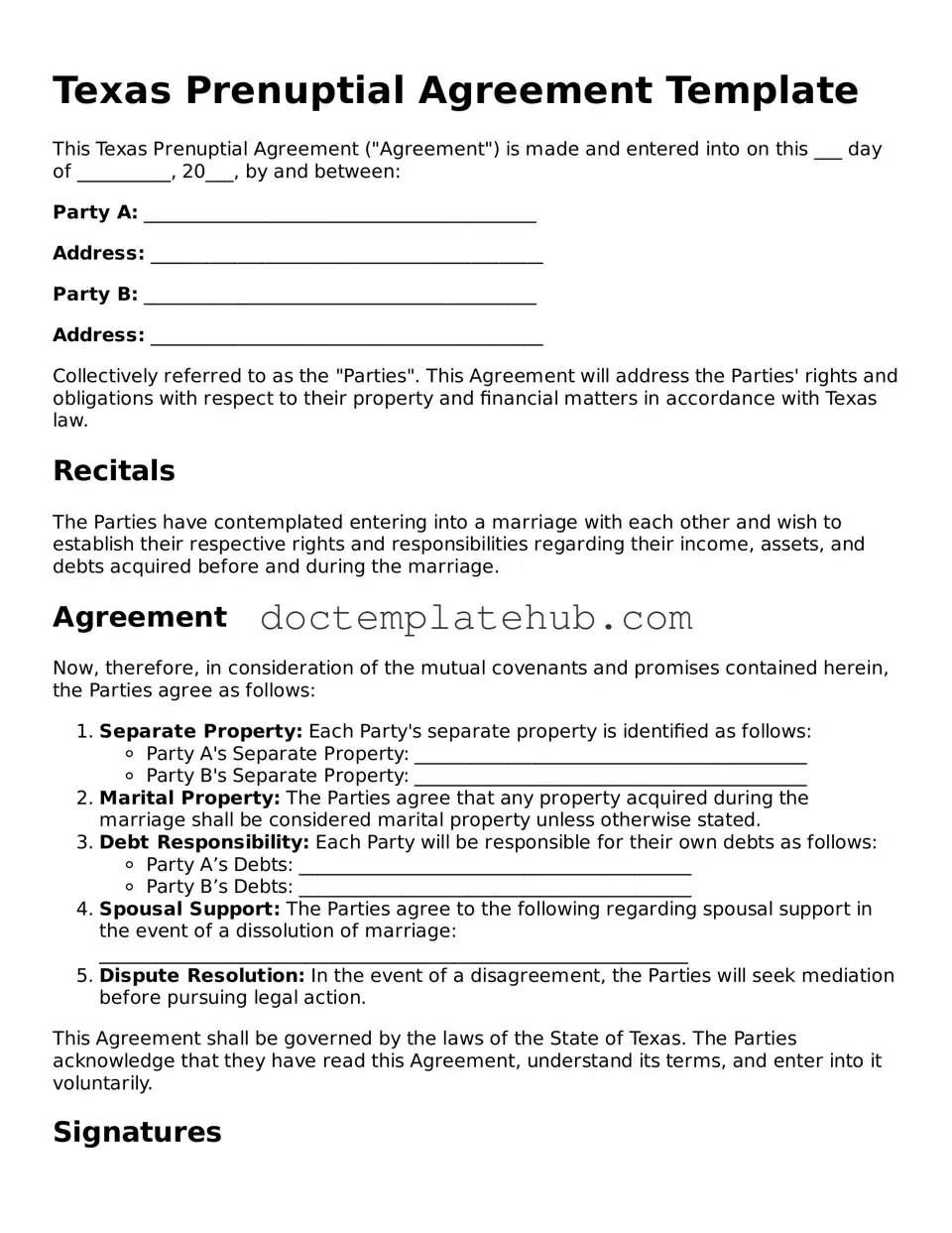

Fillable Prenuptial Agreement Template for Texas State

In the heart of Texas, couples contemplating marriage often find themselves navigating the complexities of a prenuptial agreement, commonly known as a prenup. This legal document serves as a foundation for understanding financial responsibilities and asset distribution in the event of a divorce or separation. It allows partners to outline their individual assets, debts, and income, ensuring that both parties have a clear understanding of their financial landscape before tying the knot. A Texas prenuptial agreement can address various aspects, including property division, spousal support, and even the handling of future earnings. By having open discussions about these topics, couples can foster a sense of transparency and trust, which is crucial for a healthy marriage. While the thought of discussing financial matters before saying "I do" may seem daunting, a well-crafted prenup can ultimately provide peace of mind and protect both individuals' interests, paving the way for a more harmonious union.

