Fillable Last Will and Testament Template for Texas State

Creating a Last Will and Testament is a vital step in ensuring that your wishes are honored after you pass away. In Texas, this legal document outlines how your assets will be distributed, who will care for your minor children, and who will manage your estate. The Texas Last Will and Testament form is designed to be straightforward, allowing you to specify your desires clearly. It includes sections for naming an executor, detailing beneficiaries, and listing specific bequests. Additionally, the form allows for the appointment of guardians for dependents, which is crucial for parents. Understanding the components of this form can empower you to make informed decisions about your legacy and provide peace of mind for your loved ones. By addressing these key aspects, you can ensure that your intentions are documented and legally binding, making the process easier for those you leave behind.

Similar forms

The Texas Last Will and Testament is similar to a Living Will, which outlines a person's wishes regarding medical treatment in situations where they are unable to communicate their preferences. While a Last Will and Testament focuses on the distribution of assets after death, a Living Will specifically addresses healthcare decisions. Both documents serve to express an individual's desires, but they operate in different contexts—one in the realm of estate planning and the other in healthcare directives.

Another document akin to the Last Will and Testament is the Durable Power of Attorney. This legal instrument allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. Like a Last Will, the Durable Power of Attorney is designed to ensure that a person's wishes are respected, but it does so while the individual is still alive. Both documents are crucial for effective planning and can prevent disputes among family members during challenging times.

The Revocable Trust shares similarities with the Last Will and Testament in that both serve to manage the distribution of assets. A Revocable Trust allows an individual to place assets into a trust during their lifetime, which can be managed and altered as needed. Upon the individual's death, the assets in the trust can be distributed according to their wishes, often bypassing the probate process. This can lead to a quicker and more private transfer of assets compared to a Last Will.

A Codicil is another document that relates closely to a Last Will and Testament. It serves as an amendment to an existing will, allowing individuals to make changes without drafting an entirely new document. This can be particularly useful for updating beneficiaries or altering specific provisions. Both a Codicil and a Last Will must adhere to legal formalities to ensure their validity, making them important tools in estate planning.

The Advance Healthcare Directive is similar to a Last Will in that it encompasses an individual's preferences regarding medical treatment and end-of-life care. This document combines elements of a Living Will and a Durable Power of Attorney for healthcare, allowing individuals to specify their medical wishes and designate someone to make decisions on their behalf. While a Last Will pertains to asset distribution, the Advance Healthcare Directive focuses on health-related decisions, highlighting the importance of planning for both financial and medical matters.

A Declaration of Guardian is another document that complements a Last Will and Testament. It allows an individual to nominate a guardian for their minor children in the event of their death or incapacitation. While a Last Will primarily deals with the distribution of assets, the Declaration of Guardian ensures that the care and upbringing of children are addressed. Both documents work together to provide comprehensive planning for an individual's family and estate.

Lastly, a Trust Agreement is similar to a Last Will and Testament in that it establishes a legal framework for managing and distributing assets. Unlike a will, which takes effect upon death, a Trust Agreement can be effective during a person's lifetime. It allows for the management of assets and can provide for beneficiaries in a manner that may be more flexible than a Last Will. Both documents aim to fulfill an individual's wishes regarding asset distribution, but they do so through different mechanisms.

Other Common State-specific Last Will and Testament Templates

Lawyer to Write a Will - Used to declare personal and financial wishes in a legally binding way.

Free Will Forms to Print - Can detail the individual's values and how they wish to be remembered.

Will Template Arizona - Can provide a sense of closure for grieving family members.

Online Will Georgia - This form is recognized by courts to validate your estate distribution plans.

More About Texas Last Will and Testament

What is a Texas Last Will and Testament?

A Texas Last Will and Testament is a legal document that outlines how a person's assets and affairs will be handled after their death. It allows individuals to specify who will inherit their property and appoint guardians for any minor children. This document ensures that a person's wishes are respected and followed when they pass away.

Do I need a lawyer to create a Last Will and Testament in Texas?

No, you do not need a lawyer to create a Last Will and Testament in Texas. Individuals can prepare their own wills using forms available online or through legal document services. However, consulting with a lawyer may be beneficial to ensure that the will meets all legal requirements and accurately reflects your wishes.

What are the requirements for a valid will in Texas?

In Texas, a valid will must be in writing, signed by the person making the will (the testator), and witnessed by at least two people who are at least 14 years old. The witnesses should not be beneficiaries of the will to avoid potential conflicts of interest. Additionally, the testator must be at least 18 years old and of sound mind when creating the will.

Can I change my will after it is created?

Yes, you can change your will at any time while you are alive. To make changes, you can either create a new will that revokes the previous one or add a codicil, which is an amendment to the existing will. It is important to follow the same legal requirements when making changes to ensure the validity of the will.

What happens if I die without a will in Texas?

If you die without a will in Texas, your assets will be distributed according to state intestacy laws. This means that the state will determine how your property is divided among your heirs, which may not align with your wishes. To avoid this situation, it is advisable to create a will to ensure your preferences are honored.

Can I include my funeral arrangements in my will?

Yes, you can include your funeral arrangements in your will. You may specify your preferences for burial or cremation, as well as any specific wishes regarding your memorial service. However, keep in mind that a will may not be read until after your funeral, so it may be helpful to communicate your wishes to family members or a trusted friend.

Is a handwritten will valid in Texas?

Yes, a handwritten will, also known as a holographic will, can be valid in Texas. The testator must write the entire will in their own handwriting and sign it. However, it is recommended to have witnesses sign the will to avoid potential disputes regarding its validity.

How can I ensure my will is carried out as I intended?

