Fillable Quitclaim Deed Template for Texas State

The Texas Quitclaim Deed is a vital legal instrument that facilitates the transfer of property ownership without the guarantees that accompany other deed types. This form is particularly useful in situations where the grantor, or property owner, wishes to convey their interest in a property without making any warranties about the title's validity. Unlike warranty deeds, which provide assurances regarding the title's status, a quitclaim deed simply transfers whatever interest the grantor has, if any. This means that the grantee, or recipient, receives no guarantees about the property's condition or any existing liens or claims. The simplicity of the Texas Quitclaim Deed makes it an appealing option for various scenarios, such as transferring property between family members, clearing up title issues, or resolving disputes. However, while the form is straightforward, it is crucial for parties involved to understand the implications of using a quitclaim deed, particularly regarding potential risks and liabilities. Properly executing this document requires attention to detail, including the inclusion of accurate property descriptions and the necessary signatures. Given the potential complexities surrounding property rights, individuals should approach the use of the Texas Quitclaim Deed with careful consideration and, if necessary, seek legal guidance to ensure a smooth transfer process.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, a Warranty Deed provides a guarantee that the seller has clear title to the property and the right to sell it. This means that if any issues arise with the title after the sale, the seller may be held responsible. In contrast, a Quitclaim Deed offers no such guarantees, making it a riskier option for the buyer. It is often used in situations where the parties know each other well, such as between family members or in divorce settlements.

A Grant Deed is another document related to property transfer. Like a Quitclaim Deed, it conveys ownership from one party to another. However, a Grant Deed includes assurances that the property has not been sold to anyone else and that it is free from any encumbrances, except those disclosed. This provides more protection to the buyer compared to a Quitclaim Deed, which does not offer any warranties regarding the title. Grant Deeds are commonly used in real estate transactions where buyers seek a bit more security.

A Bargain and Sale Deed is also comparable to a Quitclaim Deed but carries its own unique characteristics. This type of deed implies that the seller has the right to sell the property and has not encumbered it, but it does not guarantee that the title is clear. While it offers some assurances, it does not provide the same level of protection as a Warranty Deed. Bargain and Sale Deeds are often used in foreclosure sales or tax sales where the seller may not have full knowledge of the property’s title status.

An Executor’s Deed is used when a property is transferred as part of a deceased person’s estate. This deed allows the executor of the estate to transfer property to heirs or beneficiaries. Similar to a Quitclaim Deed, an Executor’s Deed typically does not come with warranties regarding the title. It simply conveys the property from the estate to the new owner. This document is essential in estate planning and ensures that property is distributed according to the deceased’s wishes.

A Deed in Lieu of Foreclosure is a document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This deed is similar to a Quitclaim Deed in that it transfers ownership without warranties. It is often used as a last resort for homeowners facing financial difficulties. By voluntarily giving up the property, the homeowner may avoid the lengthy and damaging foreclosure process. This option can be beneficial for both the homeowner and the lender, as it can save time and resources.

Other Common State-specific Quitclaim Deed Templates

Quit Claim Deed Form Arizona - The form should be filled out completely for valid transfer.

Ohio Quit Claim Deed Form - It is commonly utilized between family members and in divorces to simplify transfers.

Georgia Deed Transfer Forms - Two parties can use a Quitclaim Deed to clarify share ownership.

Quitclaim Form - This deed is typically fast and easy to process.

More About Texas Quitclaim Deed

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without making any guarantees about the title. This means the person transferring the property (the grantor) does not assure the recipient (the grantee) that they hold clear title. It is often used in situations where the parties know each other, such as family transfers or divorces, and want to simplify the transfer process.

When should I use a Quitclaim Deed in Texas?

You might consider using a Quitclaim Deed in several situations. For instance, if you are transferring property to a family member, such as a child or spouse, a Quitclaim Deed can facilitate that process without the need for extensive legal proceedings. Additionally, if you are resolving a dispute over property ownership or clarifying title issues among co-owners, this deed can serve as a useful tool. However, it is essential to be aware that this type of deed does not provide any warranty or guarantee regarding the property’s title.

How do I complete a Texas Quitclaim Deed?

