Fillable Tractor Bill of Sale Template for Texas State

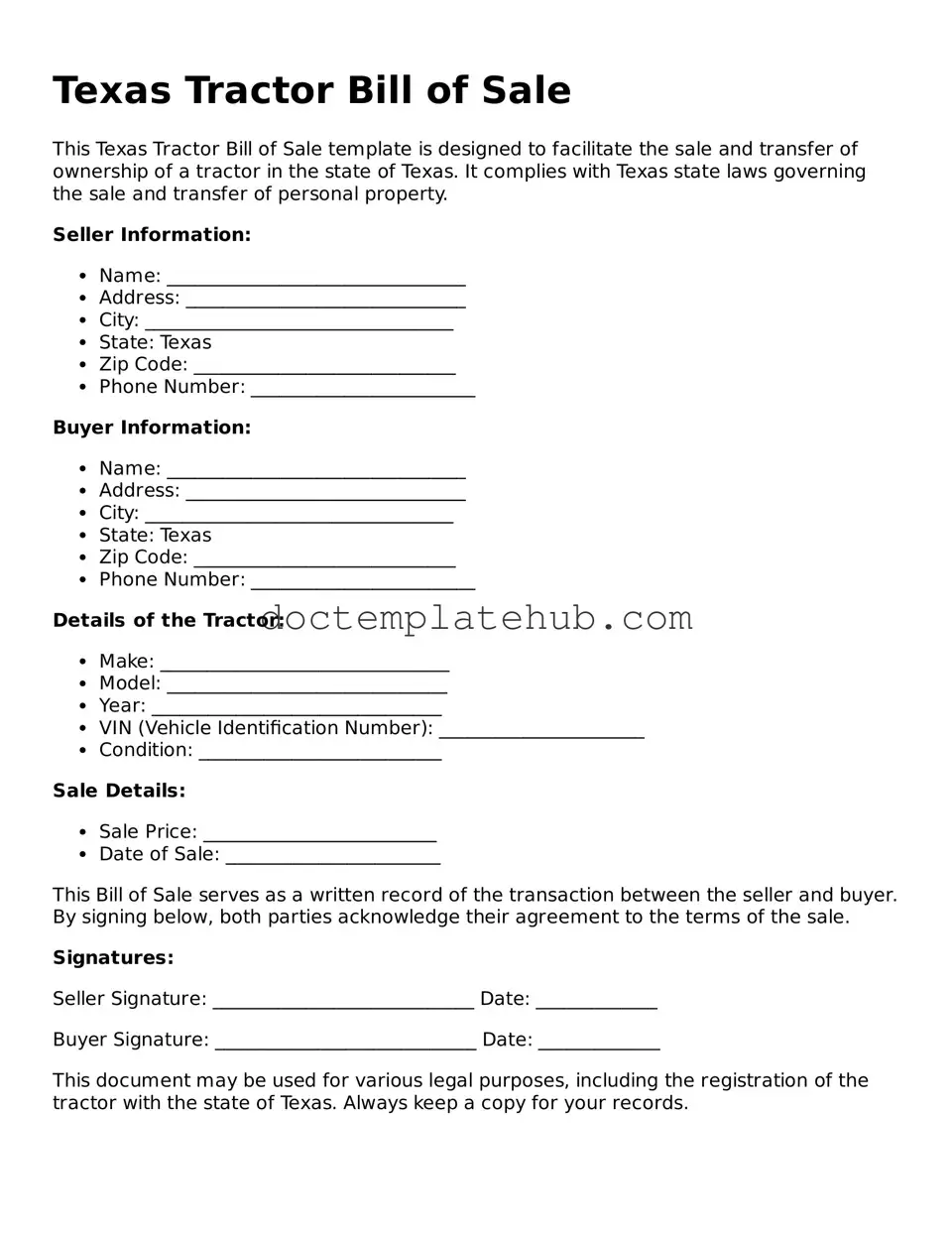

In the vast landscape of agricultural commerce, the Texas Tractor Bill of Sale form serves as a crucial document for both buyers and sellers engaged in the transfer of tractor ownership. This form not only provides essential details about the transaction but also ensures that both parties are protected under Texas law. Key aspects of the form include the identification of the seller and buyer, a comprehensive description of the tractor being sold—including its make, model, year, and Vehicle Identification Number (VIN)—and the agreed-upon sale price. Additionally, the form often includes provisions regarding any warranties or guarantees, as well as the signatures of both parties, which signify their agreement to the terms laid out. By formalizing the sale in writing, this document helps prevent disputes and misunderstandings down the line, making it an indispensable tool for anyone involved in the buying or selling of tractors in Texas.

