Official Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TOD) form serves as a vital estate planning tool, allowing property owners to designate beneficiaries who will receive their real estate upon their passing, without the need for probate. This straightforward yet powerful document enables individuals to maintain control over their property during their lifetime while ensuring a smooth transition of ownership after death. By completing a TOD deed, property owners can specify who will inherit their assets, making it easier for loved ones to avoid the complexities and costs associated with probate proceedings. Importantly, the form must be properly executed and recorded to be valid, and it can be revoked or amended at any time before the owner's death. This flexibility makes the Transfer-on-Death Deed an appealing option for many, as it provides both peace of mind and clarity regarding the future of one’s property. Understanding the nuances of this form is essential for anyone looking to streamline their estate planning process and protect their loved ones from potential complications down the road.

Similar forms

A Last Will and Testament is a document that outlines how a person wishes their assets to be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries. However, a will goes into effect only after probate, which can take time and may involve court proceedings. In contrast, a Transfer-on-Death Deed allows property to pass directly to the designated beneficiary without the need for probate, making the process quicker and often less costly.

In addition to understanding various estate planning documents, individuals may find it useful to have access to templates such as the documentonline.org/blank-doctors-excuse-note/ which can aid in formalizing medical absences effectively.

A Living Trust is another estate planning tool that shares similarities with a Transfer-on-Death Deed. Both documents allow for the transfer of assets outside of probate. A living trust holds assets during a person's lifetime and specifies how they should be distributed upon death. While a Transfer-on-Death Deed is limited to real property, a living trust can encompass various types of assets, providing more comprehensive management and distribution options.

Joint Tenancy with Right of Survivorship is another way to transfer property upon death. In this arrangement, two or more individuals own the property together, and when one owner passes away, the surviving owner automatically receives full ownership. This is similar to a Transfer-on-Death Deed in that it allows for a seamless transfer of property without probate. However, joint tenancy requires both owners to share ownership during their lifetimes, whereas a Transfer-on-Death Deed allows for a single owner to designate a beneficiary without sharing ownership until death.

Fill out Common Types of Transfer-on-Death Deed Templates

Lady Bird Johnson Deed - With this deed, owners can ensure that their property goes directly to loved ones.

In addition to using traditional accounting methods, businesses can enhance their financial monitoring by utilizing resources available at smarttemplates.net, where they can find templates designed to simplify the creation and management of Profit and Loss forms, ensuring accuracy and efficiency in tracking financial performance.

What Is a Deed in Lieu - Potential benefits of a Deed in Lieu include minimizing foreclosure delays and legal fees.

More About Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) allows an individual to transfer real estate to a designated beneficiary upon their death. This deed bypasses probate, making the transfer process simpler and faster for heirs. It is a useful estate planning tool for those who want to ensure their property goes directly to a chosen person without the complications of probate court.

Who can use a Transfer-on-Death Deed?

Any property owner in the United States can use a Transfer-on-Death Deed, provided their state recognizes this type of deed. It is available to individuals who own real estate and wish to designate a beneficiary to receive the property after their death. However, specific rules and regulations may vary by state, so it's essential to check local laws.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the appropriate form, which typically includes details about the property, the owner's name, and the beneficiary's information. After filling out the form, it must be signed and notarized. Finally, the deed should be recorded with the local county recorder's office to ensure its validity and enforceability.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must execute a new deed or a formal revocation document, and then record it with the county recorder’s office. It is important to follow the proper legal procedures to ensure that the changes are valid and enforceable.

What happens if the beneficiary dies before me?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed typically becomes void. However, the property owner can designate an alternate beneficiary in the deed. If no alternate is named, the property will be distributed according to the owner's will or, if there is no will, according to state intestacy laws.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. The property is transferred to the beneficiary without the need for probate, which can help avoid certain taxes. However, beneficiaries may be responsible for property taxes and capital gains taxes upon the sale of the property. Consulting with a tax professional is advisable to understand the specific implications.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be an effective estate planning tool for many, but it is not suitable for everyone. Individuals with complex estates, multiple properties, or specific wishes regarding their assets may benefit from more comprehensive estate planning strategies. It is advisable to consult with an estate planning attorney to determine the best approach for your unique situation.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's essential to approach the task with care. Here are some key points to consider:

- Do ensure you are eligible: Confirm that you meet the requirements to use a Transfer-on-Death Deed in your state.

- Do provide accurate information: Double-check all names, addresses, and legal descriptions of the property to avoid future disputes.

- Do sign in front of a notary: Most states require the deed to be notarized for it to be valid.

- Do record the deed: Submit the completed deed to your local recorder's office to ensure it is legally recognized.

- Don't rush through the process: Take your time to fill out the form correctly to prevent mistakes.

- Don't leave out beneficiaries: Clearly name all individuals who will inherit the property to avoid confusion later.

- Don't forget to review state laws: Each state has specific regulations regarding Transfer-on-Death Deeds; ensure you understand them.

- Don't neglect to inform beneficiaries: It’s courteous and practical to let your beneficiaries know about the deed and their future interest in the property.

