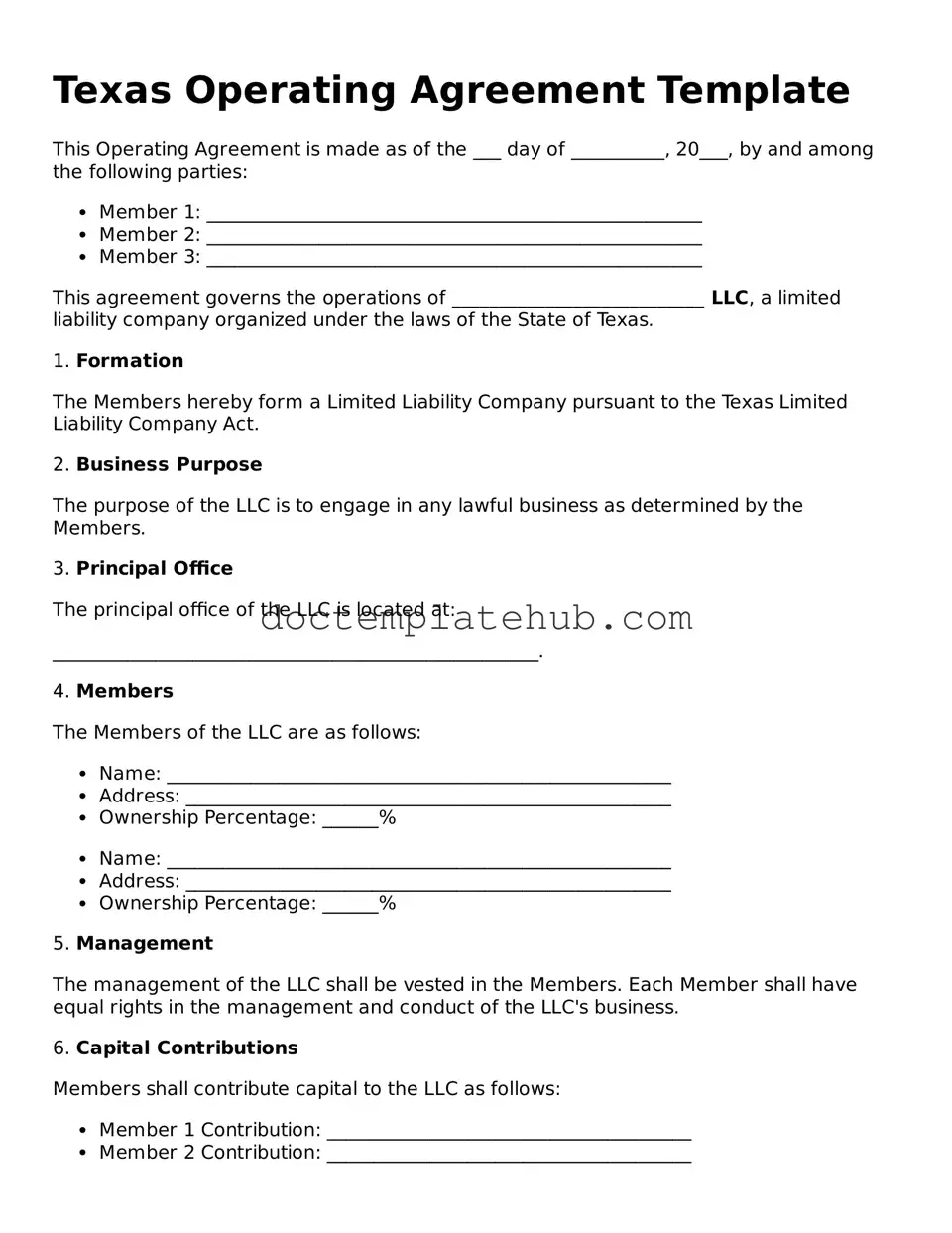

Fillable Operating Agreement Template for Texas State

The Texas Operating Agreement form serves as a foundational document for limited liability companies (LLCs) operating in the state of Texas. This form outlines the internal workings of the LLC, detailing the roles and responsibilities of its members, as well as the procedures for decision-making and profit distribution. It establishes rules for management and governance, ensuring that all members understand their rights and obligations. The agreement also addresses crucial aspects such as the process for adding new members, handling disputes, and dissolving the company if necessary. By clearly defining these elements, the Texas Operating Agreement helps to prevent misunderstandings and conflicts among members, promoting a smoother operation of the business. Additionally, while the form is not legally required in Texas, having one in place is highly recommended for any LLC seeking to protect its members and ensure compliance with state laws.

Similar forms

The Texas Operating Agreement is similar to the Limited Liability Company (LLC) Articles of Organization. Both documents are essential for establishing an LLC in Texas. While the Articles of Organization officially register the business with the state, the Operating Agreement outlines the internal structure and management of the LLC. It details the roles of members, voting rights, and profit distribution, ensuring clarity and reducing potential conflicts among members.

Another document that shares similarities is the Partnership Agreement. Like the Operating Agreement, a Partnership Agreement defines the relationship between partners in a business. It specifies each partner's responsibilities, profit-sharing arrangements, and procedures for resolving disputes. Both documents aim to provide a clear framework for business operations and decision-making, promoting transparency and cooperation among the parties involved.

