Fill Your Tax POA dr 835 Form

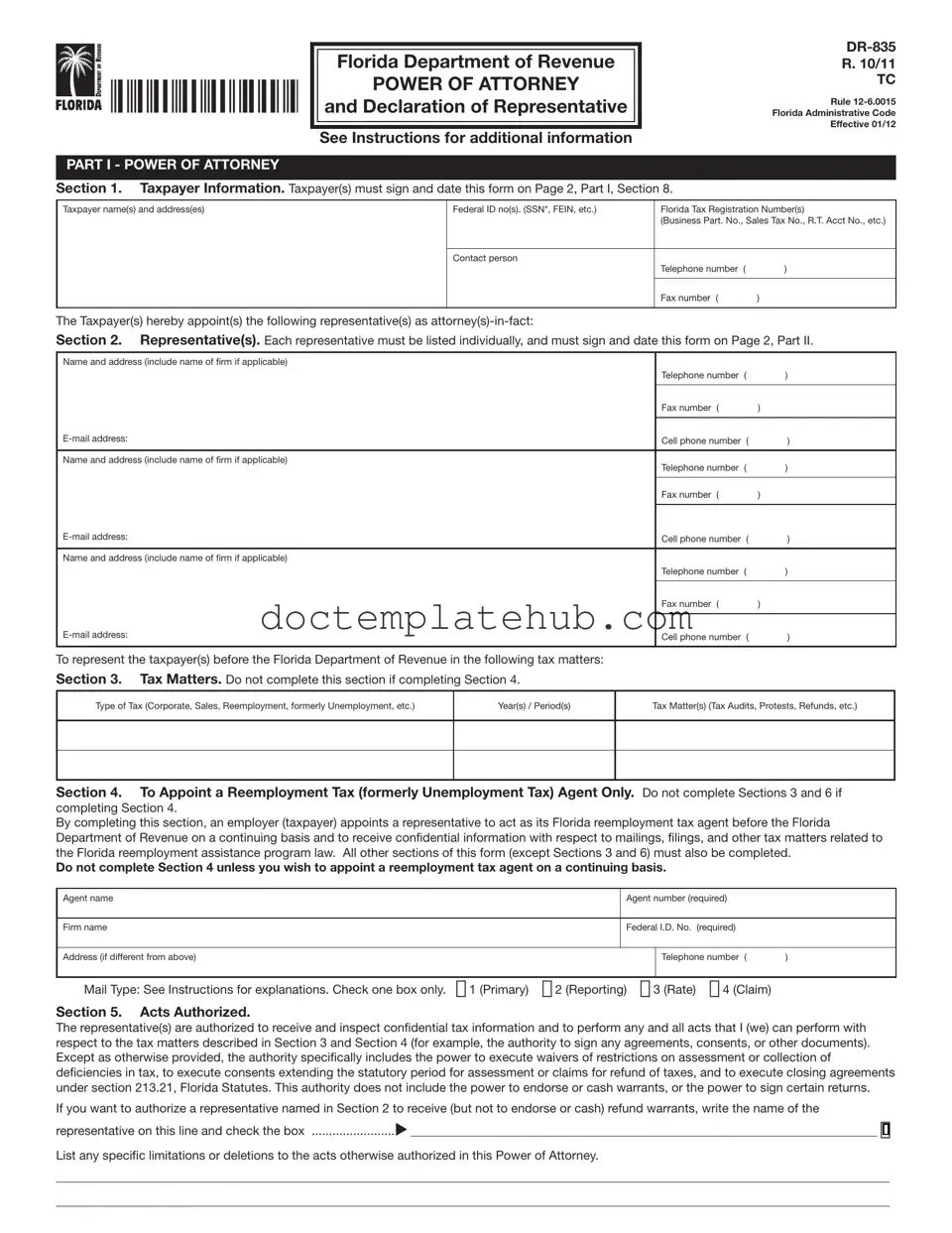

The Tax Power of Attorney (POA) DR 835 form plays a crucial role in tax matters for individuals and businesses alike. This form allows taxpayers to authorize another person, often a tax professional, to act on their behalf in dealings with the Department of Revenue. By completing the DR 835 form, taxpayers can ensure that their representative has the authority to discuss their tax information, make decisions, and even sign documents related to their tax obligations. It is important to note that the form requires specific information, including the taxpayer's details, the representative's information, and the scope of authority granted. Additionally, taxpayers must understand the implications of granting such authority, as it can affect their financial and legal responsibilities. Overall, the Tax POA DR 835 form streamlines communication between the taxpayer and the tax authority, making it easier to navigate complex tax issues.

Similar forms

The IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, is similar to the Tax POA DR 835 form. Both documents allow individuals to authorize someone else to act on their behalf in matters related to taxes. The IRS Form 2848 is specifically used for federal tax matters, while the Tax POA DR 835 is tailored for state tax issues. Each form requires the taxpayer's signature and the representative's information, ensuring that the appointed person has the authority to communicate with tax authorities on behalf of the taxpayer.

The IRS Form 8821, which is the Tax Information Authorization form, shares similarities with the Tax POA DR 835 form as well. While both forms allow a representative to access tax information, the key difference lies in the scope of authority. Form 8821 permits the representative to receive information but does not grant them the power to act on the taxpayer's behalf. This distinction is crucial for individuals who may need someone to review their tax information without granting full power of attorney.

The Durable Power of Attorney form is another document that is comparable to the Tax POA DR 835. This form allows individuals to appoint someone to make financial and legal decisions on their behalf, even if they become incapacitated. While the Tax POA DR 835 focuses specifically on tax-related matters, the Durable Power of Attorney has a broader scope, covering various aspects of an individual’s financial life. Both forms require clear identification of the principal and the agent, along with their respective signatures.

