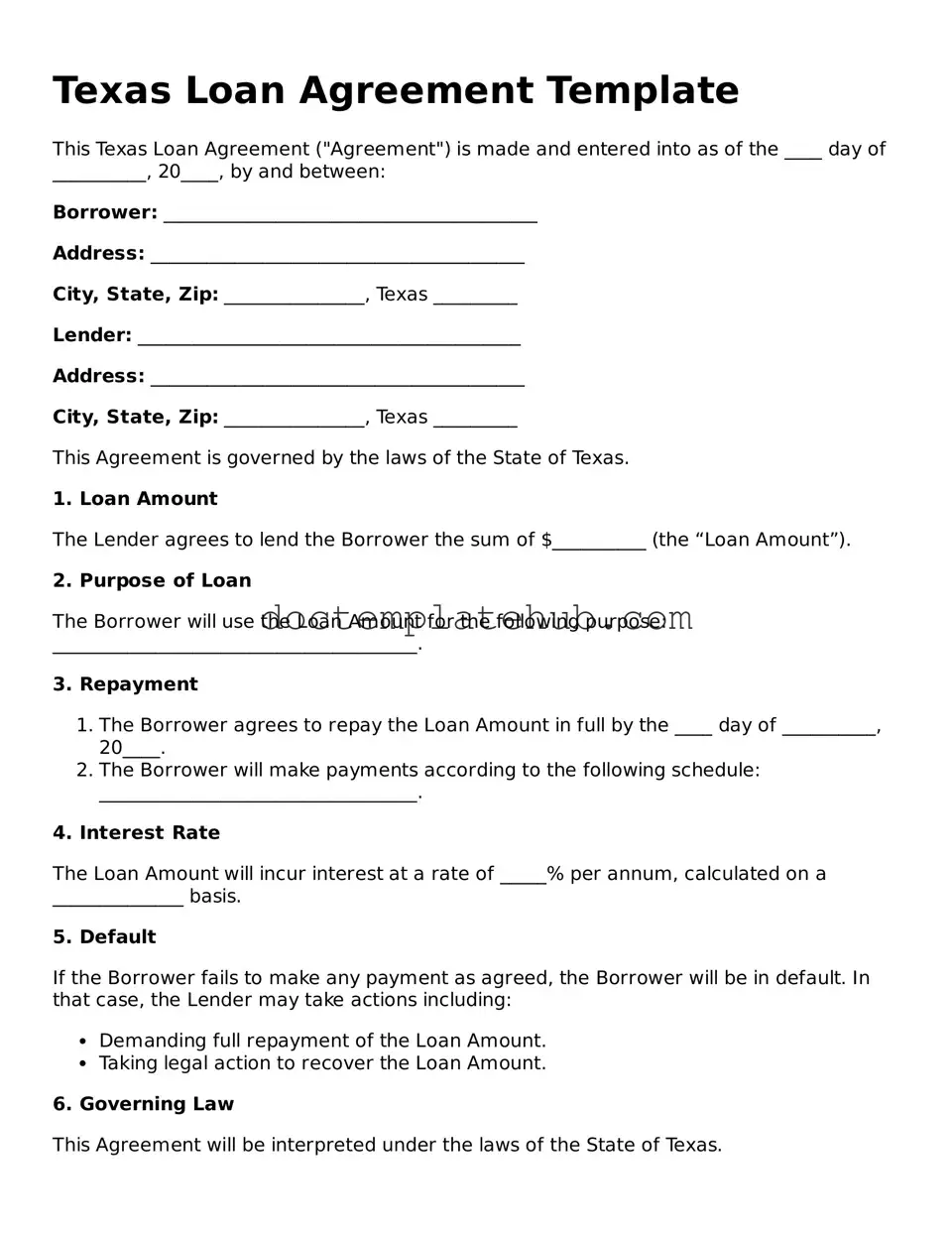

Fillable Loan Agreement Template for Texas State

When considering a loan in Texas, understanding the Texas Loan Agreement form is crucial for both borrowers and lenders. This document serves as a written record of the terms and conditions of a loan, ensuring that all parties are on the same page regarding their rights and obligations. Key aspects of the form typically include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the agreement outlines the consequences of default, providing clarity on what will happen if the borrower fails to meet their obligations. By carefully reviewing and completing this form, individuals can protect their interests and foster a transparent lending relationship. Awareness of the various components and implications of the Texas Loan Agreement form can empower borrowers to make informed decisions while navigating the lending landscape in the Lone Star State.

Similar forms

The Texas Loan Agreement form shares similarities with a Promissory Note. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Promissory Note serves as a written promise from the borrower to repay the loan, while the Loan Agreement may include additional details about the loan's terms and conditions, such as collateral requirements and default clauses.

A Credit Agreement is another document akin to the Texas Loan Agreement. This type of agreement typically involves a financial institution lending money to a borrower. Like the Loan Agreement, it specifies the loan amount, repayment terms, and interest rates. However, Credit Agreements often encompass broader terms, including covenants that the borrower must adhere to during the loan period.

The Mortgage Agreement is also comparable to the Texas Loan Agreement. Both documents involve a borrower receiving funds in exchange for an obligation to repay. In a Mortgage Agreement, the property itself serves as collateral for the loan, whereas the Texas Loan Agreement may not necessarily involve secured assets. Both documents detail the consequences of default and the rights of the lender.

