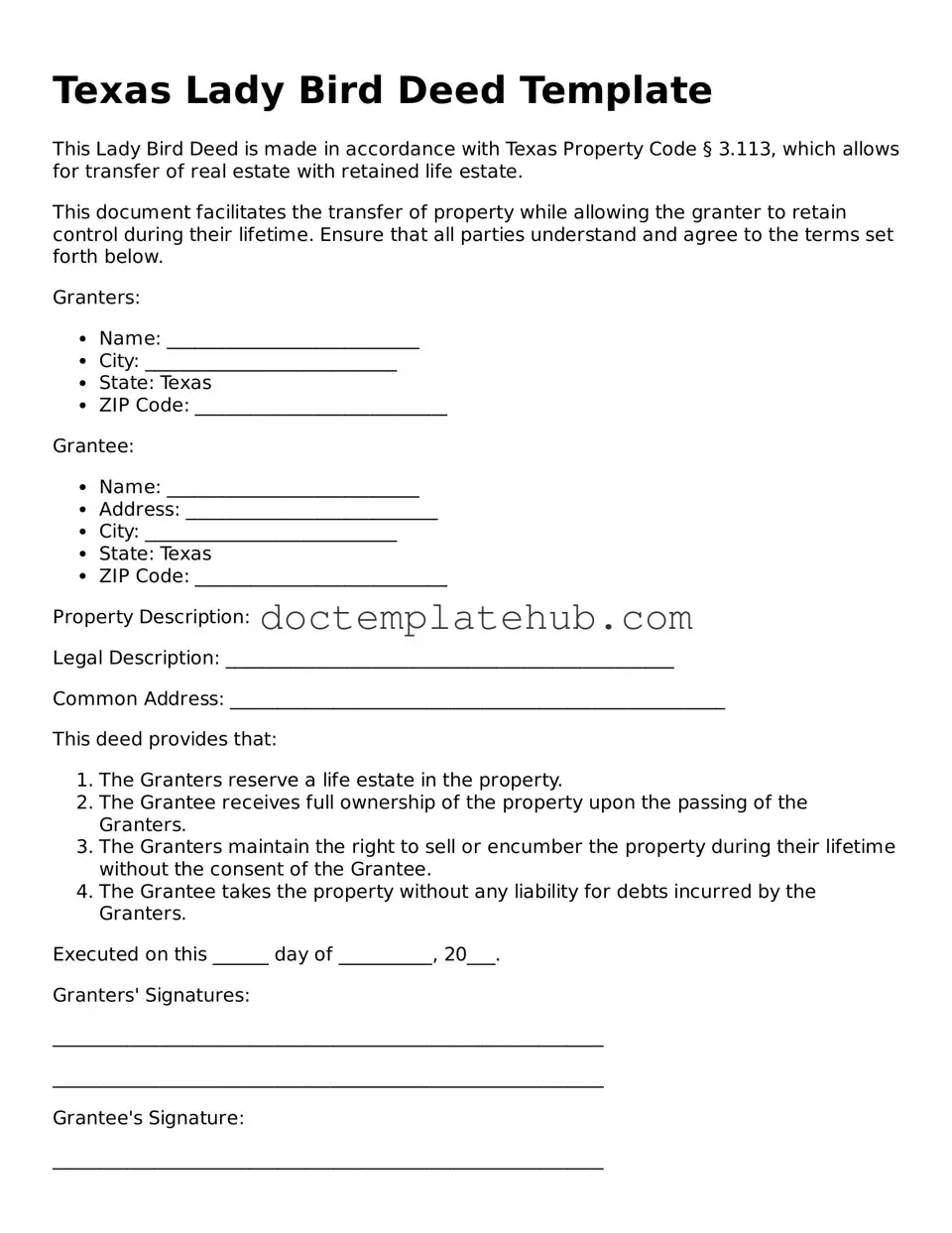

Fillable Lady Bird Deed Template for Texas State

The Texas Lady Bird Deed is a unique legal instrument designed to simplify the transfer of property while providing significant benefits to the property owner and their heirs. This form allows property owners to retain control over their real estate during their lifetime, ensuring they can live in and manage the property as they see fit. Upon the owner’s passing, the property automatically transfers to designated beneficiaries without the need for probate, streamlining the process and reducing potential legal complications. Additionally, the Lady Bird Deed offers flexibility, allowing the owner to modify or revoke the deed at any time before death. It is particularly advantageous for those looking to protect their assets from potential claims or Medicaid recovery, as it helps maintain the property’s value while avoiding lengthy court proceedings. Understanding this deed's implications is crucial for anyone considering estate planning options in Texas.

Similar forms

The Texas Lady Bird Deed is often compared to a traditional warranty deed. Both documents serve the purpose of transferring property ownership, but they differ in the way they handle the rights of the grantor and the grantee. A warranty deed guarantees that the grantor holds clear title to the property and will defend it against any claims. In contrast, a Lady Bird Deed allows the property owner to retain certain rights, such as the ability to live in the home and sell it during their lifetime, while still transferring ownership to beneficiaries upon death without the need for probate.