Similar forms

The Vehicle Bill of Sale is similar to the Texas Tractor Bill of Sale in that both documents serve as proof of transfer of ownership. When you sell or buy a vehicle, this form outlines the specifics of the transaction, including the buyer, seller, and details of the vehicle. Just like the Tractor Bill of Sale, it protects both parties by documenting the agreement and can be used for registration purposes.

The Motorcycle Bill of Sale also shares similarities with the Texas Tractor Bill of Sale. It records the sale of a motorcycle, including the buyer's and seller's information, as well as the motorcycle's details. This document is essential for establishing ownership and can be used for title transfers, just like the tractor bill.

The RV Bill of Sale serves a similar purpose as the Texas Tractor Bill of Sale. It provides a written record of the sale of a recreational vehicle, capturing important details about the buyer, seller, and the RV itself. This document is vital for title transfer and can protect both parties in the transaction.

Understanding the Non-compete Agreement guidelines is essential for employers and employees in New York. This document serves to ensure that sensitive company information remains protected while clarifying the boundaries of employment transitions. Familiarizing oneself with these agreements can facilitate smoother career transitions and uphold professional integrity in the competitive job market.

The ATV Bill of Sale is akin to the Texas Tractor Bill of Sale, as it documents the sale of an all-terrain vehicle. This form includes the buyer's and seller's information and specifics about the ATV. Both documents ensure that ownership is clearly transferred and can be used for registration with the appropriate authorities.

The Equipment Bill of Sale is similar in nature to the Texas Tractor Bill of Sale, particularly for those involved in agricultural or construction businesses. This document outlines the sale of various types of equipment, including tractors. It protects both parties by providing a clear record of the transaction and is often required for financial or insurance purposes.

The Gun Bill of Sale is another document that has similarities with the Texas Tractor Bill of Sale. It serves to record the transfer of ownership of firearms. Like the tractor bill, it includes information about the buyer and seller, as well as details about the firearm. This documentation is important for legal compliance and ownership verification.

The Mobile Home Bill of Sale is comparable to the Texas Tractor Bill of Sale in that it provides a formal record of the sale of a mobile home. It includes details about the buyer and seller, along with the specifics of the mobile home. Both documents are essential for establishing ownership and ensuring proper registration.

The Livestock Bill of Sale is another relevant document. It records the sale of livestock, detailing the buyer and seller's information and the specifics of the animals sold. Similar to the Texas Tractor Bill of Sale, it serves as proof of ownership transfer and can help prevent disputes in the future.

Lastly, the Personal Property Bill of Sale is similar to the Texas Tractor Bill of Sale as it can be used for a wide range of personal items, including vehicles and equipment. This document records the sale and transfer of ownership, protecting both the buyer and seller. It is essential for establishing clear ownership and can be used for various legal purposes.

Other Common State-specific Tractor Bill of Sale Templates

Tractor Bill of Sale Form - Particularly useful in rural areas where tractors are common assets.

Do Tractors Have Titles in Texas - Can simplify the process of transferring any warranties on the tractor.

To simplify the process of creating a Power of Attorney, many individuals turn to resources such as smarttemplates.net, where they can find fillable templates tailored to New York's legal requirements, ensuring that all necessary elements are included to protect their interests effectively.

What Is a Bill of Sale Vs Title - It can outline any additional agreements, such as trade-ins or future maintenance commitments.

More About Texas Tractor Bill of Sale

What is a Texas Tractor Bill of Sale?

