Fillable Gift Deed Template for Texas State

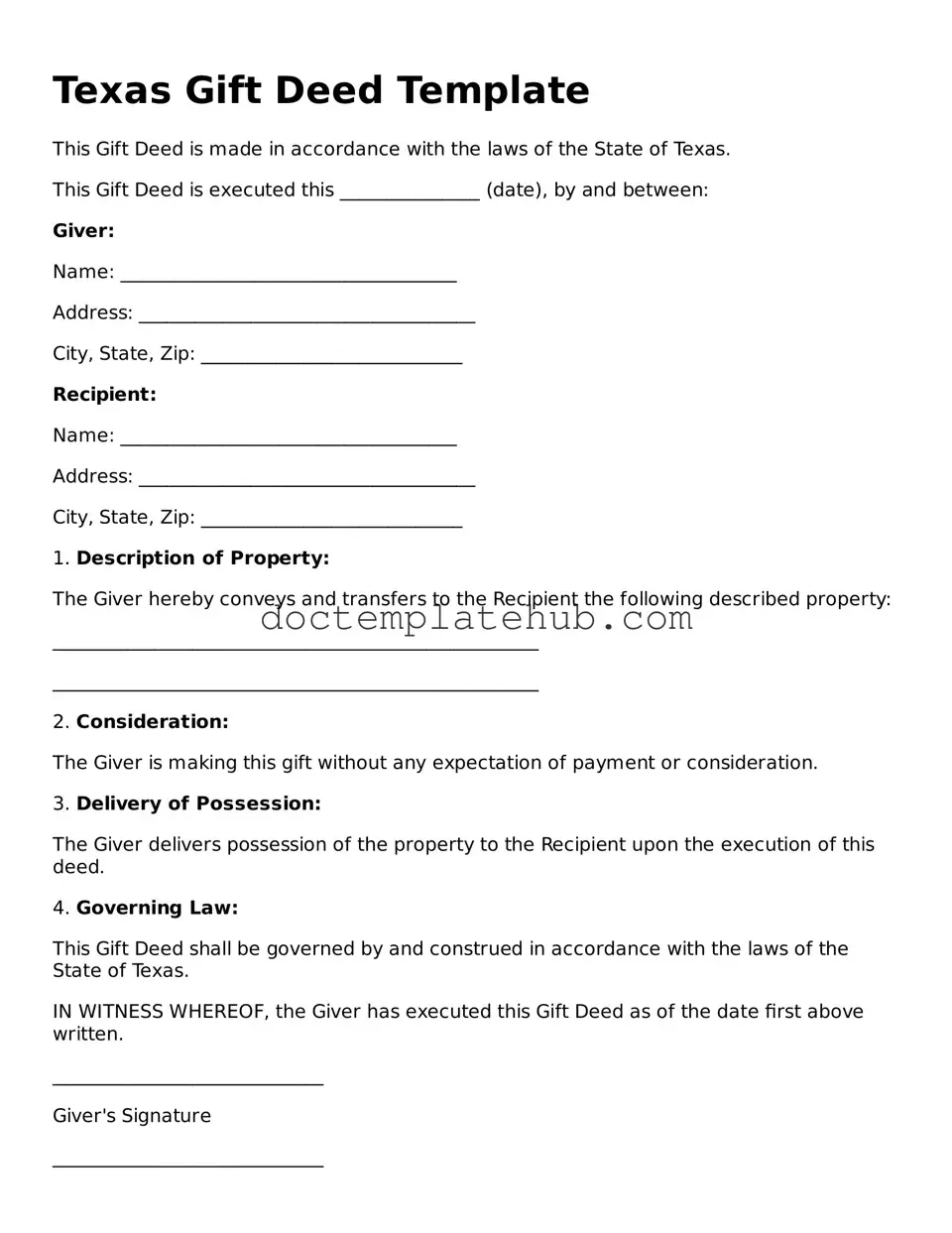

The Texas Gift Deed form serves as a crucial legal document for individuals wishing to transfer property ownership without monetary exchange. This form is specifically designed to facilitate the gifting process, ensuring that the transfer is executed in compliance with state laws. Key components of the Gift Deed include the identification of the donor and the recipient, a clear description of the property being gifted, and the intent to make the transfer without compensation. Additionally, the form often requires the signatures of both parties, along with a notary public to validate the transaction. By utilizing this form, individuals can avoid potential disputes and clarify their intentions regarding property ownership. Understanding the nuances of the Texas Gift Deed is essential for anyone looking to make a gift of real estate, as it outlines the legal framework that governs such transfers and protects the rights of all parties involved.

Similar forms

The Texas Gift Deed form is similar to a Warranty Deed. A Warranty Deed is a legal document that transfers property ownership from one party to another, guaranteeing that the title is clear of any liens or encumbrances. Like the Gift Deed, a Warranty Deed must be signed and notarized. However, the primary difference lies in the consideration; a Warranty Deed typically involves a sale, while a Gift Deed involves a voluntary transfer without any payment.

Another document similar to the Texas Gift Deed is the Quitclaim Deed. A Quitclaim Deed transfers whatever interest the grantor has in the property without any warranties. This means that if the grantor has no legal claim to the property, the grantee receives nothing. While both documents facilitate the transfer of property, the Quitclaim Deed does not provide the same level of assurance regarding the title as a Gift Deed does.

The Texas Gift Deed also resembles a Transfer on Death Deed (TOD). A TOD allows an individual to transfer property upon their death without going through probate. Like the Gift Deed, it is revocable and does not require the consent of the beneficiary during the grantor's lifetime. The key distinction is that a Gift Deed transfers ownership immediately, while a TOD only takes effect after the grantor's death.