Similar forms

A Texas Prenuptial Agreement is akin to a Cohabitation Agreement, which is designed for couples living together but not married. Both documents serve to clarify financial responsibilities and property rights, ensuring that each party understands their obligations and entitlements. While a Prenuptial Agreement is executed before marriage, a Cohabitation Agreement is established before or during cohabitation, providing similar protections and expectations for both partners in a non-marital relationship.

Another document that shares similarities with the Prenuptial Agreement is the Postnuptial Agreement. This agreement is created after a couple is married, allowing them to outline their financial arrangements and property rights. Like a Prenuptial Agreement, a Postnuptial Agreement can help mitigate conflicts in the event of a divorce by clearly defining each spouse's rights and responsibilities regarding assets and debts.

The Separation Agreement is also comparable to a Prenuptial Agreement, as it outlines the terms of a couple's separation. This document typically addresses issues such as asset division, child custody, and support obligations. Both agreements aim to provide clarity and reduce disputes, although a Separation Agreement is utilized when a couple has already decided to part ways, while a Prenuptial Agreement is proactive, established before marriage.

Similarly, a Marital Settlement Agreement functions like a Prenuptial Agreement but is specifically designed for couples going through a divorce. This document details the terms of asset division, spousal support, and other critical issues. While a Prenuptial Agreement seeks to prevent disputes before they arise, a Marital Settlement Agreement resolves them after the fact, both serving to protect the interests of each party.

The Property Settlement Agreement also bears resemblance to a Prenuptial Agreement, as it delineates how assets and debts will be divided in the event of a divorce. This document is often part of the divorce proceedings and aims to ensure a fair distribution of property. In contrast, a Prenuptial Agreement addresses these matters before marriage, providing a roadmap for financial arrangements that can prevent future conflicts.

A Trust Agreement can be compared to a Prenuptial Agreement in that both documents can be used to protect assets. A Trust Agreement allows individuals to place their assets into a trust for specific beneficiaries, often safeguarding those assets from creditors or divorce settlements. While a Prenuptial Agreement aims to clarify ownership and division of assets before marriage, a Trust Agreement can serve as a protective measure for those assets during and after the marriage.

The Business Partnership Agreement is another document that shares some characteristics with a Prenuptial Agreement. This agreement outlines the terms of a business partnership, including ownership stakes, profit sharing, and responsibilities. Just as a Prenuptial Agreement clarifies financial rights within a marriage, a Business Partnership Agreement delineates the financial and operational expectations between business partners, aiming to prevent disputes and misunderstandings.

In a similar vein, a Will can be likened to a Prenuptial Agreement, as both documents address the distribution of assets. A Will specifies how a person’s assets will be divided upon their death, while a Prenuptial Agreement outlines how assets will be divided in the event of divorce. Both documents serve to express an individual's wishes clearly and can help minimize conflicts among heirs or spouses.

In understanding legal documents related to financial arrangements, one must also consider the importance of a Hold Harmless Agreement, especially in contexts involving potential liabilities. Similar to other agreements that clarify various responsibilities and rights, this form is crucial for ensuring that parties are protected during their engagements. For more detailed information on how to secure such an agreement, you can refer to smarttemplates.net.

Finally, a Durable Power of Attorney can be compared to a Prenuptial Agreement in terms of protecting interests. This document allows an individual to designate someone to make financial or medical decisions on their behalf if they become incapacitated. While a Prenuptial Agreement protects financial interests in the context of marriage, a Durable Power of Attorney safeguards an individual’s rights and choices in unforeseen circumstances, ensuring that their wishes are honored.

Other Common State-specific Prenuptial Agreement Templates

Florida Premarital Contract - A prenuptial agreement can protect a family business from division in a divorce.

California Premarital Contract - A prenuptial agreement can include provisions for future changes, adapting to the couple's evolving financial landscape.

Georgia Premarital Contract - A prenuptial agreement is a proactive step towards financial security for both partners.

To further understand the importance of protecting oneself from liabilities, you can refer to resources about the Georgia Hold Harmless Agreement, which can be found at https://toptemplates.info/. This legal document is essential for ensuring safety and clarity in various transactions and activities.

Arizona Premarital Contract - Ensures both parties are aware of each other's financial situations.

More About Texas Prenuptial Agreement

What is a prenuptial agreement in Texas?

