Official Single-Member Operating Agreement Form

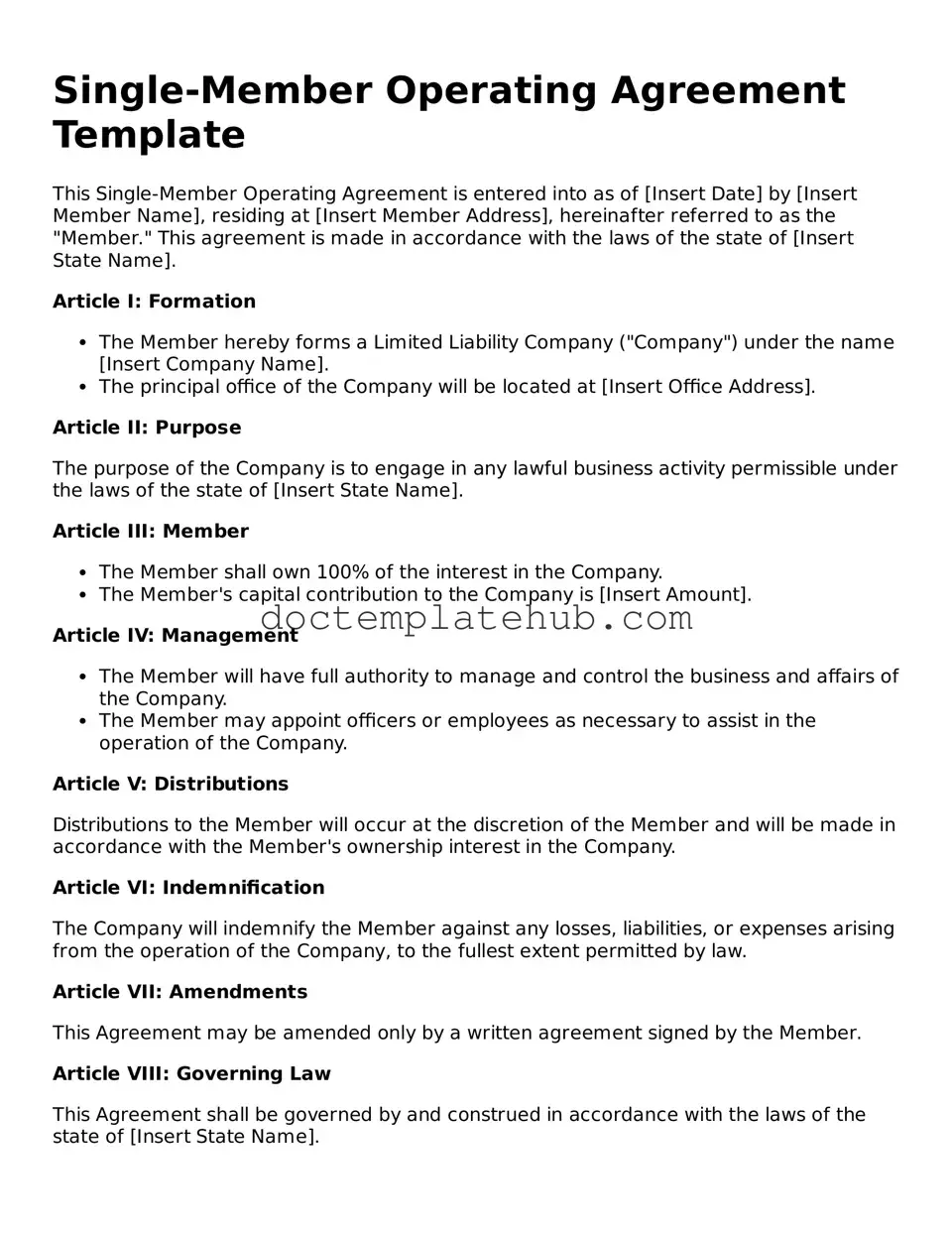

The Single-Member Operating Agreement form serves as a vital document for individuals who operate a single-member limited liability company (LLC). This form outlines the structure and operational guidelines for the business, ensuring clarity and legal protection for the owner. Key aspects of the agreement include the identification of the sole member, the purpose of the LLC, and the management structure, which typically designates the owner as the sole decision-maker. Additionally, the form addresses financial matters, such as capital contributions and profit distribution, establishing a clear framework for how funds will be handled. By defining the rights and responsibilities of the member, the agreement also helps to limit personal liability, distinguishing between personal and business assets. Overall, the Single-Member Operating Agreement is essential for anyone looking to formalize their business operations while safeguarding their interests.

Similar forms

The Single-Member Operating Agreement is akin to a Sole Proprietorship Agreement. Both documents serve to establish the terms and conditions under which a business operates. While a Sole Proprietorship Agreement outlines the responsibilities and rights of the owner, a Single-Member Operating Agreement details the management structure and operational guidelines for a limited liability company owned by a single individual. This distinction is crucial for liability protection and tax considerations.

Another similar document is the Partnership Agreement. Although a Partnership Agreement involves two or more parties, it shares similarities in defining roles, responsibilities, and profit-sharing arrangements. Both agreements aim to provide clarity and structure, ensuring that all parties understand their obligations and the operational framework of the business. The key difference lies in the number of members and the liability implications for each party.

The Bylaws of a corporation also bear resemblance to the Single-Member Operating Agreement. Bylaws govern the internal management of a corporation, detailing how decisions are made and how the organization operates. Like the Operating Agreement, Bylaws establish procedures for meetings, voting, and the appointment of officers. However, Bylaws are typically more complex due to the multi-member nature of corporations.

