The Investment Letter of Intent form is a crucial document that outlines the preliminary agreement between parties interested in pursuing a potential investment opportunity. This form serves as a roadmap, detailing key terms and conditions that both parties agree to...

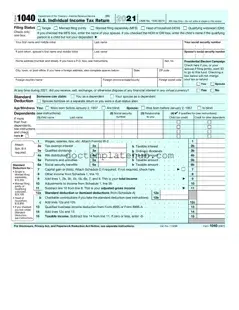

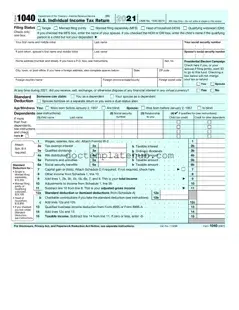

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income. This essential document helps determine your tax liability and eligibility for various credits and deductions. Ready to tackle your taxes?...

The IRS 1095-A form is a document that provides important information about health insurance coverage obtained through the Health Insurance Marketplace. This form helps individuals and families determine their eligibility for premium tax credits and report their health coverage on...

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals and businesses that are not classified as wages. This form is essential for ensuring that all income is accurately reported to the...

The IRS Form 1120 is a tax form used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form plays a crucial role in ensuring that corporations meet their tax obligations while...

The IRS 2553 form is a document used by small business corporations to elect S corporation status for tax purposes. This election allows the corporation to pass corporate income, losses, and deductions through to shareholders, avoiding double taxation. Understanding how...

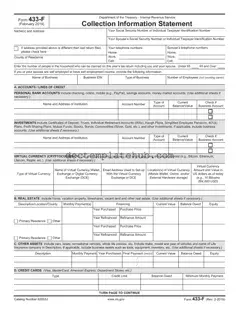

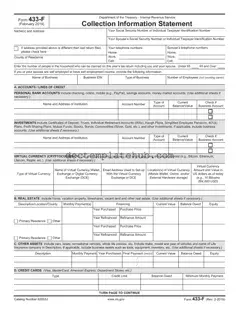

The IRS 433-F form is a financial statement used by taxpayers to provide the Internal Revenue Service with information about their income, expenses, and assets. This form is typically required when individuals are seeking to resolve tax debts or negotiate...

The IRS 941 form is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. This form helps the IRS track payroll taxes and ensures compliance with federal tax...

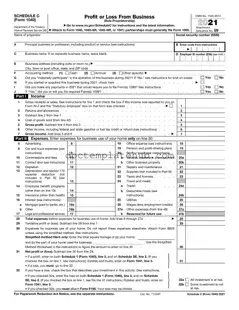

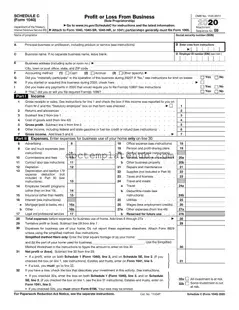

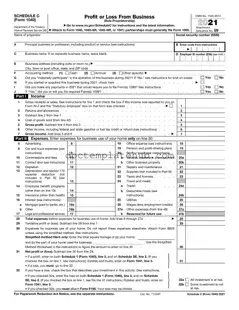

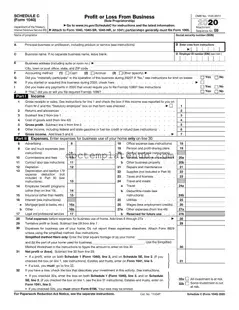

The IRS Schedule C 1040 form is used by sole proprietors to report income or loss from their business. This form allows individuals to detail their business expenses and calculate their net profit or loss for the year. Understanding how...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form allows individuals to detail their business earnings and expenses, ultimately determining their taxable income. Understanding how...

The IRS W-2 form is a document that employers use to report an employee's annual wages and the taxes withheld from their paycheck. This form is essential for employees as it provides the necessary information for filing their income tax...

The IRS W-3 form is a summary of all W-2 forms that an employer submits to the Social Security Administration. This form consolidates employee wage and tax information, ensuring accurate reporting for tax purposes. Understanding how to properly fill out...