Fillable Golf Cart Bill of Sale Template for Texas State

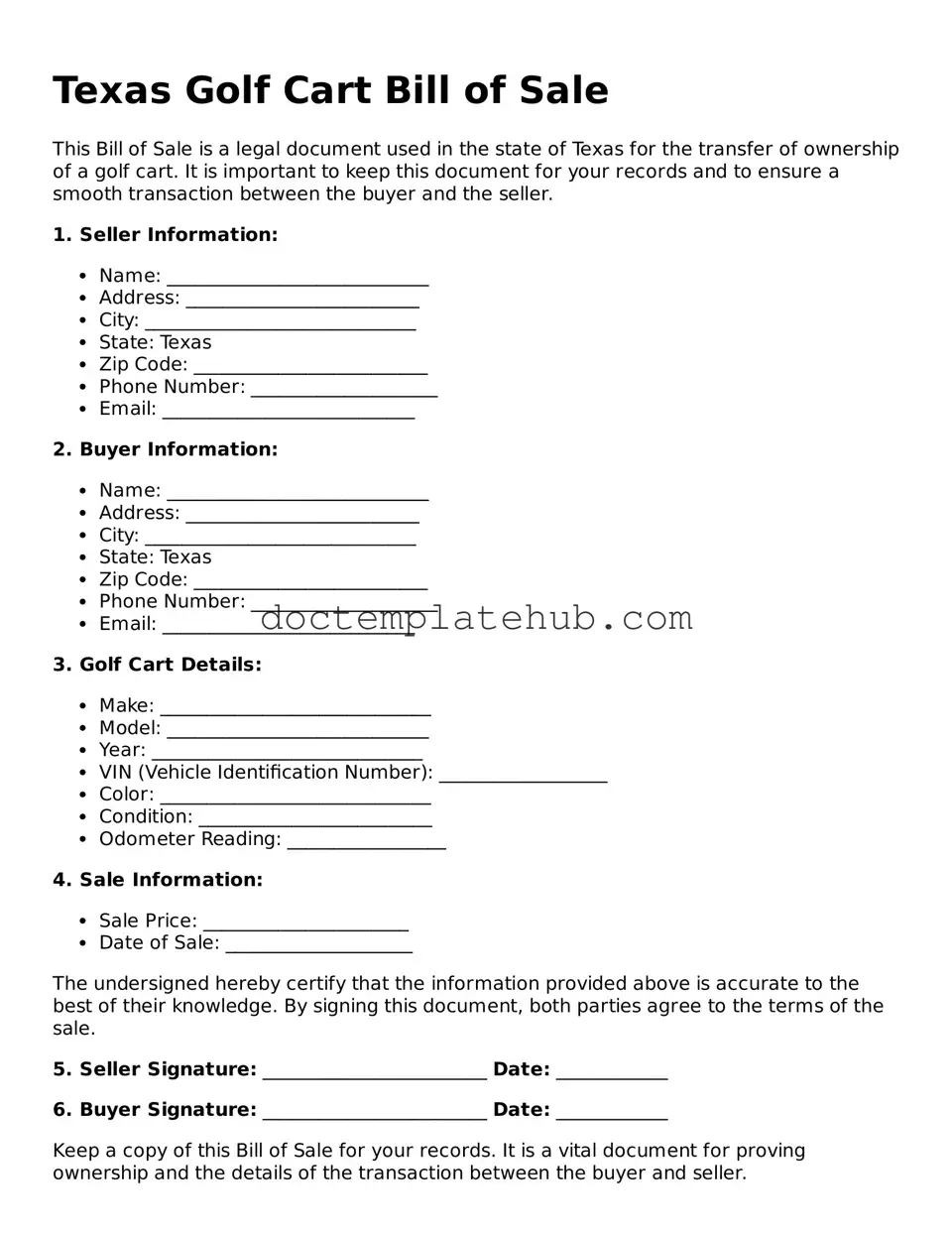

In Texas, the Golf Cart Bill of Sale form plays a crucial role in the transaction of golf carts, ensuring that both buyers and sellers are protected during the sale. This document serves as a legal record of the transfer of ownership, detailing essential information such as the names and addresses of both parties involved, a description of the golf cart, and the agreed-upon purchase price. Additionally, the form may include important details like the vehicle identification number (VIN), the year, make, and model of the cart, and any disclosures regarding the cart's condition. By documenting these specifics, the bill of sale helps to prevent disputes and provides proof of ownership, which can be particularly important for registration and insurance purposes. Understanding the significance of this form is vital for anyone looking to buy or sell a golf cart in Texas, as it lays the groundwork for a smooth and legally sound transaction.

Similar forms

The Texas Vehicle Bill of Sale serves a similar purpose to the Golf Cart Bill of Sale. Both documents facilitate the transfer of ownership from one party to another. They include essential details such as the buyer's and seller's information, a description of the vehicle or cart, and the sale price. This ensures that both parties have a clear understanding of the transaction and can provide proof of ownership transfer if needed.

The Motorcycle Bill of Sale is another document that shares similarities with the Golf Cart Bill of Sale. Like the golf cart form, it outlines the specifics of the transaction, including the motorcycle's make, model, and identification number. Both documents serve to protect the interests of both the buyer and seller, providing a legal record of the sale and helping to avoid disputes in the future.

