Fillable Promissory Note Template for Texas State

In the realm of personal and business financing, the Texas Promissory Note form serves as a crucial instrument for establishing a clear agreement between a borrower and a lender. This legally binding document outlines the specifics of a loan, detailing the amount borrowed, the interest rate, and the repayment schedule. It is designed to protect the interests of both parties by ensuring that terms are explicitly stated and understood. Additionally, the form may include provisions for late fees, prepayment options, and default consequences, which further clarify the responsibilities of each party involved. By using this form, individuals and businesses can foster trust and transparency in financial transactions, thereby minimizing the potential for disputes. Understanding the Texas Promissory Note is essential for anyone considering borrowing or lending money, as it lays the groundwork for a successful financial relationship.

Similar forms

A loan agreement is a document that outlines the terms and conditions of a loan between a borrower and a lender. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional details such as collateral, default conditions, and other legal obligations that may not be present in a standard promissory note. This document serves as a more comprehensive contract for larger loans or more complex arrangements.

Understanding the importance of legal documentation, the Power of Attorney for a Child form allows for essential arrangements, ensuring that decisions regarding a child's welfare can be managed effectively. For more information, refer to the comprehensive guide on the Power of Attorney for a Child process.

A mortgage is a specific type of promissory note used in real estate transactions. It secures the loan with the property itself, meaning that if the borrower defaults, the lender can take possession of the property through foreclosure. While a promissory note simply states the borrower’s promise to repay, a mortgage includes the legal framework for securing that promise with tangible assets, making it a critical document in real estate financing.

An IOU is an informal document acknowledging a debt. It is less formal than a promissory note and does not typically include detailed terms such as interest rates or repayment schedules. While both documents recognize a debt, an IOU is often used for smaller, more casual loans, whereas a promissory note serves as a more structured promise to repay a loan with specific terms.

A personal guarantee is a document where an individual agrees to be responsible for another party's debt. Similar to a promissory note, it involves a promise to pay; however, it is often used in business transactions where the lender requires additional assurance that the debt will be repaid. This document adds a layer of security for the lender, as it holds an individual accountable for the debt beyond just the business entity.

A security agreement is a document that outlines the terms under which a borrower pledges collateral to secure a loan. Like a promissory note, it involves a borrower and a lender, but it focuses on the collateral aspect. This agreement provides the lender with rights to the specified collateral if the borrower defaults, ensuring that the lender has a means of recourse beyond the borrower's promise to repay.

A lease agreement is similar in that it establishes the terms under which one party pays for the use of another party's property. While a promissory note deals with loans, a lease agreement outlines rental terms, including payment amounts and schedules. Both documents create binding obligations, but a lease focuses on the temporary transfer of property rights rather than a loan repayment.

A credit agreement is a broader financial document that outlines the terms of a line of credit or loan. It includes details similar to those found in a promissory note, such as repayment terms and interest rates. However, a credit agreement often encompasses a wider range of conditions, including fees, covenants, and other obligations that govern the borrowing relationship over time. It is more complex and is typically used for larger credit arrangements.

Other Common State-specific Promissory Note Templates

Ohio Promissory Note Requirements - In some agreements, a co-signer may also be required to ensure repayment.

For anyone looking to draft a comprehensive Hold Harmless Agreement, resources like smarttemplates.net can provide valuable templates and insights, ensuring that all necessary components are included to protect parties from liability appropriately.

Promissory Note Template Arizona - It can serve as a tool for personal finance management.

More About Texas Promissory Note

What is a Texas Promissory Note?