A Texas Tractor Bill of Sale is a legal document that records the sale of a tractor between a buyer and a seller. This form provides important details about the transaction, including the identities of both parties, the tractor's description, and the sale price. It serves as proof of ownership transfer and can be used for registration purposes.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is essential for documenting the sale of a tractor. It protects both the buyer and seller by providing a record of the transaction. This document can help resolve disputes and is often required when registering the tractor with the state or obtaining financing.

What information is included in the Texas Tractor Bill of Sale?

The form typically includes the names and addresses of the buyer and seller, the tractor's make, model, year, and Vehicle Identification Number (VIN). It also includes the sale price and the date of the transaction. Any warranties or conditions of the sale may also be noted.

Is the Texas Tractor Bill of Sale required by law?

While a Bill of Sale is not legally required for all tractor sales in Texas, it is highly recommended. Having a written record of the transaction can help protect both parties and simplify the registration process with the Texas Department of Motor Vehicles.

How do I complete a Texas Tractor Bill of Sale?

To complete the form, fill in the required information accurately. Ensure that all details about the tractor and the transaction are clear. Both the buyer and seller should sign the document to confirm the sale. It is advisable to keep a copy for your records.

Can I use a generic Bill of Sale for my tractor?

Yes, a generic Bill of Sale can be used, but it is best to use a form specifically designed for tractors. This ensures that all relevant information is included and meets any specific requirements for vehicle registration in Texas.

Do I need a notary for the Texas Tractor Bill of Sale?

A notary is not required for the Bill of Sale to be valid in Texas. However, having the document notarized can add an extra layer of authenticity and may be beneficial if there are disputes in the future.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a signed copy for their records. The buyer may need to present this document to the Texas Department of Motor Vehicles when registering the tractor.

Can I cancel the sale after signing the Bill of Sale?

Once the Bill of Sale is signed, it generally indicates that the transaction is complete. Cancelling the sale can be complicated and may require mutual agreement between both parties. It is advisable to consult with a legal professional if cancellation is necessary.

Where can I find a Texas Tractor Bill of Sale form?

You can find a Texas Tractor Bill of Sale form online through various legal document websites, or you may obtain one from a local office supply store. Ensure that the form is appropriate for Texas and includes all necessary fields.

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it is essential to approach the task with care. This document serves as a legal record of the sale and transfer of ownership of a tractor. To ensure accuracy and compliance, here are ten important guidelines to follow.

- Do: Provide accurate information about the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

- Do: Include the full names and addresses of both the buyer and seller to establish clear identification.

- Do: Clearly state the sale price of the tractor to avoid any disputes later on.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed Bill of Sale for your records after signing.

- Don't: Leave any fields blank; incomplete information can lead to issues during registration.

- Don't: Use nicknames or abbreviations for names; full legal names are necessary.

- Don't: Forget to check for typos or errors in the VIN and other critical details.

- Don't: Alter the document after it has been signed, as this can invalidate the sale.

- Don't: Ignore local laws or requirements regarding the sale of vehicles; research may be necessary.

By following these guidelines, individuals can ensure a smooth transaction when completing the Texas Tractor Bill of Sale form. Proper attention to detail can prevent misunderstandings and legal complications in the future.

Texas Tractor Bill of Sale - Usage Steps

After obtaining the Texas Tractor Bill of Sale form, you will need to provide specific information to ensure a smooth transaction. This document serves as proof of the sale and includes details about the tractor, the buyer, and the seller. Follow these steps to complete the form accurately.

- Gather Required Information: Collect all necessary details about the tractor, including the make, model, year, Vehicle Identification Number (VIN), and any other relevant specifications.

- Seller Information: Fill in the seller's name, address, and contact information. Ensure that this information is accurate and up-to-date.

- Buyer Information: Enter the buyer's name, address, and contact information. Like the seller's details, this must be correct to avoid future issues.

- Sale Price: Indicate the agreed-upon sale price of the tractor. Be clear and precise to prevent misunderstandings.

- Date of Sale: Write the date when the transaction takes place. This date is important for record-keeping purposes.

- Signatures: Both the seller and buyer must sign the form. This step confirms that both parties agree to the terms of the sale.

- Notarization (if required): Some transactions may require notarization. Check local regulations to determine if this step is necessary.