Fillable Articles of Incorporation Template for Texas State

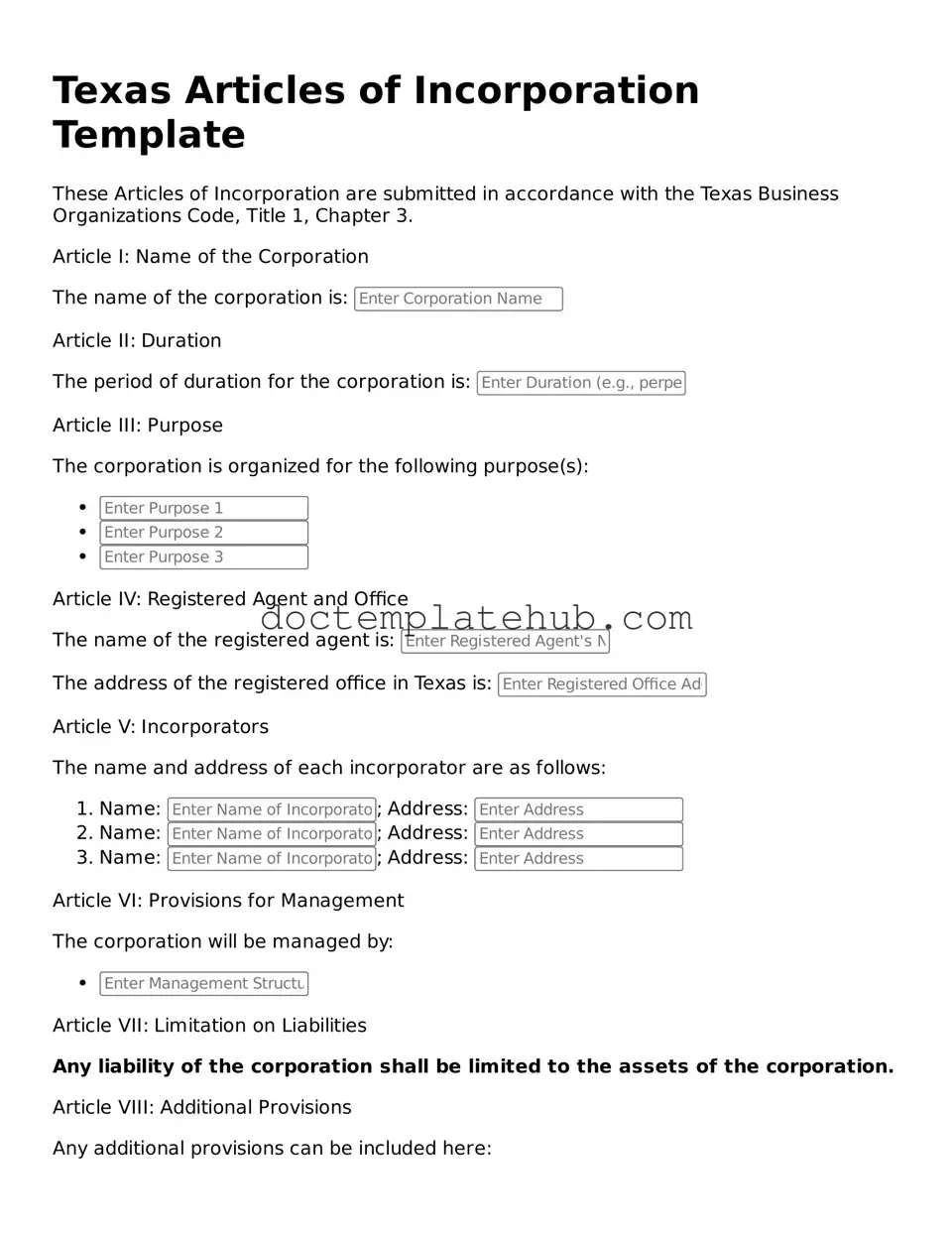

When starting a business in Texas, one of the first crucial steps is to file the Articles of Incorporation. This form serves as the foundational document that establishes a corporation's existence in the state. It outlines essential details such as the corporation's name, which must be unique and comply with state regulations. Additionally, the form requires the designation of a registered agent, an individual or entity authorized to receive legal documents on behalf of the corporation. The Articles of Incorporation also specify the purpose of the business, which can range from a general purpose to a more specific one, depending on the nature of the enterprise. Furthermore, the document includes information about the corporation's initial board of directors, including their names and addresses, as well as the number of shares the corporation is authorized to issue. Filing this form correctly is vital, as it not only ensures compliance with state laws but also provides legal protection for the business owners, separating personal assets from those of the corporation. Understanding the various components of the Articles of Incorporation is essential for anyone looking to launch a successful corporation in Texas.

Similar forms

The Texas Articles of Incorporation form is similar to the Certificate of Incorporation, which is used in other states. Both documents serve the purpose of establishing a corporation as a legal entity. They outline essential details such as the corporation's name, purpose, registered agent, and the number of shares authorized. While the specific requirements may vary by state, the fundamental goal remains the same: to provide a formal structure for the corporation and protect its owners from personal liability.

Another document akin to the Texas Articles of Incorporation is the Bylaws. While Articles of Incorporation focus on the creation of the corporation, Bylaws govern its internal operations. They detail the rules and procedures for managing the corporation, including how meetings are conducted, how officers are elected, and the rights of shareholders. Together, these documents create a framework for both the legal and operational aspects of the corporation.

The Certificate of Formation is another document that parallels the Texas Articles of Incorporation. In some states, this document serves a similar function, establishing a business entity's existence. Like the Articles of Incorporation, it includes key information about the business, such as its name, address, and purpose. However, the Certificate of Formation may also be used for other types of business entities, such as limited liability companies (LLCs), highlighting its broader applicability.