To ensure your will is carried out as intended, it is important to communicate your wishes to your executor and family members. Choose an executor you trust to manage your estate. Keep your will in a safe place and inform your executor where to find it. Regularly review and update your will as necessary to reflect any changes in your life circumstances.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it's essential to follow certain guidelines to ensure that your will is valid and reflects your wishes. Here are some dos and don'ts to consider:

- Do clearly state your full name and address at the beginning of the document.

- Do designate an executor who will manage your estate after your passing.

- Do list your beneficiaries explicitly, including their full names and relationships to you.

- Do sign the document in the presence of at least two witnesses who are not beneficiaries.

- Don't use ambiguous language that could lead to confusion about your intentions.

- Don't forget to date the will; this helps establish the most current version.

- Don't attempt to make changes without following proper legal procedures, such as creating a codicil.

- Don't leave out important details about your assets or how you wish them to be distributed.

By adhering to these guidelines, you can help ensure that your Last Will and Testament is both valid and a true reflection of your wishes.

Texas Last Will and Testament - Usage Steps

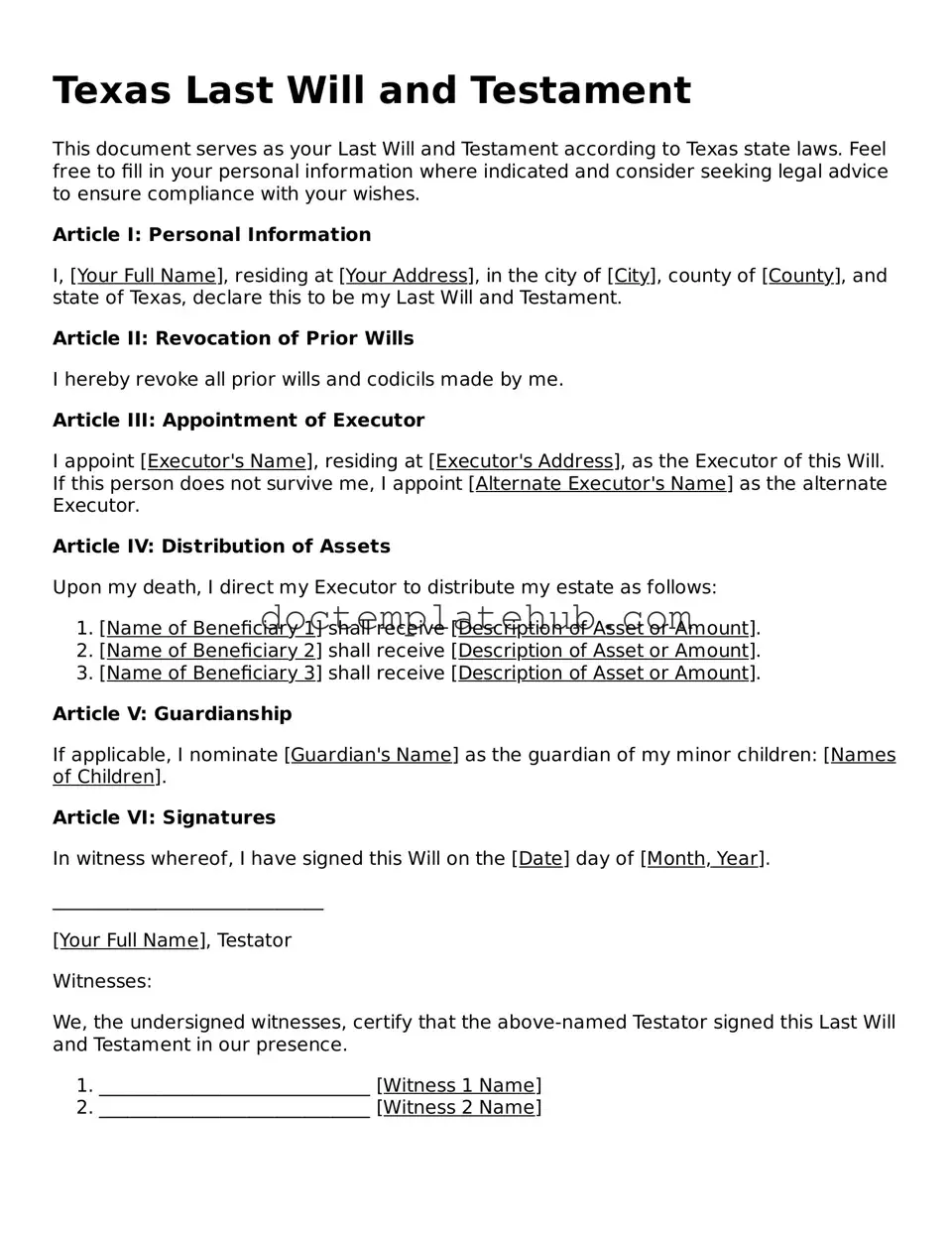

After obtaining the Texas Last Will and Testament form, it’s important to carefully fill it out to ensure that your wishes are clearly stated. Once completed, you will need to sign the document in the presence of witnesses, and then store it in a safe place. Here are the steps to guide you through the process of filling out the form.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your intention to create a Last Will and Testament by writing a clear declaration.

- Designate an executor by naming the person you trust to carry out your wishes. Include their full name and contact information.

- List your beneficiaries, specifying their names and the relationship to you. Clearly indicate what each beneficiary will receive.

- Include any specific bequests, such as personal items or property, and detail who will receive them.

- Address any debts or obligations, specifying how you wish them to be handled after your passing.

- Sign the document in the designated area, ensuring that your signature is clear and legible.

- Have at least two witnesses sign the document, confirming they saw you sign it and that you were of sound mind.

- Make copies of the completed will for your records and for your executor.