Fillable Deed Template for Texas State

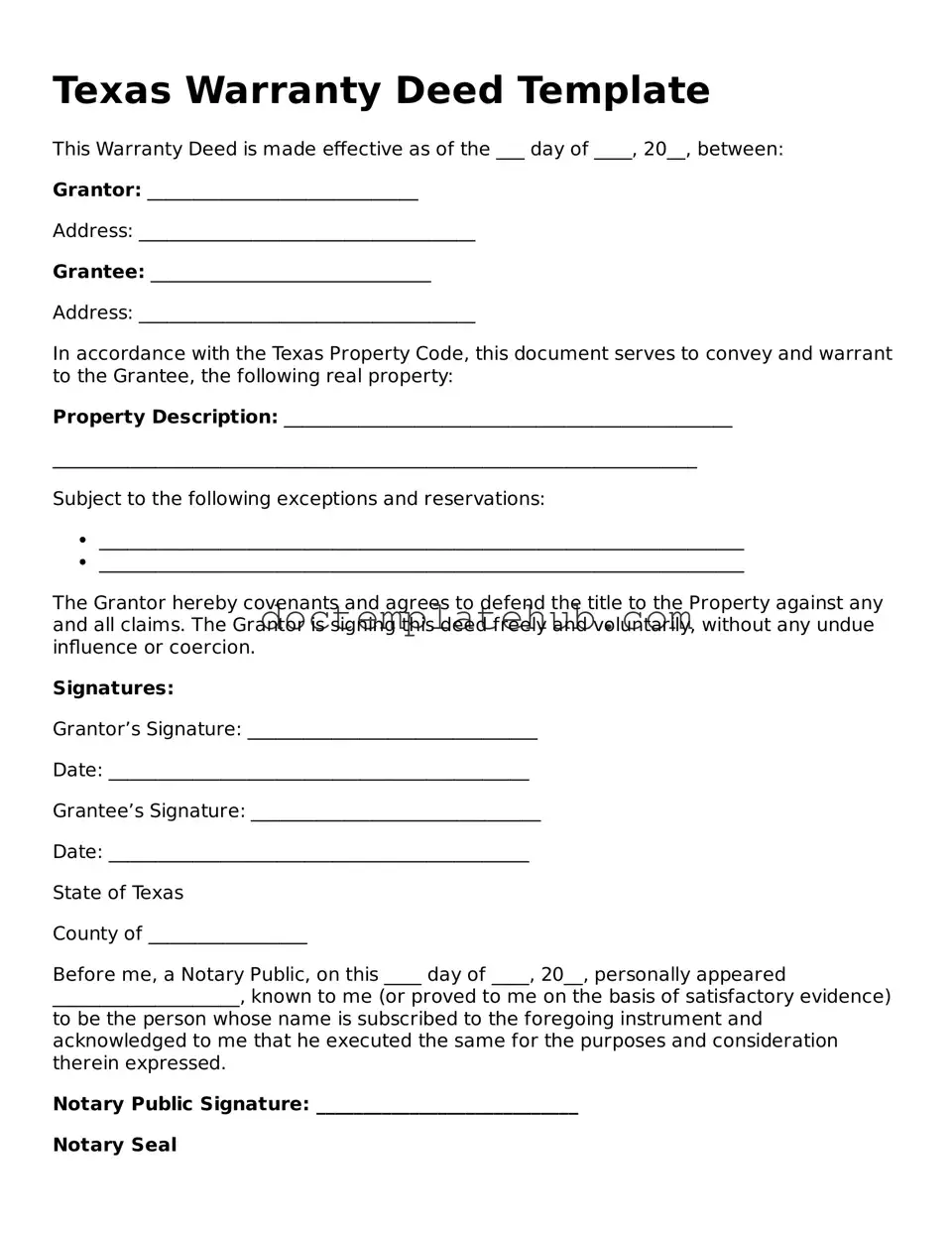

When it comes to transferring property ownership in Texas, the Texas Deed form serves as a crucial document in the real estate process. This form outlines the specifics of the transaction, including the names of the parties involved—the grantor, who is the current owner, and the grantee, who will receive the property. It also details the legal description of the property, ensuring clarity about what exactly is being transferred. In addition to these essential elements, the Texas Deed form may include information about any warranties or covenants associated with the property, which can protect the grantee from potential disputes in the future. Furthermore, the form requires signatures from both parties, as well as notarization, to validate the transfer. Understanding the various components of the Texas Deed form is vital for anyone involved in buying or selling real estate in the state, as it not only facilitates a smooth transaction but also ensures that all legal requirements are met.

Similar forms

The Texas Deed form shares similarities with the Warranty Deed. Both documents serve to transfer ownership of real estate from one party to another. A Warranty Deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding the title, the seller is responsible for resolving them. In Texas, a Warranty Deed is commonly used to ensure that the buyer receives full legal protection against any potential claims on the property.

Another document akin to the Texas Deed is the Quitclaim Deed. Unlike the Warranty Deed, a Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. This means that if the seller does not have clear title, the buyer may not have any recourse. Quitclaim Deeds are often used in situations where the parties know each other well, such as family transfers or divorce settlements, where the emphasis is on transferring whatever rights exist rather than ensuring a clean title.