The Corporate Bylaws are also comparable to the Texas Operating Agreement. Bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting procedures, and voting requirements. Similar to an Operating Agreement, Corporate Bylaws serve to establish rules and guidelines that help maintain order and facilitate effective governance within the organization.

The Shareholders' Agreement is another document that aligns with the Texas Operating Agreement. This agreement is particularly relevant for corporations and outlines the rights and obligations of shareholders. It covers aspects such as share transfers, voting rights, and procedures for resolving disputes. Both agreements aim to protect the interests of the parties involved and provide a structured approach to managing relationships within the business.

The Buy-Sell Agreement is similar in purpose to the Texas Operating Agreement, focusing on the transfer of ownership interests. This document outlines the terms under which a member's interest can be sold or transferred, including valuation methods and buyout procedures. Like the Operating Agreement, it helps prevent conflicts and ensures a smooth transition in ownership, which is crucial for the stability of the business.

The Employment Agreement also shares some similarities with the Texas Operating Agreement, particularly in terms of defining roles and responsibilities. An Employment Agreement specifies the terms of employment, including duties, compensation, and termination procedures. Both documents provide clarity and structure, helping to establish expectations and reduce misunderstandings between parties.

Lastly, the Non-Disclosure Agreement (NDA) can be viewed as similar to the Texas Operating Agreement in that both documents aim to protect sensitive information. An NDA establishes confidentiality obligations between parties, ensuring that proprietary information remains secure. While the Operating Agreement focuses on the operational aspects of a business, both documents are crucial for maintaining trust and safeguarding the interests of all parties involved.

Other Common State-specific Operating Agreement Templates

Does California Require an Operating Agreement for an Llc - The agreement can specify how the LLC will be managed, either by members or managers.

Operating Agreement Florida - It reinforces the professional relationship among members.

More About Texas Operating Agreement

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the ownership and operating procedures of a limited liability company (LLC) in Texas. It serves as a guideline for how the LLC will be run, detailing the roles of members, management structure, and financial arrangements.

Why do I need an Operating Agreement for my LLC?

Having an Operating Agreement is important because it helps to clarify the rights and responsibilities of each member. It can also protect your personal assets by reinforcing the limited liability status of the LLC. Additionally, if disputes arise, this document can provide a clear framework for resolution.

Is an Operating Agreement required in Texas?

While Texas law does not require LLCs to have an Operating Agreement, it is highly recommended. Without one, the LLC will be governed by default state laws, which may not reflect the specific needs or intentions of the members.

What should be included in a Texas Operating Agreement?

Key elements to include are the names of the members, their ownership percentages, management structure, voting rights, profit distribution, and procedures for adding or removing members. It’s also wise to outline how disputes will be handled and what happens if the LLC is dissolved.

Can I change my Operating Agreement later?

Yes, you can modify your Operating Agreement at any time, as long as all members agree to the changes. It’s a good practice to keep a record of any amendments to ensure everyone is on the same page.

How do I create a Texas Operating Agreement?

You can create an Operating Agreement by drafting it yourself or using templates available online. However, consulting with a legal professional is often beneficial to ensure that it meets all legal requirements and adequately protects your interests.

Do I need to file the Operating Agreement with the state?

No, you do not need to file your Operating Agreement with the state of Texas. It should be kept in your business records and made available to all members. However, it’s important to have it accessible in case it’s needed for reference or legal matters.

How does an Operating Agreement affect taxes?

An Operating Agreement itself does not directly affect taxes. However, it can influence how profits and losses are distributed among members, which may have tax implications. It's advisable to consult with a tax professional to understand how your Operating Agreement can impact your tax situation.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it is important to approach the task with care. Here is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about all members and their contributions.

- Do clearly outline the management structure of the LLC.

- Do specify the voting rights of each member.

- Do include provisions for handling disputes among members.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language that could lead to misunderstandings.

- Don't overlook the importance of having all members sign the agreement.

- Don't rush through the process; take your time to ensure accuracy.

Following these guidelines can help ensure that your Texas Operating Agreement is complete and effective. Proper attention to detail will serve your business well in the long run.

Texas Operating Agreement - Usage Steps

Completing the Texas Operating Agreement form is an essential step for establishing the rules and guidelines that will govern your business. This process involves careful attention to detail to ensure that all necessary information is accurately provided. Below are the steps to guide you through filling out the form.

- Obtain the form: Access the Texas Operating Agreement form from a reliable source, such as a legal website or your attorney.

- Read through the entire form: Familiarize yourself with the sections and requirements before you begin filling it out.

- Provide the business name: Clearly write the legal name of your business as registered with the state of Texas.

- List the principal office address: Enter the complete address where your business will be located.

- Identify the members: List all members of the LLC, including their names and addresses.

- Specify the management structure: Indicate whether the LLC will be managed by its members or by appointed managers.

- Outline the purpose of the LLC: Briefly describe the business activities the LLC will engage in.

- Detail the capital contributions: State the initial contributions of each member and how profits and losses will be distributed.

- Include provisions for meetings: Specify how often meetings will be held and the process for notifying members.

- Review and sign: Carefully review the completed form for accuracy. All members should sign and date the document.

After completing the form, it is advisable to keep a copy for your records. Consider consulting with a legal professional to ensure compliance with Texas laws and regulations. This will help protect your business and its members as you move forward.