Fillable Employment Verification Template for Texas State

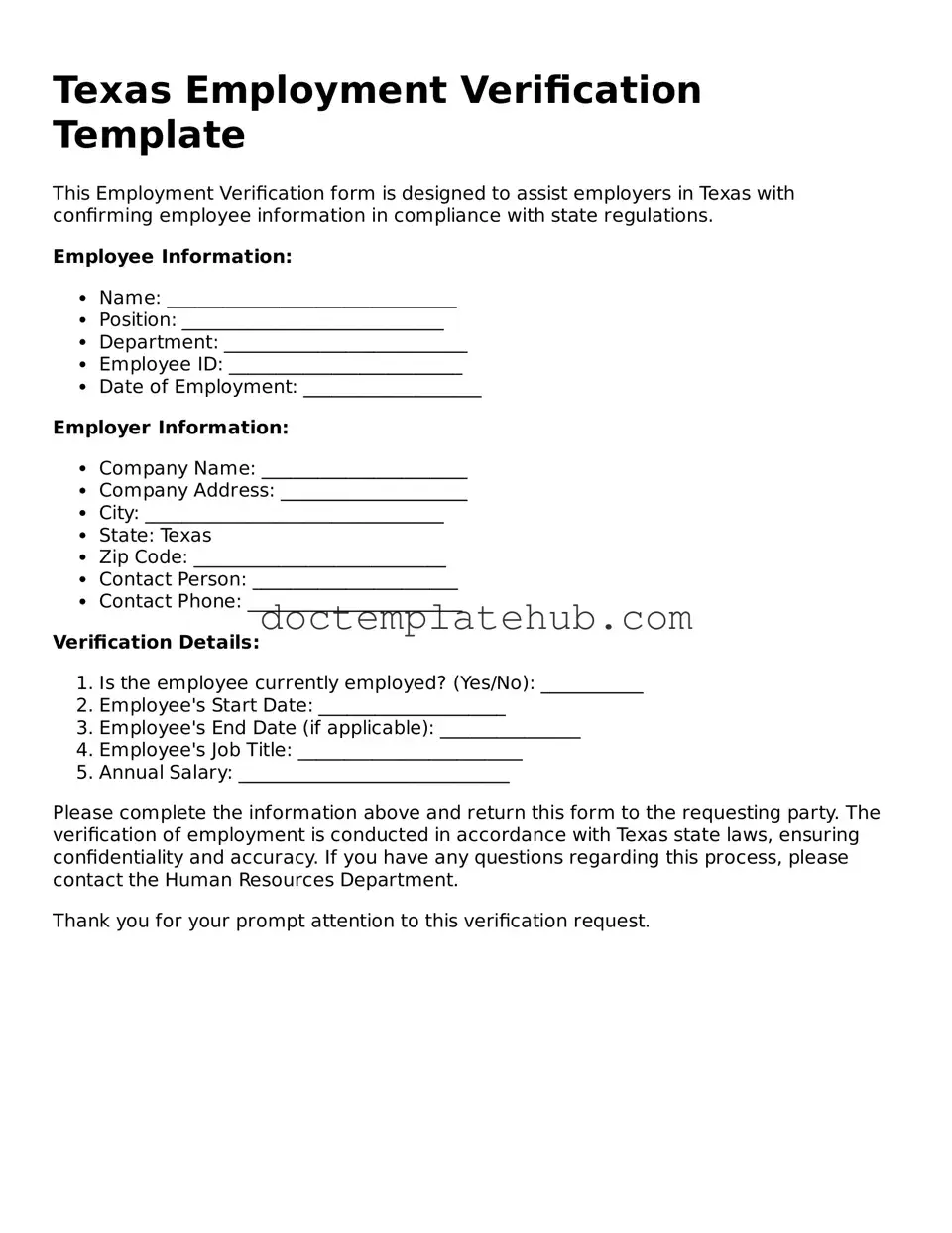

The Texas Employment Verification form is an essential document used by employers to confirm the employment status of their employees. This form plays a crucial role in various situations, such as verifying income for loan applications, housing, or government assistance programs. It typically includes important details like the employee's name, job title, dates of employment, and salary information. Employers are responsible for filling out this form accurately to ensure that the information provided is reliable and up-to-date. Employees may request this verification for numerous reasons, and understanding how to complete the form correctly can help facilitate the process. Overall, the Texas Employment Verification form serves as a valuable tool in maintaining transparency and trust between employers and employees, while also supporting individuals in their personal and professional endeavors.

Similar forms

The Texas Employment Verification form is similar to the I-9 form, which is used for employment eligibility verification in the United States. Both documents require employers to confirm the identity and employment authorization of their employees. While the I-9 is a federal requirement, the Texas Employment Verification form serves a similar purpose within the state, ensuring that employees meet the necessary qualifications for their roles. Both forms help protect the rights of workers and ensure compliance with employment laws.