Operating Agreements, especially for LLCs, share similarities with the Articles of Incorporation. While the Articles focus on the formal establishment of a corporation, an Operating Agreement outlines the management structure and operational procedures of an LLC. It specifies the roles of members and managers, decision-making processes, and profit distribution. Both documents are crucial for defining the legal framework of the respective entities.

When establishing a business, referencing essential documents such as the Employee Handbook form can be vital for setting clear expectations among employees. This form, much like the Texas Articles of Incorporation, helps to outline important policies and procedures that foster a better understanding of organizational behavior and compliance. For those in search of a template to facilitate this process, the documentonline.org/blank-employee-handbook/ provides a useful resource to create a comprehensive handbook tailored to a company’s specific needs.

Incorporation applications in other jurisdictions, such as the Articles of Organization in some states, also resemble the Texas Articles of Incorporation. These documents are used to register a business entity and typically require similar information, such as the business name, purpose, and registered agent. The primary difference often lies in the specific terminology and requirements dictated by each state’s laws.

Lastly, the Shareholder Agreement can be considered similar to the Texas Articles of Incorporation. While the Articles establish the corporation, the Shareholder Agreement outlines the rights and responsibilities of the shareholders. This document addresses issues such as share transfers, voting rights, and dispute resolution. Both documents are essential for ensuring clarity and organization within the corporation, protecting the interests of its owners.

Other Common State-specific Articles of Incorporation Templates

Biz Online - Filing the document usually grants the corporation its legal identity.

For those looking to simplify the estate settlement process in New York, understanding the requirements for the necessary documentation is crucial, especially regarding the Small Estate Affidavit form. This resource provides insights on the Small Estate Affidavit documentation needed to facilitate the transfer of assets efficiently.

Ohio Secretary of State Business Name Search - Outlines any dissolution procedures for the corporation.

More About Texas Articles of Incorporation

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document required to establish a corporation in Texas. It outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form with the Texas Secretary of State is a crucial step in the incorporation process.

Who needs to file the Articles of Incorporation?