A prenuptial agreement, often called a prenup, is a legal document created by two individuals before they get married. It outlines how assets and debts will be divided in the event of a divorce or separation. In Texas, these agreements can also address spousal support and other financial matters, providing clarity and security for both parties.

Why should I consider a prenuptial agreement?

Many couples choose to create a prenuptial agreement to protect their individual assets and establish financial expectations. It can help prevent disputes during a divorce by clearly defining each person's rights and responsibilities. Additionally, it offers peace of mind, knowing that both parties have agreed on how to handle financial matters if the relationship ends.

What should be included in a Texas prenuptial agreement?

A comprehensive prenuptial agreement in Texas typically includes the following elements: a list of assets and debts, provisions for property division, terms regarding spousal support, and any other specific agreements the couple wishes to include. It is essential to be thorough to avoid ambiguity and ensure that both parties understand the terms.

How do we create a prenuptial agreement in Texas?

Creating a prenuptial agreement involves several steps. First, both parties should discuss their financial situations and goals. Next, it is advisable to consult with legal professionals who specialize in family law to ensure that the agreement complies with Texas laws. After drafting the document, both parties must sign it voluntarily, ideally in the presence of witnesses or a notary.

Can a prenuptial agreement be modified after marriage?

Yes, a prenuptial agreement can be modified after marriage, but both parties must agree to the changes. This requires drafting a new document or an amendment to the original agreement. It is crucial to follow legal procedures to ensure that the modifications are enforceable.

Is a prenuptial agreement enforceable in Texas?

In general, prenuptial agreements are enforceable in Texas as long as they meet specific legal requirements. These include being in writing, signed by both parties, and entered into voluntarily without coercion. Additionally, the agreement must not be unconscionable, meaning it should not be extremely unfair to one party.

What happens if we don't have a prenuptial agreement?

If a couple does not have a prenuptial agreement, Texas law will govern the division of assets and debts in the event of a divorce. This means that the court will determine how property is divided, which may not align with the couple's preferences. Without a prenup, disputes may arise, leading to a potentially lengthy and costly legal process.

How can I ensure my prenuptial agreement is valid?

To ensure the validity of a prenuptial agreement, it is essential to follow legal guidelines. Both parties should fully disclose their financial situations, seek independent legal advice, and sign the agreement well in advance of the wedding. It is also beneficial to avoid any form of duress or undue influence during the signing process.

Can a prenuptial agreement address child custody and support?

While a prenuptial agreement can address financial matters, it cannot dictate child custody or support arrangements. Texas law requires that child custody decisions be made based on the best interests of the child at the time of divorce. However, parents can include provisions about their intentions regarding parenting and support, but these will not be binding in court.

Dos and Don'ts

When filling out the Texas Prenuptial Agreement form, it is essential to follow certain guidelines to ensure the document is valid and serves its intended purpose. Here are five things to do and five things to avoid:

- Do: Clearly identify both parties involved in the agreement.

- Do: Discuss the terms openly and honestly with your partner.

- Do: Include specific details about the property and assets of each party.

- Do: Have the document reviewed by a qualified attorney.

- Do: Sign the agreement in the presence of a notary public.

- Don't: Rush through the process without thorough discussions.

- Don't: Include any terms that are illegal or against public policy.

- Don't: Forget to keep copies of the signed agreement for both parties.

- Don't: Use vague language that could lead to misunderstandings.

- Don't: Assume the agreement is enforceable without proper legal advice.

Texas Prenuptial Agreement - Usage Steps

Completing a Texas Prenuptial Agreement form is an important step in planning for a future together. By filling out this form, couples can clearly outline their financial rights and responsibilities before marriage. Here’s a straightforward guide to help you navigate the process.

- Gather Necessary Information: Collect financial details such as income, assets, debts, and any other relevant information that will be included in the agreement.

- Identify Parties: Clearly state the full names and addresses of both individuals entering the agreement.

- Outline Assets and Liabilities: List all assets, including property, bank accounts, and investments, along with any debts that each party has.

- Determine Ownership: Specify how each asset and liability will be treated during the marriage. Decide if they will remain separate or be considered marital property.

- Include Provisions: Add any additional terms or conditions that both parties agree upon, such as spousal support or inheritance rights.

- Review and Revise: Go through the completed form together, making any necessary changes or clarifications to ensure mutual understanding.

- Sign the Agreement: Both parties must sign the document in the presence of a notary public to validate the agreement.

- Store Safely: Keep the signed agreement in a secure location where both parties can access it if needed in the future.