In the context of forming and managing an LLC, it’s essential to be aware of various agreements and documents that govern operations. For instance, understanding the importance of the Texas Operating Agreement form is vital, as it clarifies the operational structure, responsibilities of members, and financial protocols. To further refine your approach, consider exploring resources like TopTemplates.info, which provides templates and insights that can aid in drafting a comprehensive operating agreement that aligns with Texas regulations.

A Shareholder Agreement is another document that shares common ground with the Single-Member Operating Agreement. While it pertains to corporations, it outlines the rights and obligations of shareholders, including voting rights and profit distribution. Both documents are essential for defining the relationships between members and establishing a framework for decision-making.

The LLC Membership Agreement is similar in purpose but applies to multiple-member limited liability companies. It outlines the rights and responsibilities of each member, including profit-sharing and management roles. While the Single-Member Operating Agreement focuses on one owner, the LLC Membership Agreement addresses the dynamics of multiple members, ensuring clarity and reducing potential conflicts.

The Employment Agreement also has parallels with the Single-Member Operating Agreement. Both documents set forth the terms of engagement, outlining roles, responsibilities, and compensation. However, an Employment Agreement is specific to the relationship between an employer and an employee, while the Operating Agreement focuses on the operational aspects of a business entity.

The Non-Disclosure Agreement (NDA) shares some similarities in that both documents protect sensitive information. While an NDA is specifically designed to prevent the sharing of confidential information, the Single-Member Operating Agreement may include clauses that address confidentiality within the context of business operations. Both documents are critical for safeguarding proprietary information and ensuring trust among parties.

The Business Plan, while not a legal document, shares a focus on the operational structure of a business. A Business Plan outlines the goals, strategies, and financial forecasts, providing a roadmap for the business. Like the Single-Member Operating Agreement, it serves to clarify the business's direction and operational procedures, although it is more strategic in nature.

The Articles of Incorporation are similar in that they establish a legal entity. While the Articles are filed with the state to create a corporation, the Single-Member Operating Agreement provides the operational guidelines for an LLC. Both documents are foundational, setting the stage for how the business will function and be governed.

Lastly, the Franchise Agreement also has similarities. It outlines the relationship between a franchisor and a franchisee, detailing the operational standards and rights of both parties. Like the Single-Member Operating Agreement, it provides a framework for operations, ensuring that both parties understand their roles and responsibilities within the business structure.

Fill out Common Types of Single-Member Operating Agreement Templates

Simple Operating Agreement for Two Member Llc - Sets forth guidelines for member meetings and voting procedures.

The New York Operating Agreement form is a legal document that outlines the management and operational procedures of a limited liability company (LLC) in New York. This agreement is crucial for defining the roles and responsibilities of members, ensuring clarity and protection for all parties involved. To learn more about this essential document, visit https://documentonline.org/blank-new-york-operating-agreement, which can help business owners navigate the complexities of LLC operations effectively.

More About Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a document that outlines the structure and rules for a single-member limited liability company (LLC). It details how the business will operate, the responsibilities of the owner, and how profits and losses will be handled. While not always required by law, having this agreement can help clarify expectations and protect your personal assets.

Why do I need a Single-Member Operating Agreement?

This agreement is essential for establishing your LLC as a separate legal entity. It helps protect your personal assets from business liabilities. Additionally, it can provide clarity on management decisions and financial distributions. Without it, you may face challenges in proving your LLC's legitimacy, especially in legal matters.

Can I create my own Single-Member Operating Agreement?

Yes, you can draft your own agreement. Many templates are available online to guide you. However, it’s important to ensure that your agreement complies with state laws and accurately reflects your business operations. Consulting a legal professional can provide additional peace of mind.

What should be included in a Single-Member Operating Agreement?

Your agreement should include the LLC's name, address, and purpose. It should outline the ownership structure, management responsibilities, and how profits and losses will be distributed. Additionally, include provisions for handling disputes, amendments, and the process for dissolving the LLC if necessary.

Is a Single-Member Operating Agreement legally binding?

Yes, once signed, the agreement is legally binding. It serves as a contract between you and your LLC. Courts generally uphold the terms outlined in the agreement, provided it complies with state laws. This means that having a well-drafted agreement can significantly impact how your business operates and how disputes are resolved.

Do I need to file the Single-Member Operating Agreement with the state?

No, you typically do not need to file your Operating Agreement with the state. It is an internal document meant for your records. However, you should keep it in a safe place and refer to it when necessary. Some states may require you to provide a copy if requested, especially during legal proceedings.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it's essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do provide accurate information about your business name and address.

- Do clearly state the purpose of your business.

- Do specify the ownership percentage, which is typically 100% for a single-member LLC.

- Do include your name as the sole member of the LLC.

- Don't leave any sections blank; incomplete forms may lead to delays.

- Don't forget to review the document for any typographical errors before submission.

Following these guidelines will help ensure your form is completed accurately and efficiently.

Single-Member Operating Agreement - Usage Steps

Completing the Single-Member Operating Agreement form is essential for establishing the operational framework of your business. This document outlines key aspects of your business structure and management. Follow these steps carefully to ensure accuracy and compliance.

- Begin by entering your name and address in the designated fields at the top of the form.

- Provide the name of your business as it will be registered.

- Specify the principal place of business. This is where your business will operate.

- Indicate the date the agreement is being executed.

- Fill in the purpose of the business. Clearly state what your business will do.

- Detail the ownership structure. Confirm that you are the sole member and owner.

- Outline the management structure. Specify if you will manage the business yourself or appoint someone else.

- Include any additional provisions that are relevant to your business operations.

- Sign and date the agreement at the bottom of the form. Make sure to print your name below your signature.

Once the form is completed, review it for accuracy. Make copies for your records and submit the original as required by your local regulations. This agreement is a vital step in formalizing your business operations.