The Special Warranty Deed is yet another document that resembles the Texas Deed. This type of deed also transfers ownership but offers limited warranties. The seller guarantees that they have not encumbered the property during their ownership, but they do not provide any assurances about prior ownership. This makes the Special Warranty Deed a middle ground between a Warranty Deed and a Quitclaim Deed, often used in commercial transactions or by developers.

The importance of understanding various property transfer documents is crucial for anyone involved in real estate transactions. For instance, a Texas Durable Power of Attorney form can also play a significant role in these matters by allowing someone to manage financial affairs effectively, even if the individual is incapacitated. For more information on how to establish this legal document, you can visit smarttemplates.net, where you'll find resources to help navigate the complexities of legal forms and ensure your financial interests are protected.

The Bargain and Sale Deed is similar in that it conveys property ownership but typically does not include warranties. The seller conveys the property "as is," meaning the buyer assumes all risks associated with the title. This type of deed is often utilized in foreclosure sales or tax lien sales, where the seller may not have full knowledge of the property’s condition or title history.

The Grant Deed also bears resemblance to the Texas Deed. This document conveys property and includes implied warranties that the seller has not sold the property to anyone else and that the property is free from encumbrances made during the seller's ownership. While not as common in Texas, Grant Deeds are often used in other states and provide a level of assurance to the buyer without the extensive guarantees found in a Warranty Deed.

Lastly, the Deed of Trust, while serving a different purpose, can be compared to the Texas Deed in that it involves the transfer of property rights. A Deed of Trust is used primarily in financing transactions, where the borrower conveys the property to a trustee as security for a loan. This document outlines the responsibilities of the borrower and the lender and provides a mechanism for foreclosure if the borrower defaults. While the Texas Deed focuses on transferring ownership, the Deed of Trust emphasizes the security of a loan, illustrating the diverse ways property interests can be handled in real estate transactions.

Other Common State-specific Deed Templates

Quit Claim Deed Ga - A poorly drafted deed may result in complications, such as disputes over property lines or ownership rights.

A Doctors Excuse Note form serves as official documentation from a healthcare provider, confirming a patient's medical condition and the necessity for absence from work or school. This note can be essential for ensuring that employees and students receive the appropriate accommodations during their recovery. For those looking for a convenient option, a sample can be found at https://documentonline.org/blank-doctors-excuse-note/. Understanding its importance can help individuals navigate their healthcare and employer policies effectively.

What Does Property Deed Look Like - A deed can serve as a tool for completing transactions not only in sales but also in gifting or inheritance.

More About Texas Deed

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real estate in Texas. It outlines the details of the property, the parties involved in the transaction, and the terms of the transfer. This form is essential for ensuring that the transfer is valid and recognized by the state.

What types of Texas Deeds are available?

There are several types of Texas Deeds, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. A Quitclaim Deed transfers any interest the seller may have in the property without making any guarantees. A Special Warranty Deed offers limited warranties, only covering the period the seller owned the property.

How do I complete a Texas Deed form?

To complete a Texas Deed form, start by filling in the names of the grantor (seller) and grantee (buyer). Next, provide a legal description of the property, which can typically be found on the property's tax records. Ensure all parties sign the document in front of a notary public. Finally, file the completed deed with the county clerk's office where the property is located to make the transfer official.

Is a Texas Deed form required for all property transfers?

Yes, a Texas Deed form is required for most property transfers. This includes sales, gifts, and inheritance of real estate. However, certain transactions, such as those involving foreclosure or tax sales, may have different requirements. Always check with local regulations to ensure compliance.

Can I use a Texas Deed form for commercial property?

Absolutely. A Texas Deed form can be used for both residential and commercial property transactions. The process remains the same, but the specifics of the transaction may vary. It’s crucial to ensure that the legal description and other details accurately reflect the commercial property being transferred.

Dos and Don'ts

When filling out the Texas Deed form, it is essential to approach the task with care. Here are six important things to keep in mind:

- Do ensure that all names are spelled correctly. Mistakes in names can lead to complications in property ownership.

- Don't leave any sections blank. Each part of the form must be completed to avoid delays in processing.

- Do provide a clear and accurate legal description of the property. This description is crucial for identifying the property in question.

- Don't use abbreviations or shorthand. Clarity is key, so write out full names and terms.

- Do sign the document in the presence of a notary public. A notarized signature adds legitimacy to the deed.

- Don't forget to keep a copy of the completed deed for your records. Having a copy can be helpful for future reference.

Texas Deed - Usage Steps

Once you have the Texas Deed form in hand, you are ready to start filling it out. Be sure to have all relevant information available, such as the details of the property and the parties involved. This process is straightforward, but accuracy is crucial to ensure the deed is valid.

- Begin by entering the date at the top of the form.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the complete address and legal description of the property. This description can often be found in previous deeds or tax documents.

- Specify the consideration, which is the amount paid for the property, if applicable.

- Include any relevant terms or conditions of the transfer, if necessary.

- Have the grantor sign the deed in the designated area. Ensure the signature is notarized to validate the document.

- Finally, submit the completed deed to the appropriate county office for recording.

After completing these steps, you will have a properly filled-out Texas Deed form ready for recording. This action will officially document the transfer of property ownership.