In understanding the various property transfer documents, it is also important to consider the significance of proper documentation in different contexts, such as securing a documentonline.org/blank-doctors-excuse-note/ for medical absences, which serves a similar purpose in ensuring transparent communication and necessary arrangements, paralleling the importance of clarity in property transactions.

Other Common State-specific Lady Bird Deed Templates

How to Get a Lady Bird Deed in Florida - The Lady Bird Deed is customizable based on the owner's needs and desires.

To enhance your shipping processes, utilizing resources like smarttemplates.net can provide you with customizable templates that streamline the completion of a Straight Bill Of Lading, ensuring accuracy and compliance with industry standards.

More About Texas Lady Bird Deed

What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining certain rights. This type of deed is unique to Texas and provides a way to avoid probate, ensuring a smoother transition of property upon the owner's death.

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner can transfer ownership to a beneficiary while still retaining the right to live in and control the property during their lifetime. Upon the owner's death, the property automatically transfers to the named beneficiary without going through probate.

What are the benefits of using a Lady Bird Deed?

One of the primary benefits is the avoidance of probate, which can be a lengthy and costly process. Additionally, the property owner retains control over the property, allowing for changes in the future if desired. This deed also provides protection from Medicaid estate recovery in certain situations.

Are there any limitations to a Lady Bird Deed?

While Lady Bird Deeds offer several advantages, they may not be suitable for all situations. For instance, they cannot be used for transferring property that is held in a trust or for properties that have multiple owners unless all parties agree. Furthermore, it is essential to ensure that the deed complies with Texas law to be valid.

Can a Lady Bird Deed be revoked or changed?

Yes, a property owner can revoke or change a Lady Bird Deed at any time during their lifetime. This can be done by executing a new deed or by formally revoking the existing deed. It is advisable to consult with a legal professional to ensure that the changes are made correctly.

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in the Lady Bird Deed passes away before the property owner, the property will not automatically transfer to that beneficiary. Instead, the property will be distributed according to the property owner's will or, if there is no will, according to Texas intestacy laws.

Is a Lady Bird Deed subject to property taxes?

Yes, properties transferred through a Lady Bird Deed remain subject to property taxes. The property owner retains ownership rights until death, meaning they are responsible for any taxes incurred during their lifetime. After the transfer, the new owner will assume responsibility for property taxes.

Do I need an attorney to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without an attorney, it is highly recommended to seek legal advice. An attorney can ensure that the deed complies with Texas law and accurately reflects the property owner's intentions, minimizing the risk of future disputes.

Can a Lady Bird Deed be used for commercial property?

Yes, a Lady Bird Deed can be used for both residential and commercial properties in Texas. However, the implications for commercial properties may differ, and it is advisable to consult with a legal expert to understand the specific considerations involved.

What should I consider before executing a Lady Bird Deed?

Before executing a Lady Bird Deed, consider your long-term plans for the property and your beneficiaries' needs. It is essential to evaluate the potential tax implications, the impact on Medicaid eligibility, and the possibility of changing circumstances. Consulting with a legal professional can provide valuable guidance in this process.

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, follow these guidelines to ensure accuracy and compliance.

- Do verify the property description is accurate and complete.

- Do include the names of all grantors and grantees clearly.

- Do sign the document in front of a notary public.

- Do ensure the form is filed with the county clerk's office.

- Don't leave any required fields blank.

- Don't use outdated forms; always check for the latest version.

- Don't forget to keep a copy for your records after filing.

Texas Lady Bird Deed - Usage Steps

Filling out a Texas Lady Bird Deed form is an important step in managing property transfer. This process allows you to designate beneficiaries while retaining control over the property during your lifetime. Follow these steps carefully to ensure that the form is completed correctly.

- Begin by downloading the Texas Lady Bird Deed form from a reliable source or obtain a physical copy.

- Fill in the **Grantor's** information. This includes your full name, address, and any relevant identification details.

- Next, provide the **Grantee's** information. This is the person or people who will inherit the property. Include their full names and addresses.

- Clearly describe the property being transferred. This should include the full address and any legal descriptions necessary to identify the property accurately.

- Specify any conditions or instructions regarding the transfer. For example, you may want to include any restrictions on the property use.

- Sign and date the form. Ensure that your signature matches the name listed as the Grantor.

- Have the form notarized. This step is crucial for the document to be legally binding.

- Finally, file the completed form with the county clerk's office in the county where the property is located. Keep a copy for your records.

Once the form is filed, it becomes part of the public record. This means that the transfer of property will be officially recognized, and your beneficiaries will have clear rights to the property upon your passing. It’s wise to consult with a legal professional if you have any questions or need assistance during this process.