such as educator expenses or self-employment tax deductions.

- Complete Tax and Credits Section: Provide information regarding your tax calculations, including taxable income and any credits you may be claiming.

- Detail Payments: Enter any payments made, such as federal income tax withheld or estimated tax payments.

- Calculate Refund or Amount Owed: Determine if you owe money or if you are due a refund based on your reported income and payments.

- Designate a Third Party (if applicable): If you want to authorize someone else to discuss your tax return, fill in their information in the third-party designee section.

- Review Your Form: Go through the entire form to ensure all information is accurate and complete.

- Submit or Save: Depending on your needs, submit the form to the appropriate party or save it for your records.

After completing these steps, you'll have a filled-out Sample Tax Return Transcript form ready for your intended use. Remember, accuracy is key, so take your time to ensure everything is correct before submission or storage.