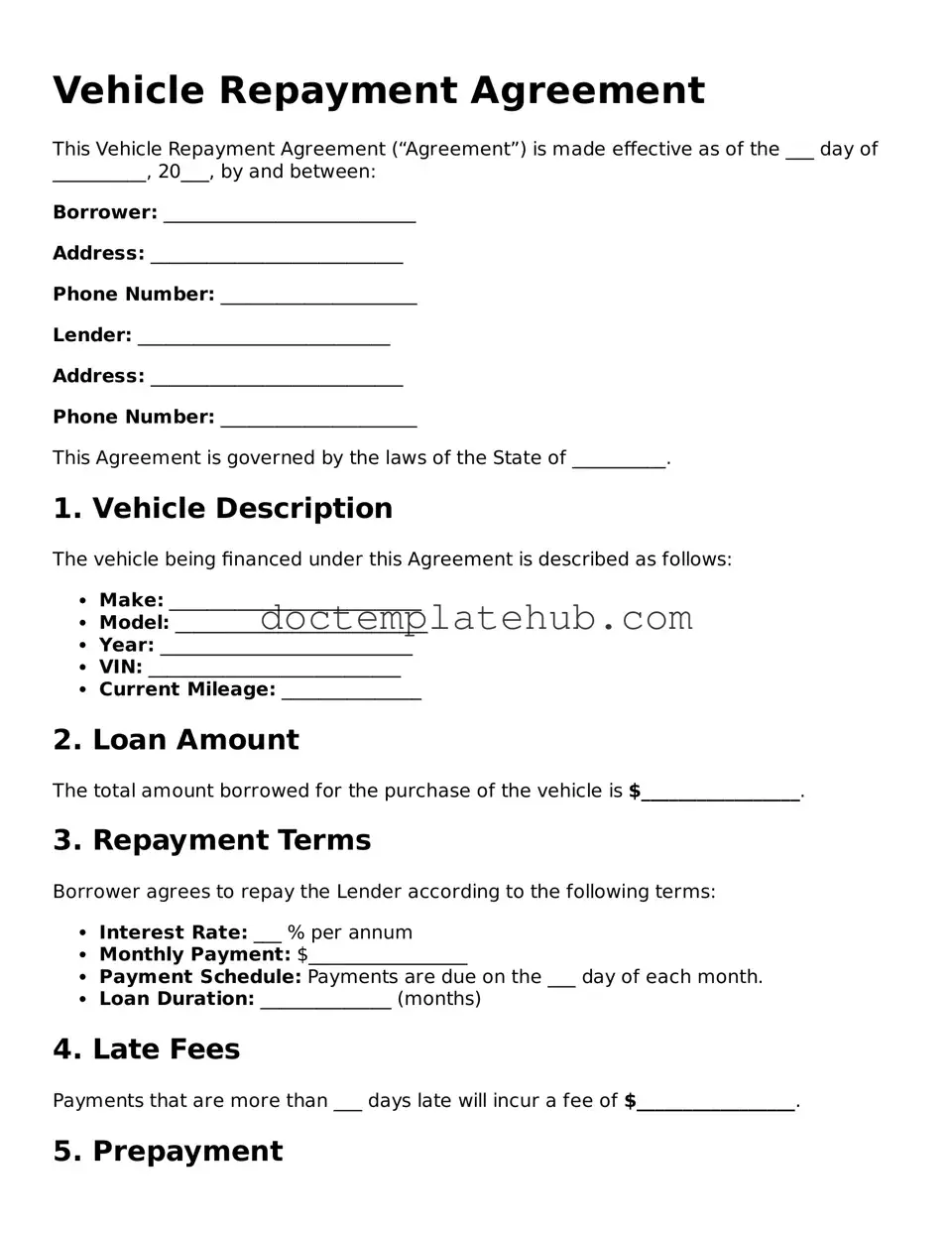

Official Vehicle Repayment Agreement Form

The Vehicle Repayment Agreement form is an essential document for individuals who are navigating the complexities of vehicle financing and repayment. This form outlines the terms and conditions under which a borrower agrees to repay a loan taken out for a vehicle purchase. Key aspects include the total amount financed, the interest rate, and the repayment schedule. Additionally, it details the consequences of defaulting on the loan, providing clarity on the rights and responsibilities of both the borrower and the lender. Understanding this form is crucial for ensuring that all parties are on the same page regarding payment obligations and expectations. By clearly laying out the financial terms, the Vehicle Repayment Agreement helps prevent misunderstandings and disputes, fostering a more transparent relationship between borrowers and lenders. It serves not only as a legal document but also as a tool for financial planning and accountability.

Similar forms

The Vehicle Repayment Agreement form shares similarities with a Loan Agreement. Both documents outline the terms and conditions under which a borrower agrees to repay a loan. They typically specify the loan amount, interest rate, repayment schedule, and consequences for default. Just as in a Vehicle Repayment Agreement, the Loan Agreement aims to protect the lender's interests while ensuring that the borrower understands their obligations. Clear communication of these terms helps prevent misunderstandings and disputes down the line.

Another document akin to the Vehicle Repayment Agreement is the Promissory Note. This legal instrument serves as a written promise to pay a specified amount of money at a certain time. Like the Vehicle Repayment Agreement, it includes details about the repayment terms and the consequences of non-payment. The primary difference lies in the fact that a Promissory Note is often simpler and may not require the same level of detail as a Vehicle Repayment Agreement, which can include additional provisions related to the vehicle itself.

The Lease Agreement also bears resemblance to the Vehicle Repayment Agreement. While a Lease Agreement typically pertains to property, it similarly outlines the terms of use and payment for the leased item. Both documents detail the obligations of the parties involved, including payment schedules and conditions for termination. In essence, they both serve to protect the interests of the lender or lessor while ensuring the borrower or lessee adheres to the agreed-upon terms.