Understanding the importance of confidentiality in business transactions, parties may consider utilizing a Michigan Non-disclosure Agreement to protect sensitive information. This legal document serves to keep proprietary information secure while allowing necessary discussions to take place. When drafting such agreements, resources like smarttemplates.net can provide templates and guidance to ensure all critical aspects are covered, effectively safeguarding trade secrets and sensitive data.

Another document that resembles the Texas Employment Verification form is the W-2 form. The W-2 is an annual tax form that employers provide to employees, detailing their earnings and tax withholdings. While the primary purpose of the W-2 is for tax reporting, it also serves as proof of employment and income, similar to how the Texas Employment Verification form confirms an individual's employment status. Both documents play a crucial role in financial and legal matters related to employment.

The Texas Workforce Commission (TWC) Employment Verification form is also comparable to the Texas Employment Verification form. The TWC form is used to verify an individual's employment history for unemployment benefits or other state assistance programs. Both forms require accurate information about the employee's job title, dates of employment, and employer details. They help ensure that individuals receive the benefits they are entitled to based on their employment status.

Additionally, the Social Security Administration (SSA) form for employment verification shares similarities with the Texas Employment Verification form. The SSA form is used to confirm an individual's earnings for Social Security benefits. Both documents require detailed information about the employee's work history and compensation. This verification process helps maintain accurate records for social security purposes and ensures that employees receive the benefits they have earned.

The Fair Credit Reporting Act (FCRA) employment verification request is another document that aligns with the Texas Employment Verification form. Employers often use this request to obtain background checks and verify an applicant's employment history. Both forms aim to provide accurate information about a person's work experience and qualifications, helping employers make informed hiring decisions while protecting the rights of applicants.

Finally, the Form 1099 is similar to the Texas Employment Verification form, particularly for independent contractors. The 1099 form reports income paid to non-employees, while the Texas Employment Verification form confirms the employment status of individuals. Both documents are important for tax purposes and help ensure that individuals report their income accurately. They also serve as proof of work for individuals in various employment situations.

Other Common State-specific Employment Verification Templates

State of Ohio Employment Verification - It is common for applicants to encounter this form when applying for jobs in various industries.

The California Trailer Bill of Sale form serves as a legal document that records the sale and transfer of ownership of a trailer in California. This form is essential for both buyers and sellers, as it helps ensure a smooth transaction and provides proof of ownership. Understanding its components can simplify the buying or selling process significantly, and you can find a useful template at documentonline.org/blank-california-trailer-bill-of-sale/.

Form I 9 - Confirm an employee's job title and dates of employment.

Snap Income Verification - It helps maintain transparency in the hiring process.

More About Texas Employment Verification

What is the Texas Employment Verification form?

The Texas Employment Verification form is a document used to confirm an individual's employment status. Employers may provide this form to verify details such as job title, dates of employment, and salary. It serves as a crucial tool for various purposes, including loan applications, rental agreements, and background checks.

Who needs to fill out the Texas Employment Verification form?

How can I obtain a Texas Employment Verification form?

What information is typically included in the Texas Employment Verification form?

Is there a fee for obtaining an Employment Verification in Texas?

Can I refuse to provide my Employment Verification form?

How long does it take to receive the completed Employment Verification form?

What should I do if there are errors on my Employment Verification form?

Is the information on the Employment Verification form confidential?

Can I use the Texas Employment Verification form for jobs outside of Texas?

Dos and Don'ts

When filling out the Texas Employment Verification form, it's crucial to ensure accuracy and completeness. Here’s a list of dos and don'ts to guide you through the process.

- Do provide accurate and up-to-date information about your employment history.

- Do include your full name and contact information at the top of the form.

- Do specify your job title and the dates of your employment clearly.

- Do review the form for any errors before submitting it.

- Do ensure that all required fields are completed to avoid delays.

- Don't leave any sections blank unless instructed to do so.

- Don't provide misleading or false information, as this can have serious consequences.

- Don't forget to sign and date the form, as an unsigned form may be considered invalid.

- Don't rush through the process; take your time to ensure everything is correct.

Texas Employment Verification - Usage Steps

Once you have the Texas Employment Verification form, it’s important to fill it out accurately to ensure that your employment information is verified correctly. This process involves providing specific details about your employment history and current status. Follow the steps below to complete the form effectively.

- Begin by entering your personal information at the top of the form. This typically includes your full name, address, and contact number.

- Provide your Social Security number. This is crucial for identification purposes.

- Fill in the details of your current employer. Include the company name, address, and phone number.

- Indicate your job title and the dates of your employment. Be sure to specify both the start date and the end date if applicable.

- List your job responsibilities briefly. This helps clarify your role within the company.

- Sign and date the form at the bottom. Your signature confirms that the information provided is accurate.

- Finally, submit the completed form to the designated recipient, whether that be your new employer or a verification service.