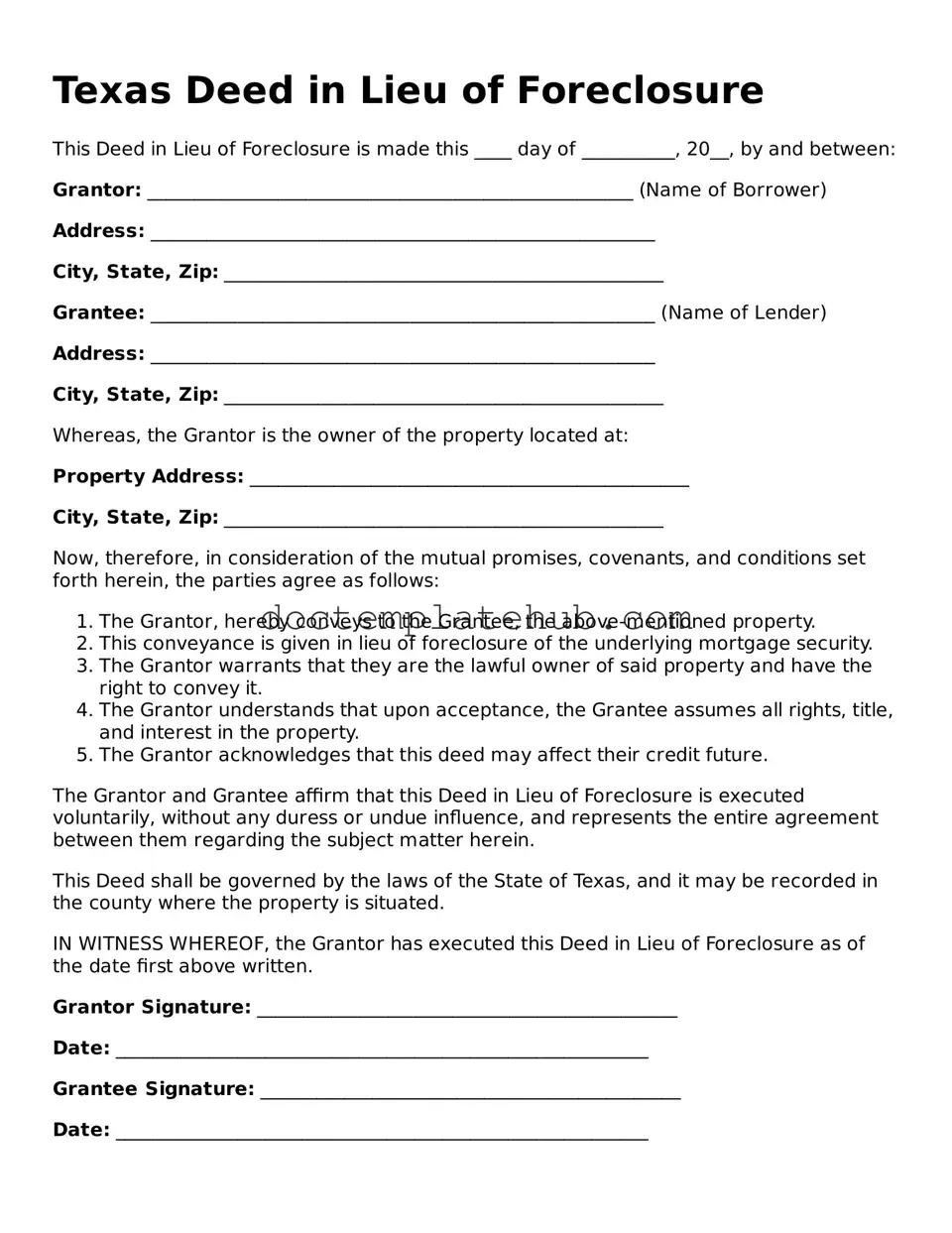

Fillable Deed in Lieu of Foreclosure Template for Texas State

The Texas Deed in Lieu of Foreclosure form serves as a crucial tool for both homeowners facing financial distress and lenders seeking to mitigate losses. This legal instrument allows a borrower to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often costly foreclosure process. By executing this deed, the borrower relinquishes their rights to the property in exchange for the lender's agreement to cancel the mortgage obligation. This arrangement can provide a more amicable resolution to a troubled mortgage situation, benefiting both parties by facilitating a quicker transition and reducing the potential for further financial strain. The form typically includes essential details such as the names of the parties involved, a description of the property, and any terms regarding the discharge of the debt. Additionally, it often outlines the responsibilities of both the borrower and lender post-transfer, ensuring clarity in the process. Understanding the nuances of this form is vital for homeowners considering this option, as it can have significant implications for their financial future and credit standing.

Similar forms

A Deed in Lieu of Foreclosure is similar to a Short Sale Agreement. In a short sale, the homeowner sells the property for less than what is owed on the mortgage, with the lender’s approval. This process allows the homeowner to avoid foreclosure while the lender recoups some of their losses. Both options aim to provide a way out of a difficult financial situation, but a short sale requires finding a buyer, whereas a deed in lieu transfers the property directly to the lender without a sale.

Another document that shares similarities is the Loan Modification Agreement. This agreement allows a borrower to change the terms of their existing mortgage, potentially making payments more manageable. While a deed in lieu involves surrendering the property, a loan modification focuses on keeping the homeowner in their home by adjusting the loan terms. Both are solutions to prevent foreclosure, but they approach the problem from different angles.

The Forebearance Agreement also has commonalities with a Deed in Lieu of Foreclosure. In a forbearance agreement, the lender agrees to temporarily suspend or reduce mortgage payments for the borrower facing financial hardship. This gives the borrower time to recover financially. While a deed in lieu results in the homeowner relinquishing the property, a forbearance allows them to stay and work through their financial issues, at least for a time.