Any individual or group looking to form a corporation in Texas must file the Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, nonprofit organizations, and professional corporations. It is important to ensure that all required information is accurately provided to avoid delays in the incorporation process.

What information is required on the form?

The form typically requires the corporation's name, its purpose, the duration of the corporation (if not perpetual), the registered agent's name and address, and the number of shares authorized. Additionally, the names and addresses of the initial directors may also be requested. Providing complete and accurate information is vital for the successful processing of the application.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can submit the completed form online through the Texas Secretary of State's website or send a paper form by mail. If filing online, you will need to create an account. Be sure to include the required filing fee, which varies depending on the type of corporation being formed.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Texas Articles of Incorporation depends on the type of corporation. For a for-profit corporation, the fee is generally $300. Nonprofit corporations may have a lower fee. It is advisable to check the Texas Secretary of State's website for the most current fee schedule and any additional costs that may apply.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, online filings are processed faster, often within a few business days. Paper filings may take longer, sometimes up to several weeks. For urgent needs, expedited processing options may be available for an additional fee.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. You will receive a certificate of incorporation from the Texas Secretary of State. Following this, the corporation must adhere to ongoing compliance requirements, such as obtaining an Employer Identification Number (EIN) and filing annual reports.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. This may be necessary if there are changes in the corporation's name, purpose, or structure. To amend, you must file a Certificate of Amendment with the Texas Secretary of State, which may involve a fee and specific procedural steps.

Do I need legal assistance to file the Articles of Incorporation?

While it is not mandatory to seek legal assistance, many individuals find it beneficial. An attorney can help ensure that the form is completed correctly and that all necessary information is included. This can prevent potential issues and save time in the incorporation process.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it’s important to follow certain guidelines to ensure your submission is correct and complete. Here are nine things you should and shouldn’t do:

- Do provide accurate information about your business name and ensure it complies with Texas naming requirements.

- Do include the purpose of your corporation clearly. A vague purpose can lead to confusion.

- Do list the names and addresses of the initial directors. This information is essential for processing your application.

- Do specify the number of shares your corporation is authorized to issue. This is a critical detail for potential investors.

- Do sign and date the form. An unsigned form will be rejected.

- Don’t use a name that is already taken by another business in Texas. Check the name availability first.

- Don’t leave any required fields blank. Incomplete forms can delay the incorporation process.

- Don’t forget to include the registered agent’s name and address. This is necessary for legal correspondence.

- Don’t submit the form without reviewing it for errors. Mistakes can lead to complications down the line.

By following these guidelines, you can navigate the process of filling out the Texas Articles of Incorporation form more smoothly. Taking the time to get it right from the start will save you headaches later on.

Texas Articles of Incorporation - Usage Steps

After gathering all necessary information, the next step involves filling out the Texas Articles of Incorporation form. This document is essential for establishing your business as a legal entity in the state of Texas. Careful attention to detail will ensure that your application is processed smoothly.

- Download the Form: Access the Texas Secretary of State's website to download the Articles of Incorporation form.

- Choose Your Business Type: Indicate whether you are forming a for-profit corporation, non-profit corporation, or another type of entity.

- Enter the Corporate Name: Provide the proposed name of your corporation. Ensure it complies with Texas naming requirements.

- Designate a Registered Agent: List the name and address of your registered agent who will receive legal documents on behalf of the corporation.

- Specify the Duration: Indicate whether the corporation will exist perpetually or for a specific duration.

- Outline the Purpose: Briefly describe the purpose of your corporation. This should be a clear statement of the business activities you plan to engage in.

- List the Initial Directors: Provide the names and addresses of the initial directors of the corporation.

- Include the Incorporator’s Information: Fill in the name and address of the person completing the form, known as the incorporator.

- Review the Information: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Sign and Date the Form: The incorporator must sign and date the form to certify the information provided is correct.

- Submit the Form: File the completed form with the Texas Secretary of State, either online or by mail, along with the required filing fee.