A Security Agreement is another document that aligns with the Vehicle Repayment Agreement. This legal contract establishes a security interest in the collateral—in this case, the vehicle. It outlines the rights and responsibilities of both parties regarding the collateral. Much like the Vehicle Repayment Agreement, it provides assurance to the lender that they have recourse if the borrower defaults. The Security Agreement is crucial in establishing the lender's claim over the vehicle until the debt is fully paid.

Understanding the requirements of a New York Promissory Note is essential for anyone involved in financial agreements. This document can clarify obligations and expectations, providing a solid foundation for repayment terms. For more information, you can refer to the comprehensive New York Promissory Note guidelines.

The Installment Agreement is similar as well, particularly in its structure and purpose. This document lays out a plan for the borrower to repay a debt in regular installments over a specified period. Like the Vehicle Repayment Agreement, it includes the amount owed, the payment schedule, and the consequences for missed payments. Both agreements aim to create a clear framework for repayment, making it easier for borrowers to manage their financial obligations.

Lastly, the Bill of Sale shares some characteristics with the Vehicle Repayment Agreement. While primarily used to transfer ownership of a vehicle, a Bill of Sale may also include terms regarding payment if the purchase is financed. Similar to the Vehicle Repayment Agreement, it details the parties involved, the item being sold, and the payment terms. Both documents are essential in ensuring transparency and clarity in transactions involving vehicles, protecting both the buyer and the seller.

Common Forms

Free Printable Puppy Health Guarantee - Severe genetic defects diagnosed within six months warrant immediate notification to the Breeder.

Understanding the intricacies of a Power of Attorney form is essential for effective legal and financial management in Texas, and resources such as smarttemplates.net can provide valuable guidance and templates to help you navigate this important process.

Alabama Lost Title - Incorrect use of the form can lead to denials of title applications.