A Bankruptcy Filing can be compared to a Deed in Lieu as well. When a homeowner files for bankruptcy, it can halt foreclosure proceedings and provide a fresh start. In some cases, the homeowner may ultimately surrender the property through the bankruptcy process, similar to a deed in lieu. Both options serve as legal means to address overwhelming debt, but bankruptcy can have broader implications on credit and financial standing.

Understanding the various documents related to property transfer and debt resolution is essential for homeowners, especially when navigating financial difficulties. For instance, the https://documentonline.org/blank-cdc-u-s-standard-certificate-of-live-birth is a different type of form crucial for recording vital information, just as mortgage release documents and Deeds in Lieu of Foreclosure play significant roles in managing mortgage obligations. Both contexts highlight the importance of properly addressing legal documents to ensure clarity and protect individual interests.

The Quitclaim Deed is another document that bears resemblance to a Deed in Lieu of Foreclosure. A quitclaim deed allows a property owner to transfer their interest in a property to another party without any guarantees regarding the title. While this is often used in family or trust situations, it can also be a way to transfer property back to the lender in lieu of foreclosure. Both documents facilitate the transfer of property ownership, but a quitclaim does not necessarily involve a financial hardship or foreclosure context.

Lastly, the Property Settlement Agreement can be likened to a Deed in Lieu of Foreclosure. This agreement often arises during divorce proceedings, where couples divide their assets, including real estate. If one spouse cannot afford to keep the home, they may agree to transfer their interest to the other spouse or sell it. Similar to a deed in lieu, this process involves transferring property ownership, but it is typically related to personal circumstances rather than financial distress alone.

Other Common State-specific Deed in Lieu of Foreclosure Templates

California Property Surrender Deed - This option may help maintain a better credit rating compared to a foreclosure mark.

For those looking to create a comprehensive Power of Attorney, the resources available at smarttemplates.net can provide invaluable assistance in ensuring that the document meets all necessary legal requirements.

Foreclosure Georgia - This option remains a valuable resource for those unable to maintain their mortgage payments.

More About Texas Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender. This process typically occurs when the homeowner is unable to keep up with mortgage payments and wants to avoid the lengthy and costly foreclosure process. By signing this deed, the homeowner can settle their mortgage debt and may be able to protect their credit score from further damage.

Who can use a Deed in Lieu of Foreclosure?

Any homeowner facing financial difficulties and at risk of foreclosure may consider a Deed in Lieu of Foreclosure. However, it is essential to consult with the lender, as they must agree to this arrangement. The property must also be free of any liens or other encumbrances for the deed to be accepted.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to using a Deed in Lieu of Foreclosure. First, it allows homeowners to avoid the foreclosure process, which can be stressful and time-consuming. Second, it may provide a quicker resolution to the homeowner's financial issues. Third, it can help preserve the homeowner's credit score, as it typically has less of a negative impact than a foreclosure. Lastly, it can allow homeowners to walk away from their mortgage debt without the stigma of foreclosure.

What are the drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks to consider. Homeowners may still face tax implications, as the IRS may view forgiven mortgage debt as taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, which may limit options. Lastly, the homeowner may have to vacate the property quickly, which can be challenging if they need more time to find a new place to live.

How do I initiate a Deed in Lieu of Foreclosure?

To initiate a Deed in Lieu of Foreclosure, start by contacting your lender to discuss your situation. They will provide specific requirements and documentation needed to proceed. You may need to submit a hardship letter explaining your financial difficulties. Once the lender agrees, you will need to sign the deed, and the lender will then take possession of the property. It is advisable to seek legal assistance to ensure all steps are followed correctly.

Dos and Don'ts

Filling out the Texas Deed in Lieu of Foreclosure form can seem daunting, but knowing what to do and what to avoid can make the process smoother. Here’s a helpful list to guide you:

- Do ensure all parties involved are clearly identified on the form.

- Do provide accurate property details, including the legal description.

- Do review the form thoroughly before submitting to avoid any mistakes.

- Do consult with a legal professional if you have any questions.

- Don't rush through the process; take your time to understand each section.

- Don't forget to sign and date the form where required.

By following these guidelines, you can navigate the Deed in Lieu of Foreclosure process with confidence and clarity.

Texas Deed in Lieu of Foreclosure - Usage Steps

Filling out the Texas Deed in Lieu of Foreclosure form is an important step in the process of transferring property ownership. Once you have completed the form, it will need to be signed and notarized before it can be submitted. Here’s how to accurately fill out the form.

- Gather Necessary Information: Collect all relevant details about the property, including the address, legal description, and any existing liens or mortgages.

- Fill Out Grantor Information: Enter your name as the current property owner (grantor). Make sure to include any co-owners if applicable.

- Complete Grantee Information: Write the name of the lender or financial institution receiving the property (grantee).

- Provide Property Description: Include the full legal description of the property. This can typically be found on your property deed or tax documents.

- List Any Encumbrances: Clearly state any existing liens or mortgages on the property that the grantee will be assuming.

- Sign the Document: Both you and any co-owners must sign the form in the designated areas. Ensure that all signatures are dated.

- Notarize the Document: Take the completed form to a notary public to have it notarized. This step is crucial for the document to be legally binding.

- Submit the Form: After notarization, submit the Deed in Lieu of Foreclosure to the appropriate county clerk’s office for recording.

Once the form is submitted and recorded, you will receive a copy for your records. This process helps to officially transfer ownership and can be a significant step in resolving foreclosure issues.