Fillable Transfer-on-Death Deed Template for Texas State

In the realm of estate planning, the Texas Transfer-on-Death Deed (TODD) form stands out as a valuable tool for property owners looking to streamline the transfer of their real estate upon death. This form allows individuals to designate a beneficiary who will automatically receive the property without the need for probate, simplifying the process for loved ones during a difficult time. By completing and recording this deed, property owners can maintain control over their assets during their lifetime while ensuring a smooth transition to their chosen heirs. The TODD form is particularly appealing because it can be revoked or amended at any time before the owner's passing, providing flexibility to adapt to changing circumstances. Moreover, it’s important to understand the specific requirements for executing this deed, including the need for proper signatures and notarization, as well as the implications of state laws on property transfer. As you explore the nuances of the Texas Transfer-on-Death Deed, you'll discover how this legal instrument can effectively align with your estate planning goals, ensuring that your wishes are honored and that your loved ones are supported when the time comes.

Similar forms

The Texas Transfer-on-Death Deed (TODD) is similar to a will in that both documents allow individuals to dictate the distribution of their property after death. A will is a legal document that outlines how a person's assets should be distributed upon their passing. However, a key difference lies in the timing of the transfer. A will takes effect only after the individual dies and must go through probate, while a TODD allows for the direct transfer of property to beneficiaries without the need for probate, making the process simpler and often quicker for heirs.

For individuals navigating the complexities of their immigration status, understanding the importance of the USCIS I-589 form can be crucial. This form is the gateway for many seeking asylum in the United States, as it allows applicants to clearly present their cases for asylum and protection. By completing the smarttemplates.net form, individuals can take the first step towards securing safety and a new beginning in the U.S., ensuring their voices are heard and their stories are noted in the immigration process.

Other Common State-specific Transfer-on-Death Deed Templates

Free Printable Transfer on Death Deed Form Florida - The document must be properly executed to ensure it holds up in the event of a dispute.

Transfer on Death Deed Georgia - Using this form reduces the risk of family disputes that often arise during estate settlements.

For those navigating the complexities of estate management, understanding the intricacies of the process is crucial. Accessing a Small Estate Affidavit form for New York can provide the necessary guidance to simplify the settling of a deceased person's estate without extensive legal proceedings.

Tod in California - Keep your beneficiary's contact information updated for smooth processing.

More About Texas Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to designate a beneficiary who will receive the property upon the owner's death. This deed bypasses probate, allowing for a smoother transition of property ownership without the need for court intervention.

Who can create a Transfer-on-Death Deed?

Any individual who owns real property in Texas can create a Transfer-on-Death Deed. The property owner must be of sound mind and at least 18 years old. It is essential that the owner properly executes the deed according to Texas law for it to be valid.

How do I complete a Transfer-on-Death Deed?