Transfer-on-Death Deed - Usage Steps

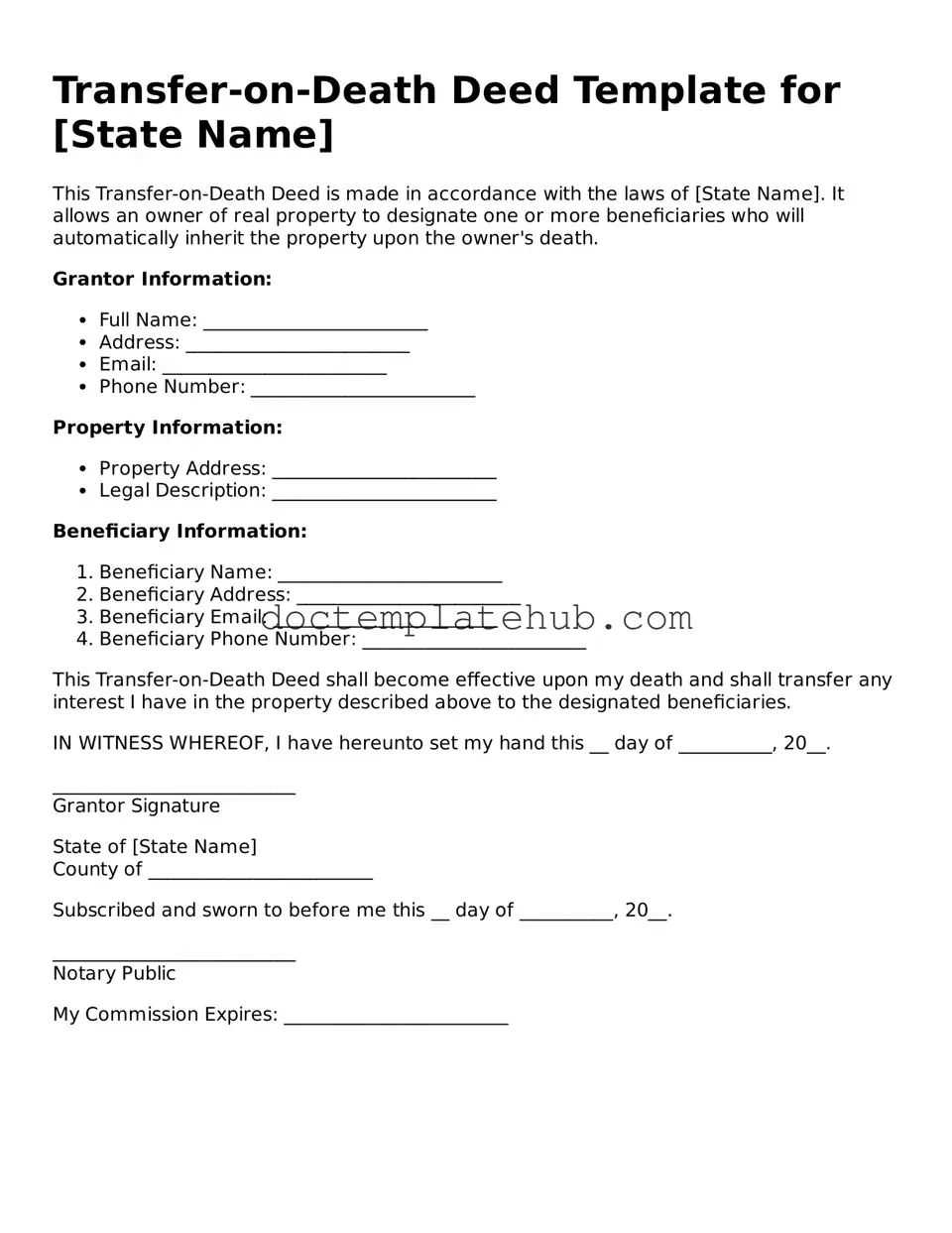

Once you have the Transfer-on-Death Deed form ready, it’s essential to fill it out accurately to ensure that your wishes regarding property transfer are clearly documented. Following these steps will guide you through the process of completing the form correctly.

- Obtain the Form: Download or acquire the Transfer-on-Death Deed form from your state’s official website or a legal stationery store.

- Property Description: Clearly describe the property you wish to transfer. Include the address, legal description, and any identifying details that specify the property.

- Owner Information: Fill in your name as the current owner of the property. Ensure that your name matches the name on the property title.

- Beneficiary Information: Enter the name of the person or people you wish to inherit the property. Provide their full names and any necessary identifying information.

- Sign the Form: Sign and date the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public complete their section, verifying your identity and signature.

- Record the Deed: Submit the completed and notarized deed to your local county recorder’s office. There may be a recording fee, so check with your local office for details.

After completing these steps, keep a copy of the recorded deed for your records. This documentation will ensure that your wishes are honored in the future. It’s wise to inform your beneficiaries about the deed and its implications, allowing for smoother transitions when the time comes.