More About Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legal document that outlines the terms under which a borrower agrees to repay a loan taken out for purchasing a vehicle. This agreement specifies the repayment schedule, interest rates, and any penalties for late payments, ensuring both parties understand their obligations.

Who needs to sign the Vehicle Repayment Agreement?

Typically, both the borrower and the lender must sign the Vehicle Repayment Agreement. The borrower is the individual or entity taking out the loan, while the lender is usually a financial institution or dealership providing the financing. In some cases, a co-signer may also be required, especially if the borrower has a limited credit history.

What information is included in the Vehicle Repayment Agreement?

The agreement generally includes the names and addresses of the parties involved, the vehicle's details (make, model, VIN), the loan amount, interest rate, repayment schedule, and any fees or penalties for late payments. It may also outline the consequences of defaulting on the loan, such as repossession of the vehicle.

How is the repayment schedule determined?

The repayment schedule is typically based on the loan amount, interest rate, and the borrower's financial situation. Lenders may offer various options, such as monthly or bi-weekly payments, allowing borrowers to choose a plan that fits their budget. It’s important to review these options carefully to find the most manageable repayment structure.

What happens if I miss a payment?

If a payment is missed, the lender may charge a late fee, as specified in the agreement. Repeated missed payments can lead to more severe consequences, including negative impacts on credit scores and potential repossession of the vehicle. It’s crucial to communicate with the lender as soon as possible if you anticipate difficulty making a payment.

Can I modify the Vehicle Repayment Agreement?

Yes, modifications to the agreement can be made, but both parties must agree to any changes. It’s advisable to document any modifications in writing and have both parties sign the updated agreement to avoid misunderstandings in the future.

What should I do if I want to pay off the loan early?

If you wish to pay off the loan early, review the agreement for any prepayment penalties. Many lenders allow early repayment without penalties, but it’s essential to confirm this before proceeding. Contact your lender to discuss the process and any potential savings on interest payments.

Is the Vehicle Repayment Agreement legally binding?

Yes, once signed by both parties, the Vehicle Repayment Agreement is a legally binding contract. This means that both the borrower and the lender are obligated to adhere to the terms outlined in the agreement. If either party fails to fulfill their obligations, the other party may seek legal recourse.

Where can I obtain a Vehicle Repayment Agreement form?

Vehicle Repayment Agreement forms can often be obtained from lenders, financial institutions, or online legal document services. It’s advisable to ensure that the form complies with state laws and includes all necessary terms to protect both parties involved in the agreement.

Dos and Don'ts

When completing the Vehicle Repayment Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are ten things you should and shouldn't do:

- Do read the form thoroughly before starting.

- Don't leave any required fields blank.

- Do use clear and legible handwriting or type the information.

- Don't use abbreviations that may cause confusion.

- Do double-check all numbers and calculations for accuracy.

- Don't sign the form until you have completed it fully.

- Do keep a copy of the completed form for your records.

- Don't submit the form without verifying that all information is correct.

- Do ask for help if you are unsure about any part of the form.

- Don't ignore any instructions provided with the form.

Vehicle Repayment Agreement - Usage Steps

Once you have the Vehicle Repayment Agreement form in hand, it’s time to fill it out accurately. This process is straightforward, but attention to detail is essential. Follow these steps to ensure that all necessary information is included.

- Begin with your personal information. Fill in your full name, address, and contact details at the top of the form.

- Next, provide the details of the vehicle involved. This includes the make, model, year, and VIN (Vehicle Identification Number).

- Indicate the total amount owed on the vehicle. Be precise and double-check your figures.

- Specify the repayment terms. This should include the payment amount, frequency (weekly, bi-weekly, monthly), and the total duration of the repayment period.

- Include any additional terms or conditions that may apply. This could involve late fees or penalties for missed payments.

- Sign and date the form at the designated area. Make sure your signature matches the name provided at the top.

- Lastly, review the entire form for accuracy. Ensure all sections are completed and legible before submitting.