Fillable Bill of Sale Template for Texas State

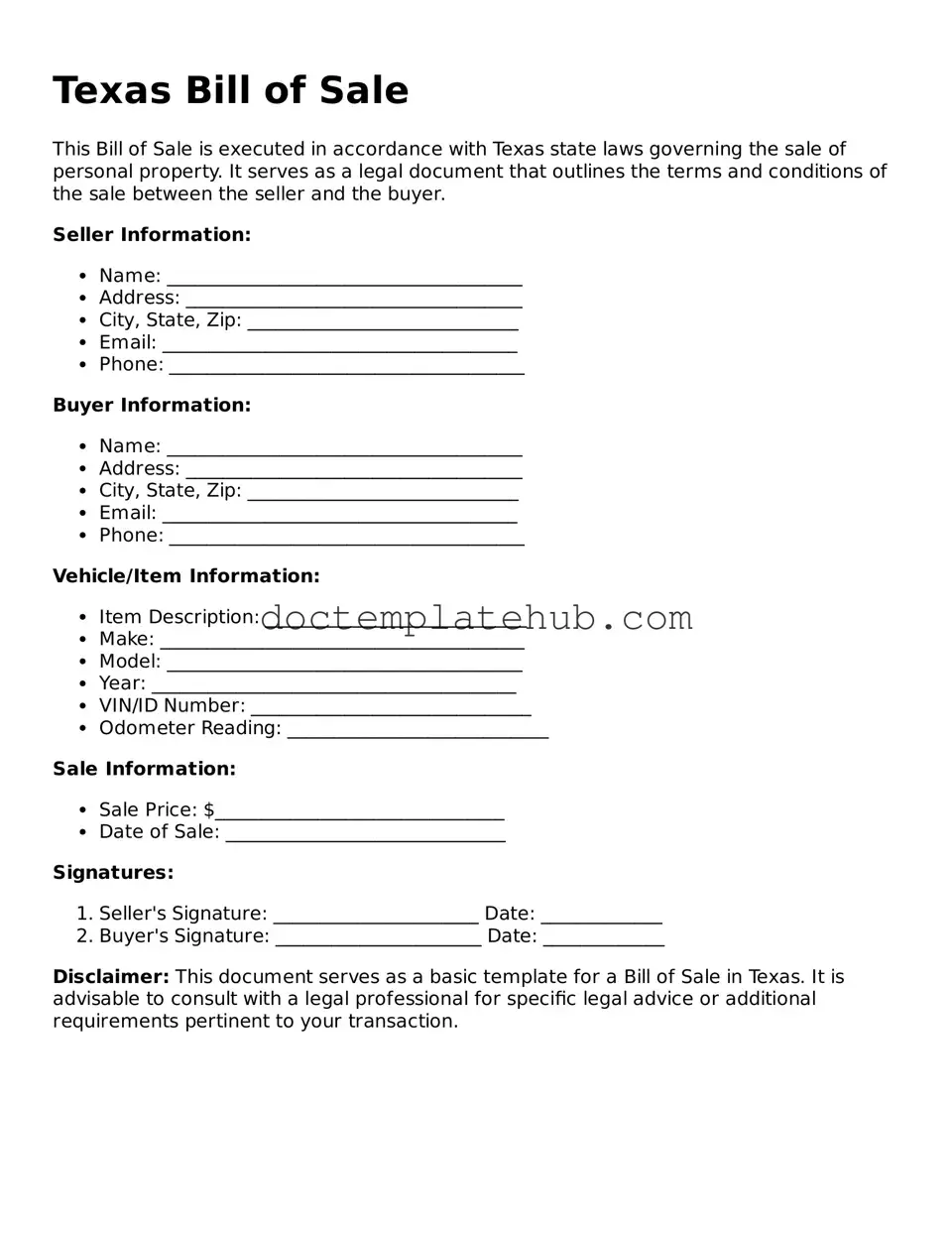

The Texas Bill of Sale form serves as a vital document in the transfer of ownership for various types of personal property, including vehicles, boats, and equipment. This form not only provides a written record of the transaction but also establishes the rights and responsibilities of both the buyer and seller. Key components of the Texas Bill of Sale include the names and addresses of the parties involved, a detailed description of the item being sold, and the sale price. Additionally, it may include information about any warranties or conditions related to the sale. By documenting the transaction, this form helps protect both parties in case of disputes, ensuring that the sale is legally recognized. Understanding the nuances of this form is essential for anyone engaging in a sale or purchase in Texas, as it lays the groundwork for a smooth and transparent exchange of property.

Similar forms

The Texas Bill of Sale form shares similarities with the Vehicle Bill of Sale. Both documents serve as proof of transfer of ownership for vehicles. The Vehicle Bill of Sale typically includes details such as the buyer's and seller's information, vehicle identification number (VIN), make, model, and sale price. This document is crucial for registering the vehicle in the new owner’s name and may be required by the Department of Motor Vehicles (DMV) in Texas.

Another document akin to the Texas Bill of Sale is the General Bill of Sale. This form is used for the sale of various personal property items, not just vehicles. It outlines the transaction details, including the names of the buyer and seller, a description of the item sold, and the sale price. Like the Texas Bill of Sale, it serves as a legal record of the transaction and can help resolve disputes over ownership in the future.