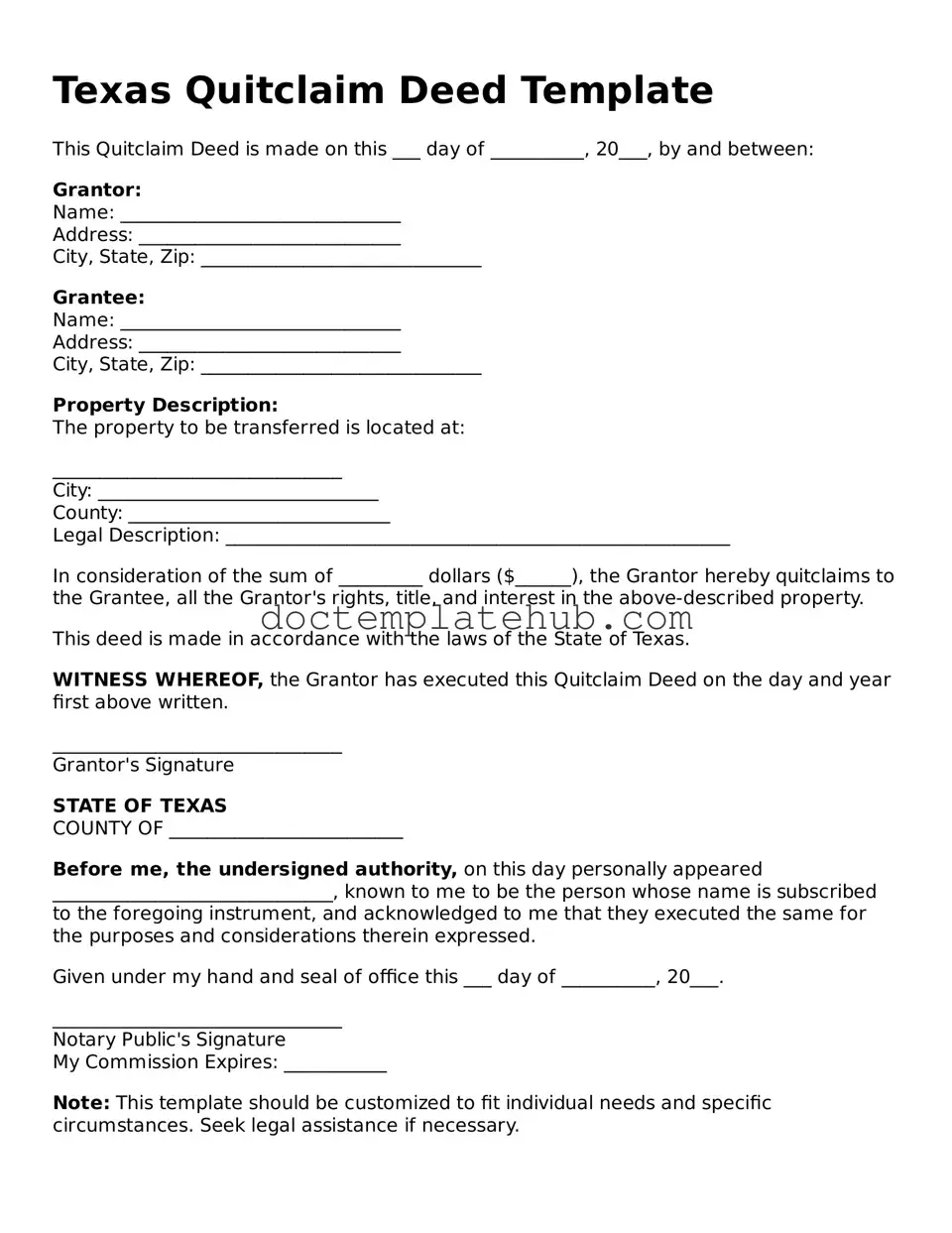

Completing a Texas Quitclaim Deed involves several steps. First, you will need to gather the necessary information, including the names of the grantor and grantee, the legal description of the property, and any relevant details about the transaction. Next, fill out the form accurately, ensuring all information is correct. After signing the deed, it must be notarized. Finally, you should file the Quitclaim Deed with the county clerk’s office in the county where the property is located to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed in Texas?

Yes, there are typically fees associated with filing a Quitclaim Deed in Texas. These fees can vary by county, so it is advisable to check with the local county clerk’s office for specific amounts. In addition to filing fees, consider any potential costs related to notarization or obtaining a copy of the deed. Understanding these costs ahead of time can help you prepare for the process more effectively.

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it’s essential to follow certain guidelines to ensure accuracy and legality. Here are seven things you should and shouldn’t do:

- Do provide accurate information about the property, including the legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the deed in front of a notary public to validate the document.

- Do check for any local requirements or additional forms that may be needed.

- Don’t leave any fields blank; fill in all required information completely.

- Don’t forget to record the deed with the county clerk’s office after signing.

- Don’t use outdated forms; ensure you are using the most current version of the Quitclaim Deed.

Texas Quitclaim Deed - Usage Steps

After you have completed the Texas Quitclaim Deed form, the next step is to ensure it is properly executed and filed. This involves obtaining the necessary signatures and then recording the deed with the appropriate county office. Following these steps carefully will help ensure that the transfer of property rights is legally recognized.

- Begin by downloading the Texas Quitclaim Deed form from a reputable source or obtain a physical copy.

- Fill in the name of the grantor (the person transferring the property) at the top of the form.

- Next, enter the name of the grantee (the person receiving the property) in the designated space.

- Provide a complete legal description of the property being transferred. This may include the address and any relevant parcel number.

- Indicate the consideration amount, which is the value exchanged for the property. This can be a nominal amount, such as $10, if no significant payment is made.

- Sign the form in the presence of a notary public. The notary will also need to sign and stamp the document to verify the authenticity of the signatures.

- Make copies of the completed deed for your records and for the grantee.

- Finally, file the original Quitclaim Deed with the county clerk’s office in the county where the property is located. There may be a small filing fee.