A Secured Loan Agreement is similar in that it involves a borrower providing collateral to secure the loan. This document outlines the terms of the loan and the specific assets pledged as security. Like the Texas Loan Agreement, it details the repayment terms and the lender's rights in case of default. The primary distinction lies in the explicit mention of collateral in a Secured Loan Agreement.

In the realm of shipping documents, understanding the importance of a Straight Bill Of Lading form is essential, as it parallels various loan agreements by ensuring clarity and specificity in transactional relations. As with loans, where terms such as repayment schedules and borrower obligations are outlined, the Straight Bill Of Lading provides critical details regarding the cargo and delivery instructions to avoid any potential disputes. For further insights into similar templates and legal forms, you can visit smarttemplates.net.

The Personal Loan Agreement is another document that resembles the Texas Loan Agreement. Both agreements outline the terms of a personal loan between individuals or entities. They include repayment schedules, interest rates, and any fees associated with the loan. However, Personal Loan Agreements may be less formal and often do not require collateral, unlike some Texas Loan Agreements.

A Business Loan Agreement is also similar to the Texas Loan Agreement. It specifies the terms of a loan taken out for business purposes, including the amount, interest rate, and repayment schedule. Both documents serve to protect the lender’s interests and outline the obligations of the borrower. Business Loan Agreements may also include clauses related to the business’s financial performance.

The Loan Modification Agreement shares similarities with the Texas Loan Agreement as well. This document alters the terms of an existing loan, which may include changes to the interest rate, repayment schedule, or other conditions. Like the Texas Loan Agreement, it requires mutual consent from both the borrower and the lender and aims to clarify the new terms of the loan.

A Lease Agreement can also bear similarities to the Texas Loan Agreement, particularly when it involves financing options for leased property. Both documents outline terms for financial obligations, including payment schedules and consequences for default. However, a Lease Agreement typically pertains to renting property, while a Loan Agreement focuses on borrowing funds.

The Installment Agreement is another document that resembles the Texas Loan Agreement. Both agreements involve the borrower making payments over a specified period. They outline the total amount due, the payment schedule, and any applicable interest rates. The key difference is that Installment Agreements may be used for various types of purchases, not just loans.

Finally, a Debt Settlement Agreement can be compared to the Texas Loan Agreement in that both deal with financial obligations. A Debt Settlement Agreement outlines terms for settling a debt for less than the total amount owed, while the Texas Loan Agreement details the terms for borrowing money. Both documents aim to provide clarity and protection for the involved parties.

Other Common State-specific Loan Agreement Templates

Georgia Promissory Note Template - The agreement might disclose the process for loan reviews or audits.

Obtaining a Doctors Excuse Note is crucial for individuals needing validation of their medical circumstances. This formal document not only provides evidence to employers or educational institutions but also aids in facilitating necessary accommodations during recovery. To streamline this process, individuals can access the necessary template for a doctor's excuse at https://documentonline.org/blank-doctors-excuse-note/.

Loan Agreement Template Florida - The Loan Agreement may include a repayment grace period after borrowing.

More About Texas Loan Agreement

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is made between a lender and a borrower in Texas. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities throughout the loan process.

Who needs a Texas Loan Agreement form?

Anyone involved in lending or borrowing money in Texas should consider using a Texas Loan Agreement form. This includes individuals, businesses, and organizations. Whether you are lending money to a friend or entering into a formal loan arrangement with a financial institution, having a written agreement helps prevent misunderstandings and provides a reference point if disputes arise.

What are the key components of a Texas Loan Agreement?

A typical Texas Loan Agreement includes several important components. These typically feature the names and addresses of both the lender and borrower, the principal loan amount, the interest rate, repayment terms, and any fees associated with the loan. Additionally, it may specify the consequences of default and any collateral that secures the loan. Ensuring all these elements are included can help make the agreement enforceable in court.

Is a Texas Loan Agreement form legally binding?

Yes, a Texas Loan Agreement form is legally binding as long as it meets the necessary legal requirements. Both parties must agree to the terms, and the agreement should be signed by both the lender and borrower. It’s important to note that while a verbal agreement can be legally binding, a written document is much easier to enforce and provides clear evidence of the terms agreed upon.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it's essential to approach the task with care and attention. Here’s a helpful list of things to do and avoid:

- Do read the entire form thoroughly before starting.

- Do provide accurate and complete information.

- Do double-check all figures and calculations.

- Do sign and date the form in the appropriate sections.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand unless specified.

- Don't submit the form without reviewing it for errors.

- Don't forget to keep a copy for your records.

By following these guidelines, you can help ensure that your Loan Agreement is processed smoothly and efficiently.

Texas Loan Agreement - Usage Steps

After obtaining the Texas Loan Agreement form, you will need to complete it accurately to ensure that both parties understand their rights and obligations. Follow these steps to fill out the form correctly.

- Read the Instructions: Before you begin, familiarize yourself with the form's sections and requirements.

- Enter the Date: Write the date on which the agreement is being made at the top of the form.

- Identify the Parties: Fill in the names and addresses of both the lender and the borrower. Make sure to include any relevant contact information.

- Specify the Loan Amount: Clearly state the total amount of money being loaned in the designated section.

- Outline the Loan Terms: Detail the interest rate, repayment schedule, and any fees associated with the loan. Be specific about how and when payments should be made.

- Include Collateral Information: If applicable, describe any collateral that secures the loan. This could be property, vehicles, or other valuable items.

- Signatures: Ensure that both the lender and borrower sign the form. Include the date of each signature.

- Witness or Notary: Depending on the requirements, you may need a witness or notary public to sign the document as well.