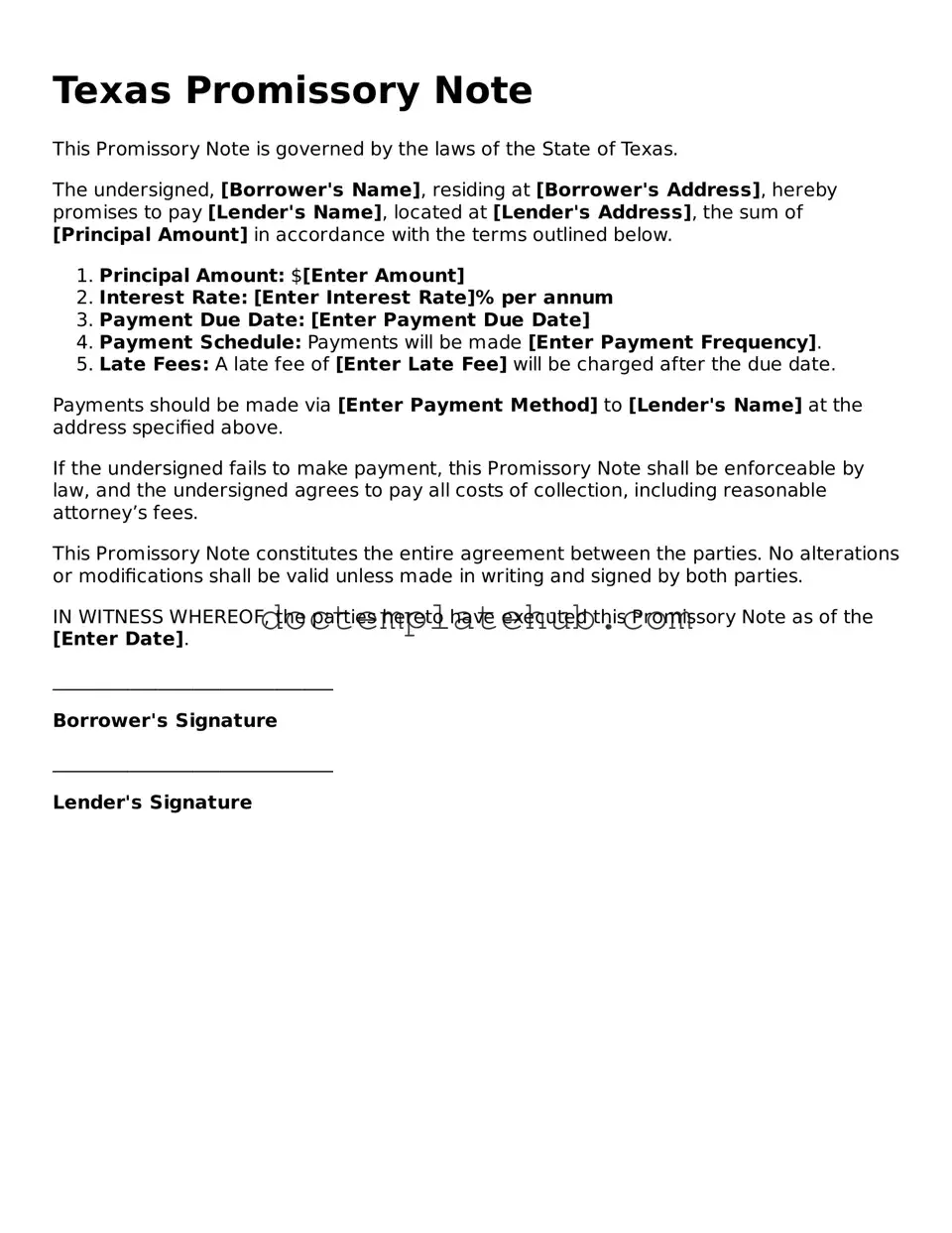

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. It serves as a written record of the loan and includes details such as the loan amount, interest rate, repayment schedule, and any applicable fees.

Who can use a Texas Promissory Note?

Anyone who is involved in lending or borrowing money can use a Texas Promissory Note. This includes individuals, businesses, and financial institutions. It is commonly used for personal loans, business loans, or any situation where money is borrowed and needs to be repaid.

What are the key components of a Texas Promissory Note?

A typical Texas Promissory Note includes several important elements: the names and addresses of the borrower and lender, the principal amount borrowed, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. It may also include clauses about default and remedies available to the lender.

Is a Texas Promissory Note legally binding?

Yes, once signed by both parties, a Texas Promissory Note is a legally binding contract. This means that both the borrower and lender are obligated to adhere to the terms outlined in the document. If either party fails to comply, the other party may seek legal recourse.

Does a Texas Promissory Note need to be notarized?

While notarization is not strictly required for a Texas Promissory Note to be valid, having it notarized can provide an extra layer of protection. Notarization helps verify the identities of the parties involved and ensures that the document is executed properly.

What happens if the borrower defaults on the loan?

If the borrower defaults, meaning they fail to make the required payments, the lender has several options. These may include charging late fees, accelerating the loan (demanding full repayment immediately), or pursuing legal action to recover the owed amount. The specific actions depend on the terms laid out in the Promissory Note.

Can a Texas Promissory Note be modified?

Yes, a Texas Promissory Note can be modified if both the borrower and lender agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to avoid future disputes.

Are there any limitations on the interest rates for Texas Promissory Notes?

Yes, Texas law imposes certain limits on interest rates. The maximum interest rate that can be charged depends on the type of loan and the amount involved. It’s important to comply with these regulations to ensure the note remains enforceable.

What should I do if I lose my Texas Promissory Note?

If you lose your Texas Promissory Note, it’s crucial to inform the other party as soon as possible. A lost note can create complications, but the lender may be able to issue a replacement note or a sworn affidavit to confirm the terms of the original agreement.

Where can I find a Texas Promissory Note template?

Templates for Texas Promissory Notes can be found online through various legal document websites, or you can consult with a legal professional to draft a customized note that meets your specific needs. Always ensure that the template complies with Texas laws.

Dos and Don'ts

When filling out the Texas Promissory Note form, it is important to be careful and thorough. Here are some guidelines to follow:

- Do read the entire form before starting.

- Do provide accurate information about the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Do outline the repayment terms in detail.

- Don't leave any fields blank unless instructed.

- Don't use vague language; be specific in your terms.

- Don't forget to date and sign the document.

- Don't ignore state-specific laws that may apply.

Texas Promissory Note - Usage Steps

After gathering the necessary information, you are ready to fill out the Texas Promissory Note form. Completing this form accurately is important to ensure that both parties understand the terms of the loan agreement. Follow these steps carefully to fill out the form correctly.

- Title the Document: At the top of the form, write "Promissory Note" to clearly identify the document.

- Insert the Date: Write the date on which the note is being created.

- Borrower Information: Fill in the full name and address of the borrower. This is the person who will be repaying the loan.

- Lender Information: Enter the full name and address of the lender. This is the individual or entity providing the loan.

- Loan Amount: Clearly state the total amount of money being borrowed. Make sure to write this amount in both numbers and words.

- Interest Rate: Specify the interest rate that will apply to the loan. This should be expressed as a percentage.

- Payment Terms: Describe how and when payments will be made. Include details about the payment schedule, such as monthly or weekly payments.

- Maturity Date: Indicate the date by which the loan must be fully repaid.

- Signatures: Both the borrower and lender must sign the document. Include the date of each signature for clarity.

- Witness or Notary: Depending on your needs, you may choose to have a witness or notary public sign the document to add an extra layer of validity.