In addition to various Bill of Sale forms, individuals may find themselves needing a Doctors Excuse Note, which provides essential documentation from a healthcare provider to verify a patient's medical condition. This note confirms the need for absence from work or school, helping to secure appropriate accommodations during recovery. For those interested in obtaining a template for such a document, a useful resource can be found at documentonline.org/blank-doctors-excuse-note.

The Boat Bill of Sale also mirrors the Golf Cart Bill of Sale in function and structure. Each document records the details of the sale, such as the parties involved, the item being sold, and the agreed-upon price. Both documents serve as proof of ownership transfer and can be crucial for registration purposes or in case of legal issues arising from the sale.

Other Common State-specific Golf Cart Bill of Sale Templates

Bill of Sale for Golf Cart - It may include space for both parties to sign, validating the transaction.

To streamline your shipping process and ensure compliance with industry standards, utilizing a reliable Straight Bill Of Lading form is essential, which you can find at smarttemplates.net, providing a clear framework for both shippers and carriers while preventing any misunderstandings during the transport of goods.

Georgia Bill of Sale for Car - It may feature sections for notarization to add an extra layer of authenticity.

More About Texas Golf Cart Bill of Sale

What is a Texas Golf Cart Bill of Sale?

A Texas Golf Cart Bill of Sale is a legal document that records the transfer of ownership of a golf cart from one party to another. It serves as proof of the transaction and includes essential details about the buyer, seller, and the golf cart itself.

Is a Bill of Sale required for golf carts in Texas?

While a Bill of Sale is not legally required for golf carts in Texas, having one is highly recommended. It provides a clear record of the transaction and can help resolve any disputes that may arise in the future regarding ownership or condition of the cart.

What information should be included in a Golf Cart Bill of Sale?

A comprehensive Golf Cart Bill of Sale should include the names and addresses of both the buyer and seller, the date of the sale, a description of the golf cart (make, model, year, and VIN if applicable), the purchase price, and any terms of the sale. It’s also helpful to include the signatures of both parties to validate the agreement.

Can I create my own Bill of Sale for a golf cart?

Yes, you can create your own Bill of Sale for a golf cart. There are templates available online that can guide you through the process. Just ensure that all necessary information is included and that both parties sign the document to make it official.

Do I need to have the Bill of Sale notarized?

Notarization is not required for a Golf Cart Bill of Sale in Texas, but it can add an extra layer of security to the transaction. If you choose to have it notarized, it may help in proving the authenticity of the signatures in case of any disputes.

What if the golf cart has a lien on it?

If there is a lien on the golf cart, the seller must disclose this information to the buyer. The Bill of Sale should also reflect the lien status. It’s important for the buyer to understand that they may be responsible for the lien if it is not resolved before the sale.

How does a Bill of Sale affect registration and titling?

A Bill of Sale is often required when registering or titling a golf cart in Texas. It serves as proof of ownership and may be needed when applying for a title with the Texas Department of Motor Vehicles. Be sure to check local regulations for any specific requirements.

What happens if the golf cart is sold "as-is"?

If the golf cart is sold "as-is," it means that the buyer accepts the cart in its current condition, with no warranties or guarantees from the seller. This should be clearly stated in the Bill of Sale to avoid any misunderstandings about the condition of the cart at the time of sale.

Can I use a Bill of Sale for a golf cart purchased out of state?

Yes, you can use a Bill of Sale for a golf cart purchased out of state. Just ensure that it complies with Texas regulations and includes all necessary information. This document will be essential for registering the golf cart in Texas.

Where can I obtain a Texas Golf Cart Bill of Sale form?

You can find templates for a Texas Golf Cart Bill of Sale online, or you can create one yourself using a word processing program. Just be sure to include all required information and have both parties sign the document to make it valid.

Dos and Don'ts

When filling out the Texas Golf Cart Bill of Sale form, there are important guidelines to follow. Here’s a list of dos and don’ts to ensure the process goes smoothly.

- Do provide accurate information about the golf cart, including make, model, and year.

- Do include the Vehicle Identification Number (VIN) to uniquely identify the cart.

- Do ensure both the buyer and seller sign the document to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any sections blank; all fields should be filled out completely.

- Don't use vague language; be specific about the terms of the sale.

- Don't forget to include the date of the transaction.

- Don't overlook any local requirements; check if additional documentation is needed.

Texas Golf Cart Bill of Sale - Usage Steps

After gathering the necessary information, you will be ready to fill out the Texas Golf Cart Bill of Sale form. This document is crucial for the legal transfer of ownership between the seller and the buyer. It ensures that both parties have a clear record of the transaction.

- Obtain the Form: Download the Texas Golf Cart Bill of Sale form from a reliable source or obtain a physical copy from a local office.

- Fill in Seller Information: Enter the full name, address, and contact details of the seller. This identifies who is selling the golf cart.

- Fill in Buyer Information: Provide the full name, address, and contact details of the buyer. This identifies the new owner of the golf cart.

- Describe the Golf Cart: Include specific details about the golf cart, such as the make, model, year, and Vehicle Identification Number (VIN). This information helps in accurately identifying the vehicle being sold.

- Indicate the Sale Price: Clearly state the agreed-upon sale price for the golf cart. This is important for both parties to acknowledge the transaction value.

- Signatures: Both the seller and buyer must sign and date the form. This signifies that both parties agree to the terms of the sale.

- Notarization (if required): Depending on local regulations, consider having the document notarized to add an extra layer of authenticity.

Once completed, both parties should retain a copy of the signed Bill of Sale for their records. This document serves as proof of the transaction and can be useful for future reference or in case of disputes.