Additionally, the Texas Gift Deed is similar to a Special Warranty Deed. This type of deed conveys property with a limited warranty, where the grantor guarantees that they have not encumbered the property during their ownership. Both documents serve to transfer property, but the Special Warranty Deed offers some assurances about the title, unlike a Gift Deed, which is unconditional.

When considering various property transfer options, it's essential to understand the implications and details of each document, such as the need for a well-crafted smarttemplates.net that outlines these agreements clearly to prevent future disputes and ensure that all parties involved are aware of their rights and responsibilities.

A Bill of Sale is another document that shares similarities with the Texas Gift Deed. A Bill of Sale is used to transfer ownership of personal property, such as vehicles or equipment, without any exchange of money. While the Gift Deed pertains to real property, both documents signify a voluntary transfer of ownership without consideration, highlighting the intent to give.

Lastly, the Texas Gift Deed can be compared to a Power of Attorney (POA) document. A POA grants someone the authority to act on behalf of another person, often in financial or legal matters. In the context of property, a POA can facilitate the transfer of real estate. However, while a Gift Deed is a straightforward transfer of ownership, a POA may involve ongoing responsibilities and decisions regarding the property.

Other Common State-specific Gift Deed Templates

Gift Deed Georgia - Creating a Gift Deed can be a thoughtful way to pass on cherished assets to loved ones.

When applying for a position at Chick-fil-A, candidates must carefully fill out the Chick-fil-A job application form, which includes vital details about their experience and schedule. To streamline the process, applicants can access the necessary form online at documentonline.org/blank-chick-fil-a-job-application, ensuring they provide accurate information for a chance to be part of a company celebrated for its exceptional service and community engagement.

California Gift Deed - Proper execution of a Gift Deed can simplify future property inheritance issues.

More About Texas Gift Deed

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This form is particularly useful when a property owner wishes to give their property as a gift to a family member or friend.

Who can use a Gift Deed in Texas?

Any property owner in Texas can use a Gift Deed to transfer their property. The donor (the person giving the gift) must be the legal owner of the property, and the recipient (the person receiving the gift) must be a capable individual or entity, such as a family member or friend.

What information is required to complete a Gift Deed?

To complete a Gift Deed, you will need the names and addresses of both the donor and the recipient, a legal description of the property being transferred, and the date of the transfer. It’s important to ensure that all details are accurate to avoid future disputes.

Is a Gift Deed taxable in Texas?

In Texas, a Gift Deed itself does not incur a state transfer tax. However, the recipient may need to consider federal gift tax implications if the value of the property exceeds certain thresholds. Consulting a tax professional is advisable to understand any potential tax liabilities.

Do I need to notarize a Gift Deed?

Yes, a Gift Deed must be signed in the presence of a notary public to be legally valid. Notarization helps verify the identities of the parties involved and ensures that the document is executed properly.

How do I record a Gift Deed in Texas?

To record a Gift Deed, take the signed and notarized document to the county clerk’s office in the county where the property is located. There may be a small fee for recording the deed, and it is important to keep a copy for your records.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it typically cannot be revoked. The transfer of ownership is considered final. However, if the donor has reserved certain rights or conditions in the deed, those may allow for some level of control over the property.

What happens if the donor dies after signing a Gift Deed?

If the donor dies after signing a Gift Deed, the property will remain with the recipient as per the terms of the deed. The transfer is effective upon execution and recording, so the recipient will not need to go through probate for that property.

Can I use a Gift Deed for partial property transfers?

Yes, a Gift Deed can be used to transfer a portion of the property. The deed should clearly specify the percentage or portion being gifted to ensure that both parties understand the extent of the transfer.

Are there any limitations on who can receive a Gift Deed?

There are generally no limitations on who can receive a Gift Deed, as long as the recipient is a legal entity or individual capable of holding property. However, it is advisable to consider the relationship and potential tax implications when gifting property to individuals or entities.

Dos and Don'ts

When filling out the Texas Gift Deed form, it is essential to follow specific guidelines to ensure the process goes smoothly. Here are nine important do's and don'ts to consider:

- Do ensure that the property description is accurate and complete.

- Do include the names of both the donor and the recipient clearly.

- Do sign the deed in the presence of a notary public.

- Do provide a detailed explanation of the gift, including any conditions.

- Do check for any local requirements that may affect the deed.

- Don't leave any sections of the form blank.

- Don't forget to date the document at the time of signing.

- Don't use vague language when describing the property.

- Don't overlook the need for witnesses if required by local laws.

By adhering to these guidelines, you can help ensure that your Texas Gift Deed is valid and effective.

Texas Gift Deed - Usage Steps

Once you have your Texas Gift Deed form ready, it’s time to fill it out. Make sure to have all necessary information at hand, including details about the property and the parties involved. Follow the steps below to complete the form accurately.

- Title the Document: At the top of the form, write “Gift Deed.” This clearly identifies the purpose of the document.

- Identify the Grantor: Fill in the name and address of the person giving the gift (the grantor).

- Identify the Grantee: Enter the name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a detailed description of the property being gifted. Include the address and any legal descriptions if available.

- State the Consideration: Write “for love and affection” or any other consideration you wish to state, if applicable.

- Sign the Document: The grantor must sign the form. If there are multiple grantors, each must sign.

- Notarization: Have the document notarized. This step is important to ensure the deed is legally binding.

- File the Deed: After signing and notarizing, file the completed Gift Deed with the county clerk in the county where the property is located.