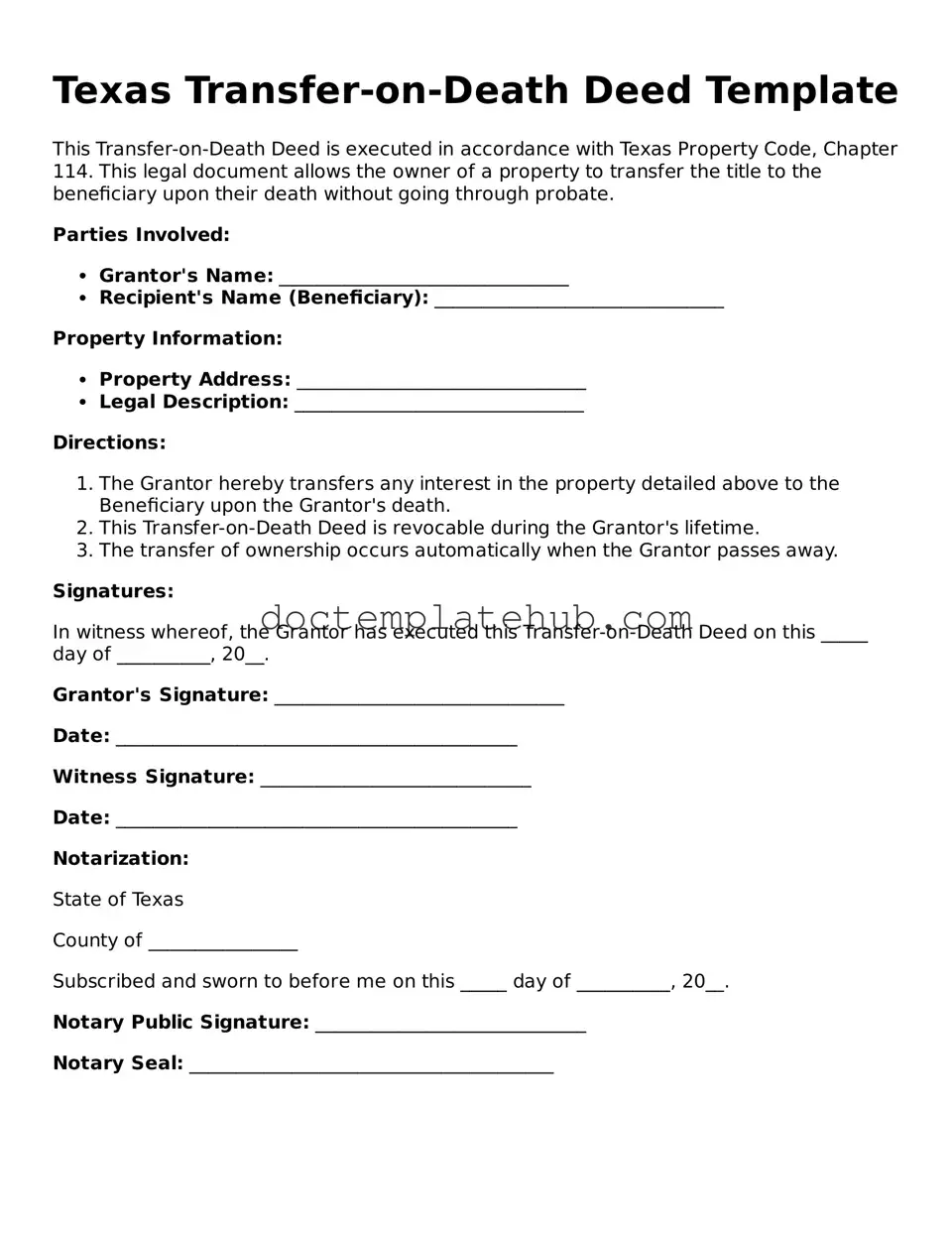

To complete a Transfer-on-Death Deed, you must provide specific information including the legal description of the property, the name of the beneficiary, and your signature. It is advisable to have the deed notarized and recorded in the county where the property is located to ensure it is legally recognized.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do this, you must create a new deed that explicitly states the changes or file a revocation form with the county clerk's office where the original deed was recorded.

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before you, the property will not automatically transfer to that individual. Instead, the property will become part of your estate and will be distributed according to your will or, if there is no will, according to Texas intestacy laws.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the distribution of property after death, a TODD specifically transfers real property directly to a beneficiary without going through probate. A will, on the other hand, typically requires probate proceedings to validate and execute the distribution of assets.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it is essential to follow specific guidelines to ensure the document is valid and effective. Here are nine important dos and don'ts to consider:

- Do provide accurate information about the property, including the legal description.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Do ensure that the deed is recorded with the county clerk's office where the property is located.

- Do review the form for completeness and correctness before submission.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't use vague language when describing the property or beneficiaries.

- Don't forget to check the form for any required signatures.

- Don't assume that verbal agreements about the deed are sufficient; everything must be in writing.

- Don't overlook the importance of consulting with a legal professional if you have questions.

Texas Transfer-on-Death Deed - Usage Steps

Filling out a Texas Transfer-on-Death Deed form is a straightforward process. After completing the form, you will need to sign it in front of a notary public. Once notarized, you should file it with the county clerk in the county where the property is located. This ensures that your wishes regarding the transfer of property are officially recorded.

- Obtain the Texas Transfer-on-Death Deed form. You can find it online or at your local county clerk's office.

- Fill in the names of the current property owners in the designated section.

- Provide the legal description of the property. This can usually be found on your property tax statement or deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon your passing.

- Include the address of the beneficiary or beneficiaries.

- Sign the form in the presence of a notary public. Make sure to do this step carefully, as your signature must match the name on the form.

- File the completed and notarized form with the county clerk's office in the county where the property is located. Be sure to keep a copy for your records.