The General Power of Attorney is similar in nature to the Tax POA DR 835 form as it allows an individual to designate someone to act on their behalf in a variety of legal matters, including tax issues. However, unlike the Tax POA DR 835, which is limited to tax authority matters, the General Power of Attorney can encompass a wide range of decisions, from financial transactions to healthcare decisions. This flexibility can be beneficial for those seeking comprehensive representation.

The Limited Power of Attorney form also bears resemblance to the Tax POA DR 835. This document allows a principal to grant specific powers to an agent for a defined period or purpose. For instance, an individual might use a Limited Power of Attorney to allow someone to handle tax filings for a specific year. Like the Tax POA DR 835, it requires clear identification of the powers granted and typically includes a signature from both parties.

In addition to the various power of attorney forms, it’s vital to understand the importance of legal instruments like a Hold Harmless Agreement, which can protect parties involved in financial or business transactions. This legal document helps clarify responsibilities and liabilities, ensuring that one party is not held accountable for the other's actions, thus minimizing risks. Those interested in creating such agreements may find resources at smarttemplates.net, which provides templates and guidance for proper documentation.

Lastly, the Medical Power of Attorney form, while primarily focused on healthcare decisions, can be viewed as similar in its function of designating a representative. This form allows individuals to appoint someone to make medical decisions on their behalf if they are unable to do so. Although it does not pertain to tax matters, the underlying principle of granting authority to another person is a common thread shared with the Tax POA DR 835. Each of these documents serves to empower individuals by allowing them to choose trusted representatives for specific needs.

Other PDF Templates

Warranty on Roof - Lifetime coverage emphasizes quality and expertise.

Understanding the significance of a Transfer-on-Death Deed ensures property owners can effectively plan their estate. This form simplifies the inheritance process, allowing specified individuals to inherit real estate automatically upon the owner's death, thus avoiding probate delays. If you wish to see how this deed can benefit you, explore further using the link provided.

Dmv on Veterans - To verify your status, provide your date of birth, driver license, or ID number.

More About Tax POA dr 835

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document specifically designed for tax purposes in the state of Colorado. It allows an individual or entity to designate another person to act on their behalf in matters related to state taxes. This includes the authority to communicate with the Colorado Department of Revenue regarding tax filings, payments, and any other tax-related issues.

Who can be designated as a representative on the Tax POA DR 835 form?

Any individual or entity can be designated as a representative on the Tax POA DR 835 form, provided they are competent to act in a legal capacity. This often includes tax professionals, such as accountants or attorneys, but can also be a trusted friend or family member. It is crucial that the appointed representative understands the responsibilities and implications of this role.

How do I complete the Tax POA DR 835 form?

Completing the Tax POA DR 835 form involves filling in specific details such as the taxpayer's name, address, and Social Security number or Employer Identification Number. Additionally, the representative’s information must be included. The form requires signatures from both the taxpayer and the representative, confirming their consent to the arrangement. It is important to ensure that all information is accurate to avoid any processing delays.

Is there a fee associated with filing the Tax POA DR 835 form?

Generally, there is no fee for submitting the Tax POA DR 835 form to the Colorado Department of Revenue. However, if the representative is a professional, they may charge for their services in preparing or submitting the form on your behalf. Always check for any updates or changes regarding fees by visiting the official Colorado Department of Revenue website.

How long does it take for the Tax POA DR 835 form to be processed?

The processing time for the Tax POA DR 835 form can vary. Typically, it may take a few weeks for the Colorado Department of Revenue to process the form and update their records. Once processed, both the taxpayer and the representative will receive confirmation of the Power of Attorney status. It is advisable to follow up if confirmation is not received within a reasonable timeframe.

Can I revoke the Tax POA DR 835 form after it has been submitted?

Yes, a taxpayer can revoke the Tax POA DR 835 form at any time. To do this, the taxpayer must submit a written notice of revocation to the Colorado Department of Revenue. This notice should include the taxpayer’s details, the representative’s information, and a clear statement indicating the desire to revoke the Power of Attorney. Once the revocation is processed, the representative will no longer have the authority to act on behalf of the taxpayer.

What should I do if my representative is not acting in my best interest?

If a representative is not acting in the taxpayer's best interest, the taxpayer has the right to revoke the Power of Attorney using the process mentioned above. It is essential to act promptly in such situations to protect one’s interests. Additionally, seeking advice from another tax professional may provide further guidance on how to address any issues arising from the representative's actions.

Dos and Don'ts

When filling out the Tax POA DR 835 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Ensure that all information is accurate and up to date.

- Do: Sign and date the form where required.

- Don't: Leave any required fields blank; this could delay processing.

- Don't: Use incorrect or outdated forms, as this may result in rejection.

Tax POA dr 835 - Usage Steps

Once you have the Tax POA DR 835 form in hand, you’re ready to take the next steps. This form is essential for designating someone to handle your tax matters. Follow these steps carefully to ensure you fill it out correctly.

- Obtain the Form: Download the Tax POA DR 835 form from the appropriate tax authority's website or request a physical copy.

- Fill in Your Information: Start with your name, address, and Social Security number (or Employer Identification Number) at the top of the form.

- Designate Your Representative: Provide the name, address, and contact information of the person you are appointing as your representative.

- Specify the Scope: Indicate the specific tax matters for which your representative is authorized to act on your behalf. Be clear and detailed.

- Sign and Date: Don’t forget to sign and date the form at the bottom. This step is crucial as it validates your authorization.

- Submit the Form: Send the completed form to the appropriate tax authority. Check if you need to submit it electronically or by mail.

After submitting the form, your designated representative will have the authority to handle your tax issues as specified. Keep a copy of the completed form for your records, and monitor any correspondence from the tax authority regarding your designation.