The Equipment Bill of Sale is also similar to the Texas Bill of Sale, particularly for transactions involving heavy machinery or equipment. This document specifies the type of equipment sold, its condition, and any warranties or guarantees provided by the seller. It protects both parties by documenting the transfer of ownership and can be essential for tax purposes or financing arrangements.

The Boat Bill of Sale shares common elements with the Texas Bill of Sale, specifically in the context of transferring ownership of watercraft. This document includes details such as the boat's registration number, hull identification number (HIN), and any accessories included in the sale. It is vital for registering the boat with the appropriate authorities and ensuring that the new owner has clear title to the vessel.

In addition, the Firearm Bill of Sale is comparable to the Texas Bill of Sale, as it documents the sale of firearms. This document must include information about the firearm, such as make, model, and serial number, along with the buyer's and seller's information. It is important for compliance with state and federal laws regarding firearm transactions, serving as proof of ownership transfer and potentially aiding in background checks.

Lastly, the Animal Bill of Sale is similar to the Texas Bill of Sale in that it is used for the transfer of ownership of pets or livestock. This document typically includes details about the animal, such as breed, age, and any identifying features. It provides legal evidence of ownership and can be important for registration with breed organizations or local authorities, ensuring that the new owner has clear rights to the animal.

Other Common State-specific Bill of Sale Templates

Bill of Sale Dmv Pdf - This form underscores the importance of documenting personal and financial agreements in everyday life.

Ohio Bill of Sale Template - This document can record any conditions discussed prior to the sale, such as repairs.

Do You Need a Bill of Sale in Florida - A Bill of Sale can also protect against claims of theft by showing legal ownership.

Az Car Bill of Sale - This document is often used for the sale of vehicles, equipment, and other significant assets.

More About Texas Bill of Sale

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that records the transfer of ownership of personal property from one individual to another. This form serves as proof that a sale has occurred and outlines the details of the transaction, including the identities of the buyer and seller, a description of the item being sold, and the sale price. It is particularly useful for items such as vehicles, boats, and other significant personal property.

Do I need a Bill of Sale for every transaction in Texas?

While a Bill of Sale is not required for every transaction, it is highly recommended for significant purchases. For example, when selling a vehicle, a Bill of Sale can help protect both the buyer and the seller by providing a clear record of the sale. In some cases, such as the sale of a vehicle, the state may require a Bill of Sale for registration purposes.

What information should be included in a Texas Bill of Sale?

A comprehensive Texas Bill of Sale should include several key pieces of information. This includes the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, year, and Vehicle Identification Number for vehicles), the sale price, and the date of the transaction. Additionally, it may be beneficial to include any warranties or conditions of the sale, if applicable.

Is a Bill of Sale legally binding in Texas?

Yes, a Bill of Sale is legally binding in Texas as long as it is properly executed. Both parties must sign the document, indicating their agreement to the terms outlined within it. While notarization is not required, having the document notarized can add an extra layer of legitimacy and may be beneficial if disputes arise later.

Can I create my own Bill of Sale in Texas?

Absolutely, you can create your own Bill of Sale in Texas. There are many templates available online that can guide you in drafting a document that meets your needs. However, ensure that all required information is included, and consider consulting with a legal professional if you have specific concerns or unique circumstances surrounding your transaction.

What if the item sold has a lien on it?

If the item being sold has a lien, it is crucial to address this in the Bill of Sale. The seller should disclose the existence of the lien to the buyer and ensure that it is cleared before the sale is finalized. Failure to do so could lead to legal complications for both parties. It is advisable to obtain a lien release from the lender and include this information in the Bill of Sale.

Where can I find a Texas Bill of Sale form?

You can find Texas Bill of Sale forms through various online legal document services, government websites, or local office supply stores. Many websites offer free or paid templates that you can customize to fit your transaction. Ensure that the form you choose complies with Texas laws and includes all necessary details for your specific sale.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it's essential to be careful and thorough. Here are some important dos and don'ts to keep in mind:

- Do include accurate information about the buyer and seller.

- Do clearly describe the item being sold, including any identification numbers.

- Do specify the sale price to avoid any misunderstandings.

- Do sign and date the form to make it legally binding.

- Do keep a copy of the Bill of Sale for your records.

- Don't leave any sections blank; fill out all required fields.

- Don't use vague language when describing the item.

- Don't forget to check for spelling errors or incorrect information.

- Don't sign the document without reading it thoroughly.

Texas Bill of Sale - Usage Steps

After obtaining the Texas Bill of Sale form, you will need to complete it accurately to ensure a smooth transaction. Follow the steps below to fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Identify the seller's information. Include the seller's full name, address, and contact number.

- Next, provide the buyer's information. This should include the buyer's full name, address, and contact number.

- Describe the item being sold. Include details such as the make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Indicate the purchase price of the item. This should be clearly stated in both numbers and words.

- Include any additional terms of the sale, such as warranties or conditions, if applicable.

- Both the seller and buyer should sign and date the form to validate the transaction.

Once the form is filled out and signed, keep a copy for your records. This document serves as proof of the transaction and may be needed for future reference.